2.8 — Trade Agreements

ECON 324 • International Trade • Spring 2023

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/tradeS23

tradeS23.classes.ryansafner.com

Where We’re At

What We've Learned:

- Predict & understand why and what countries trade (Trade Models)

- Consequences of trade barriers (tariffs, quotas, subsidies, etc)

- Intellectual history of free trade & protectionist arguments

What's Left: for good or bad, why do countries have the trade policies they have today?

- A theory of how politics interacts with economics: political economy

Where We’re At

If you agree with the following premises:

- Trade barriers are on in general harmful and inefficient on net for a society

- Trade barriers do benefit specific groups of people

We need to answer two questions:

- Why do trade barriers that are often inefficient and welfare-reducing persist?

- How is it possible to get groups or countries to agree to reduce trade barriers?

International Trade Negotiations

The Strategy of Trade Agreements

The Strategy of Trade Agreements

Unilateral free trade is the theoretically ideal strategy

- we immediately drop all tariffs

- economists continuously recommend this, dispersed benefits outweigh concentrated costs

But this is not good politics!

The Strategy of Trade Agreements

Political infeasibility of unilateral free trade

Note: opposite of politically stable policy: dispersed benefit, concentrated cost!

Domestic import-competing industries are best-organized political group, stand to lose a large concentrated benefit with free trade

The Strategy of Trade Agreements

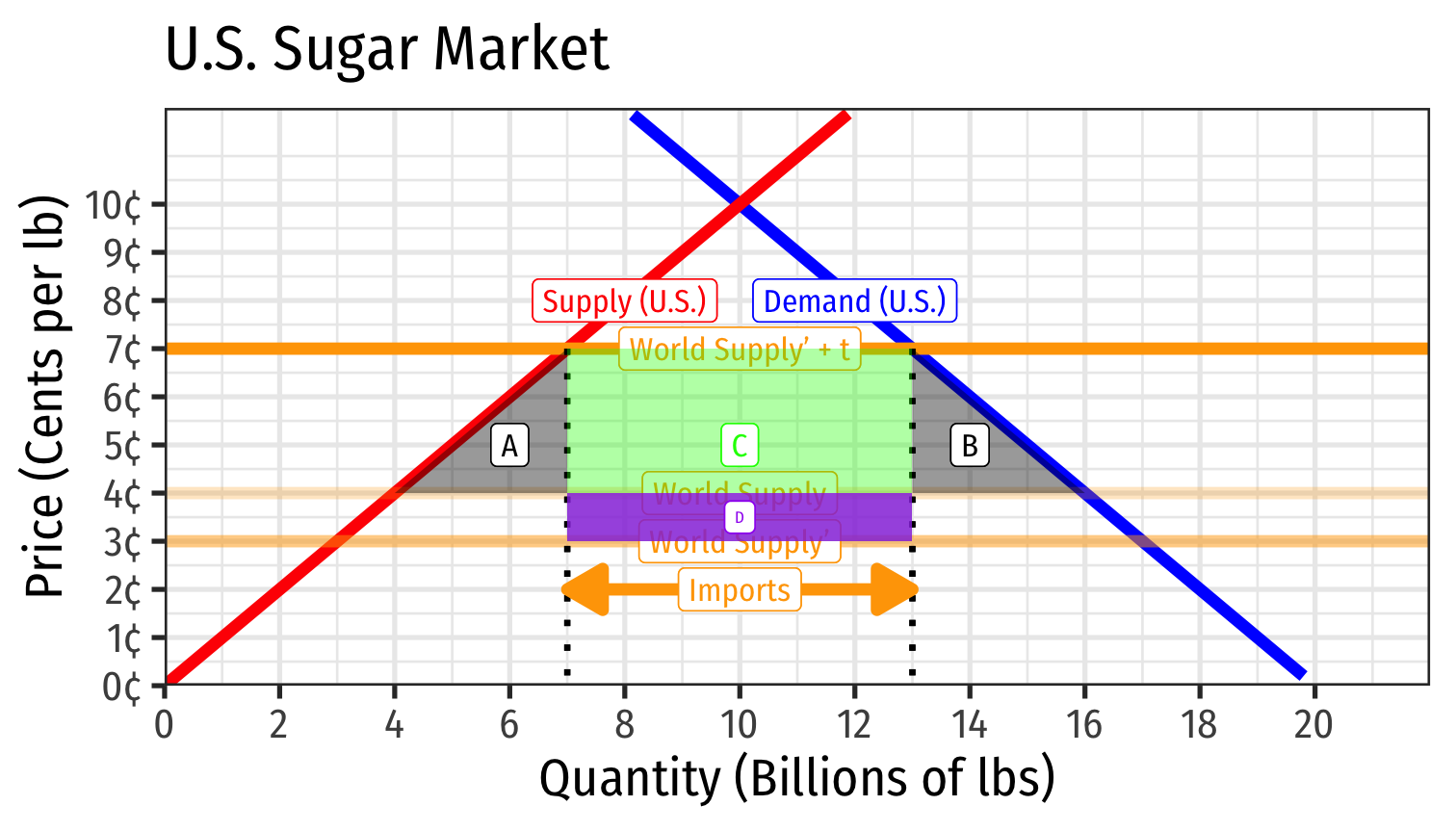

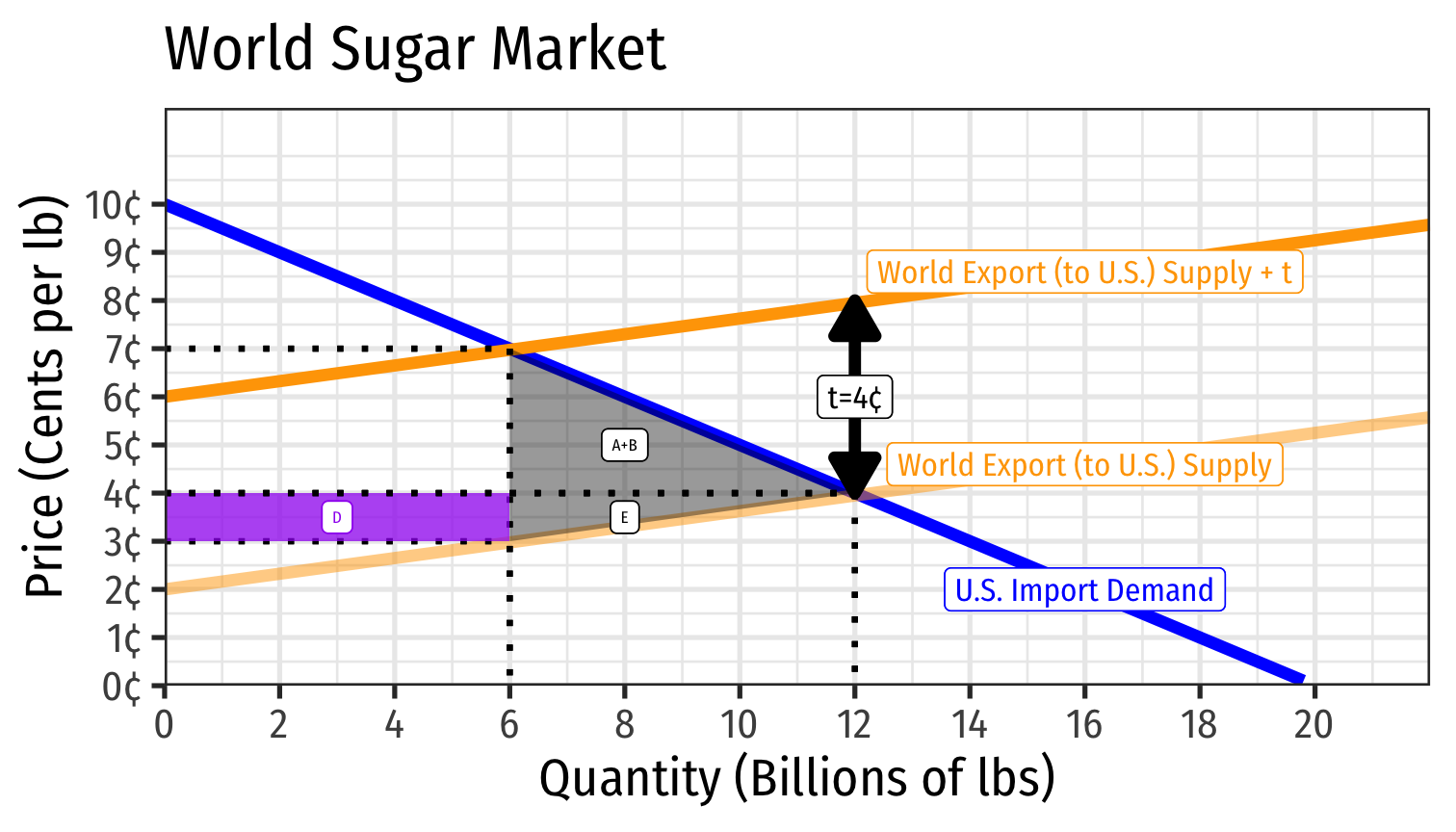

Recall effects of a large country’s tariffs on world trade

Compared to no-tariff, U.S. gains D−(A+B) from tariff

Foreign country loses D+E from U.S. tariff

The Strategy of Trade Agreements

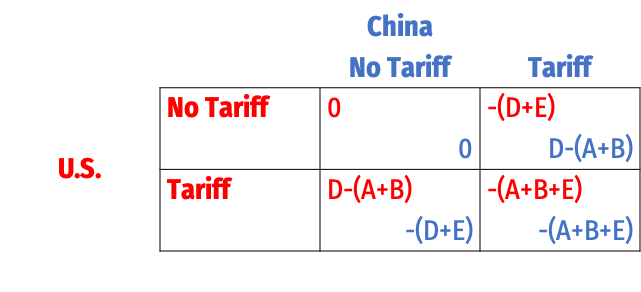

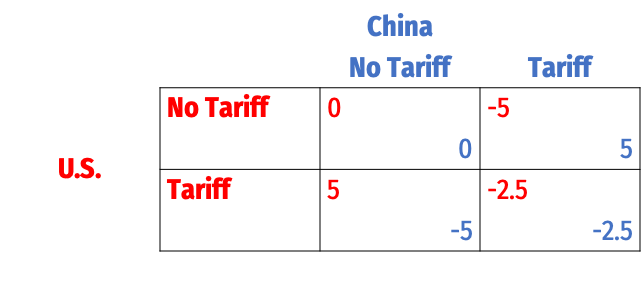

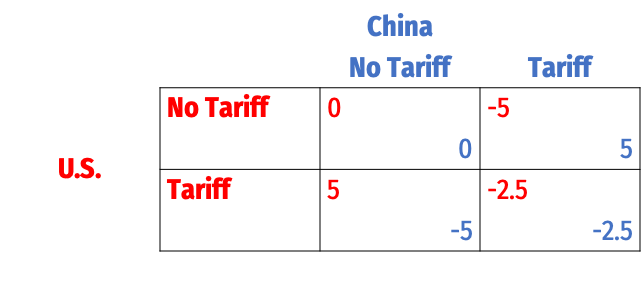

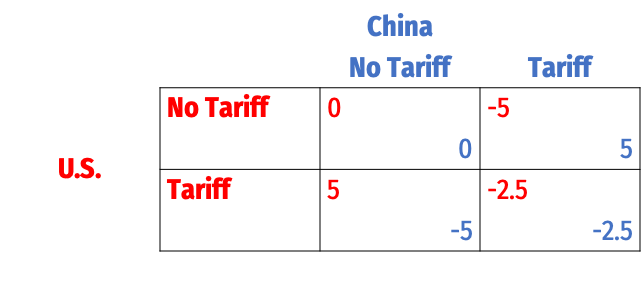

Now consider two big countries: U.S. and China negotiating with one another

If one has a tariff, they gain D−(A+B) and the other loses −(D+E)

If both have tariffs, both lose A+B+E

If neither have tariffs (free trade), they earn 0

The Strategy of Trade Agreements

Now consider two big countries: U.S. and China negotiating with one another

If you’re having trouble keeping track, let’s simplify

The Strategy of Trade Agreements

Now consider two big countries: U.S. and China negotiating with one another

If you’re having trouble keeping track, let’s simplify

Nash Equilibrium:

The Strategy of Trade Agreements

Now consider two big countries: U.S. and China negotiating with one another

If you’re having trouble keeping track, let’s simplify

Nash Equilibrium: (Tariff, Tariff)

Each country has a dominant strategy to give in to political pressure for protectionism

Adam Smith: Strategic Trade Policy

Adam Smith

1723-1790

“[I]t may sometimes be a matter of deliberation [how to remove tariffs] when some foreign nation restrains by high duties or prohibitions the importation of some of our manufactures into their country. Revenge in this case naturally dictates retaliation, and that we should impose the like duties and prohibitions upon the importation of some or all of their manufactures into our country...nations accordingly seldom fail to retaliate in this manner.”

“There may be a good policy in retaliations of this kind...The recovery of a great foreign market will generatlly more than compensate the transitory inconveniency of paying dearer during a short time for some sorts of goods. To judge whether such retaliations are likely to produce such an effect...[belongs] to the skill of that insidious and crafty animal, vulgarly called the statesman or politician, whose councils are directed by the momentary fluctuations of affairs.”

Smith, Adam, 1776, An Enquiry into the Nature and Causes of the Wealth of Nations, (Book IV, Chapter 2

Torrens & Mill: Strategic Trade Policy

L: Col. Robert Torrens (1780—1864)

R: John Stuart Mill (1806-1873)

“[Reciprocity] would hold out to [foreign countries] a powerful inducement to act upon the principles of reciprocal freedom” - Torrens

“[C]onsiderations of reciprocity...are of material importance when the repeal of duties...is discussed. A country cannot be expected to renounce the power of taxing foreigners, unless foreigners will in return practise towards itself the same forbearance. The only mode in which a country can save itself from being a loser by the duties imposed by other countries on its commodities, is to impose corresponding duties on theirs.” - Mill

Finding Commitments: Bilateral Agreements

Bilateral/multilateral trade agreements provide commitment strategies for each nation to reduce tariffs

Traditionally, it’s concentrated benefits to domestic importers who lobby politicians to put up tariffs

With a trade agreement, domestic exporters (who want free access to foreign markets) act as a concentrated political force fighting to lower tariffs

Creates multiple groups in multiple countries with vested interest in keeping trade open (tariffs down)

More concentrated & strongly interested groups fighting against tariffs than for tariffs!

- Less incentive for domestic politician to cater to protectionist interests

Odysseus and the Sirens by John William Waterhouse, Scene from Homer's The Odyssey

The Strategy of Trade Negotiations

- Why aren't all trade negotiations a single sentence:

“We hereby eliminate all tariffs”

- Trade agreements are often hundreds or thousands of pages long!

The Strategy of Trade Negotiations

There is a reason the public is not allowed into the "room where it happens"

- there's a reason Congress does is not allowed into the room!

If negotiations were public, or open to Congress:

- Different interest groups would try to grab their own carve outs and exemptions

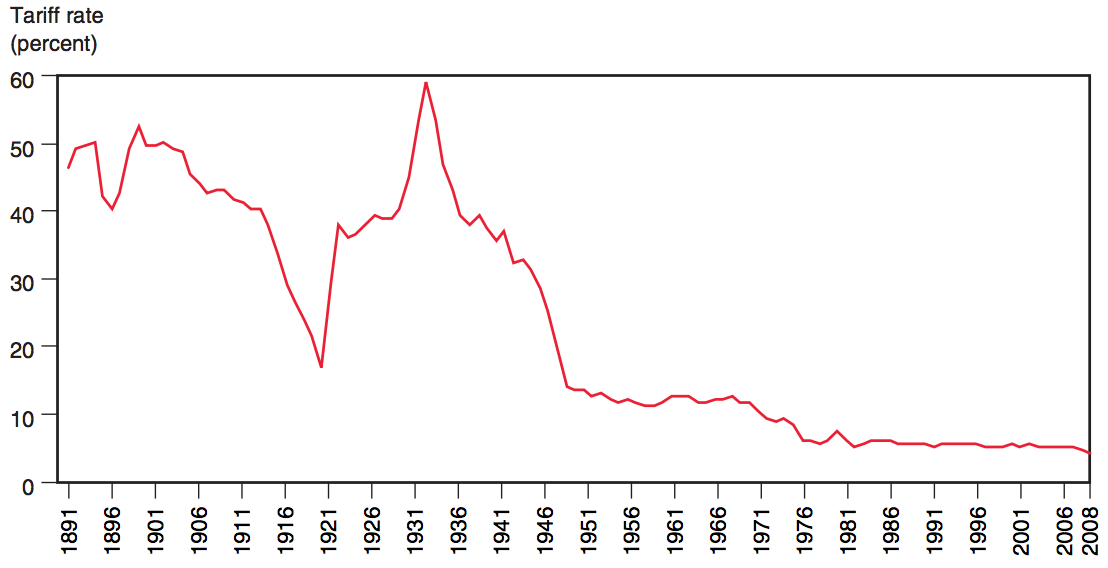

History of Recent Trade Liberalization

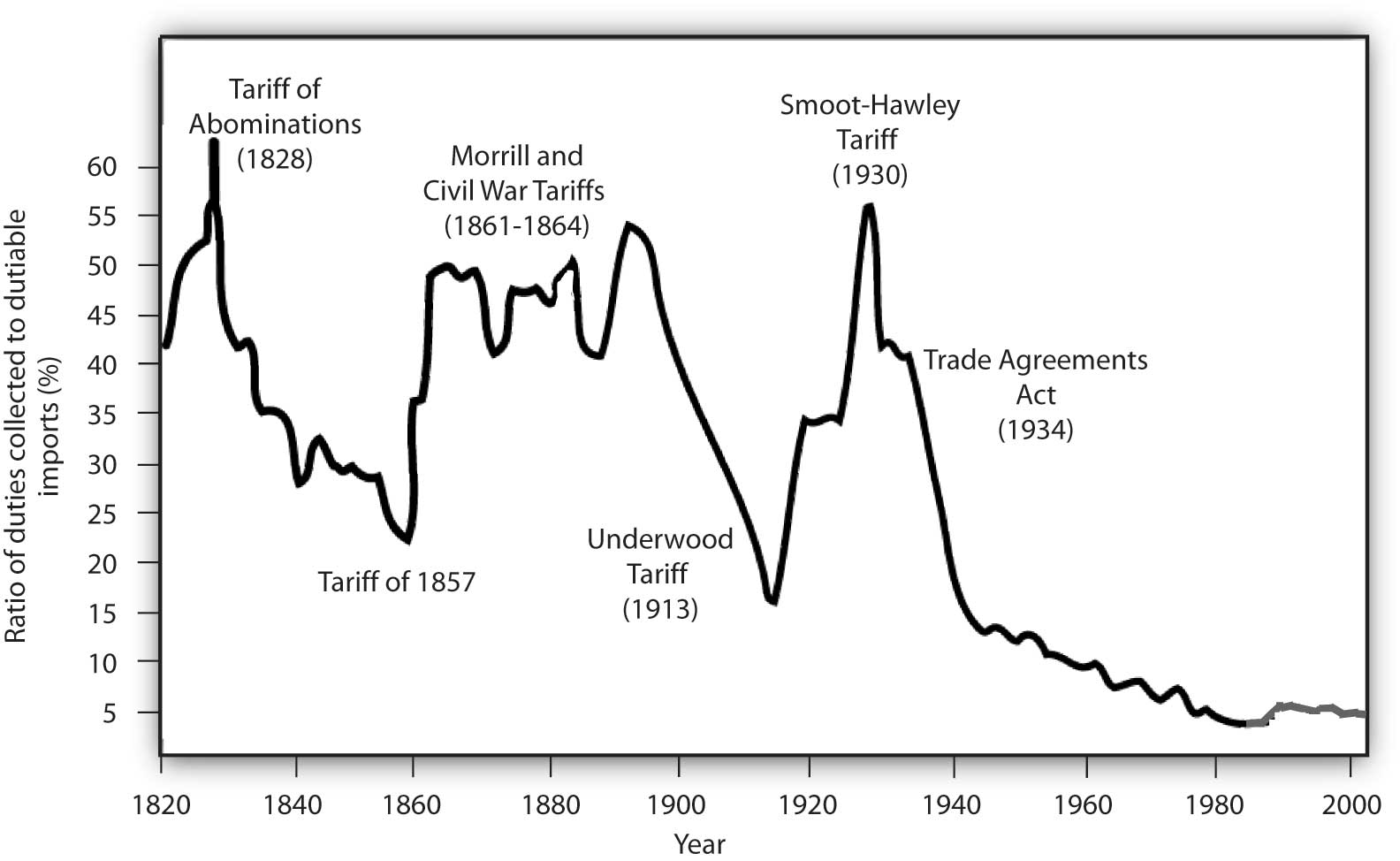

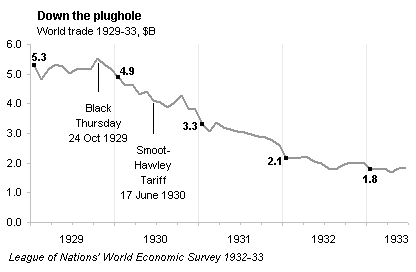

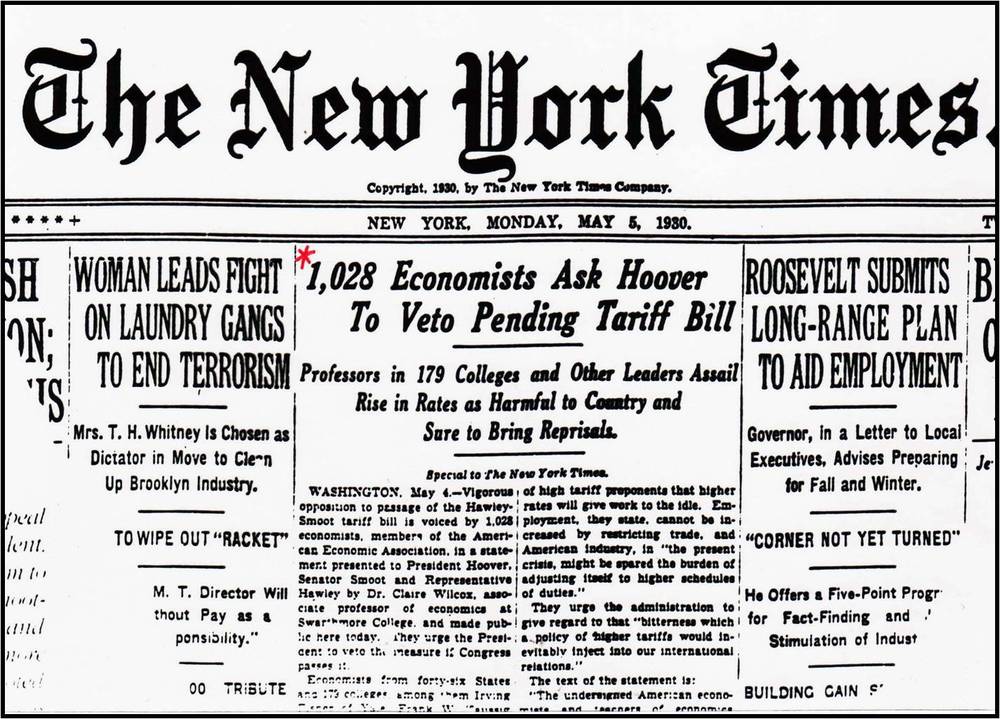

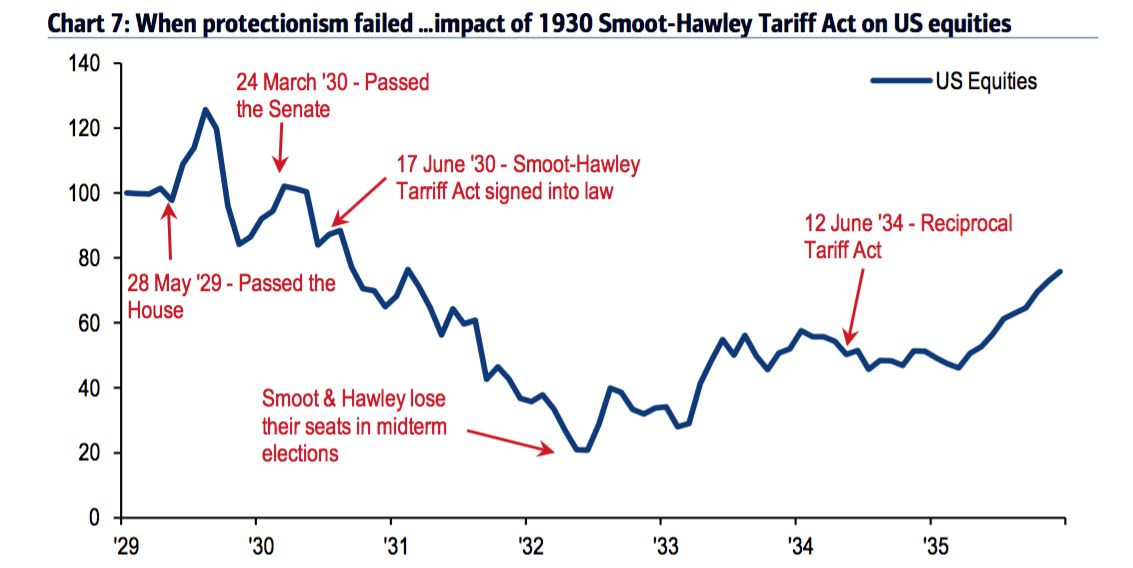

Smoot-Hawley Tariff Act and “Beggar Thy Neighbor”

Smoot-Hawley Tariff Act and “Beggar Thy Neighbor”

L: Rep. Willis C. Hawley

R: Sen. Reed Smoot

Smoot-Hawley Tariff Act and “Beggar Thy Neighbor”

Most-Favored Nation

1934 Trade Agreements Act

Authorized the president to negotiate mutual tariff reductions with other countries by up to 50% from Smoot-Hawley tariff

Based on most favored nation (MFN) principle: requires a country to provide any concessions, privileges, or immunities granted to another nation in a trade agreement also to the U.S. (and vice versa)

- sounds like favoritism — is actually about equal treatment!

GATT

1947 General Agreement on Tariffs and Trade (GATT)

First major multilateral agreement

Set in motion 9 major “rounds” of negotiations through 2001

GATT

1947 General Agreement on Tariffs and Trade (GATT)

Principle of nondiscrimination:

- Most Favored Nation principle again: any better bilateral trade agreement made between two members must also be applied to all GATT members

“Binding” of tariffs: countries may lower tariffs, but are not allowed to raise tariffs (except in exceptional cases)

Resolution of trade disputes through GATT institutions

GATT

Protectionist measures in U.S. in 1950s:

- “Peril-point provisions”

- “Escape clause”

- “National security clause”

1962 Trade Expansion Act: created Trade Adjustment Assistance (TAA)

GATT

- “Uruguay Round” (8th of GATT, 1986-1993, concluded 1994)

- Tariffs

- Industrial products fell from 4.7% on average to 3%

- Share of goods with no tariffs increased from 20-22% to 40-45%

- Tariffs removed on pharmaceuticals, construction equipment, medical equipment, paper products, steel

- Tariffs

GATT

- “Uruguay Round” (8th of GATT, 1986-1993, concluded 1994)

- Quotas

- Quotas on agricultural products to be replaced with less restrictive tariffs by 1999

- Quotas on textiles to be replaced with less restrictive tariffs by 2004

- Quotas

GATT

- “Uruguay Round” (8th of GATT, 1986-1993, concluded 1994)

- Antidumping: Doesn't outright ban countervailing duties, but focuses more on tougher action through GATT institutions

- Subsidies

- Volume of subsidized agricultural products to be reduced 21% by 1999

- Government subsidies for industrial research to be limited to 50% of cost

GATT

- “Uruguay Round” (8th of GATT, 1986-1993, concluded 1994)

- Safeguards

- Countries banned from using health and safety laws not based on scientific research

- Temporary tariffs allowed to protect domestic industry against temporary import surges

- Safeguards

GATT → WTO

“Uruguay Round” (8th of GATT, 1986-1993, concluded 1994)

- Intellectual property

- 20 year protection of patents, trademarks, and copyrights

- 10 year phase-in period allowed for developing countries' pharmaceuticals

- Intellectual property

World Trade Organization (WTO)

- GATT Secretariat is replaced and extended by institutions of the WTO

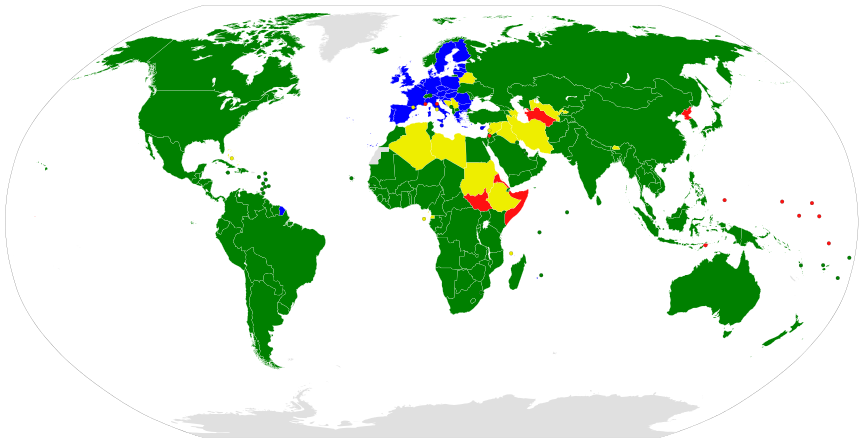

WTO

WTO Members, WTO Members dually represented by EU, Observer nations, Non-members

WTO

WTO principles:

- Nondiscrimination

- Reciprocity

- Binding and enforceable commitments

- Transparency

- Safety Valves

Organization: Councils for Trade in Goods, Trade-Related Aspects of Intellectual Property Rights (TRIPS), Trade in Services, Trade Negotiations Committee

Dispute Resolution Mechanisms

WTO

- Estimated that Uruguay Round:

- increased the volume of world trade by 20% (25% from manufacturing, 75% from agriculture)

- increased world income gains by $349 billion ($164 billion from agriculture, $130 billion from manufacturing, $55 billion from services)

- developing countries receiving 42% of the gains - double their share of world GDP

Salvatore, Domenick, 2001, International Eocnomics, 164

WTO

2001 China admitted to WTO

2002 Congress granted President “fast-track authority” to negotiate trade deals, expired in 2007

WTO

Doha Round (9th of GATT, 2001-?, failed so far)

Disagreements over agricultural subsidies

Debates about GMOs, health and safety issues, environmental protection

The Economic Effects of Trade Agreements

Trade Creation & Trade Diversion

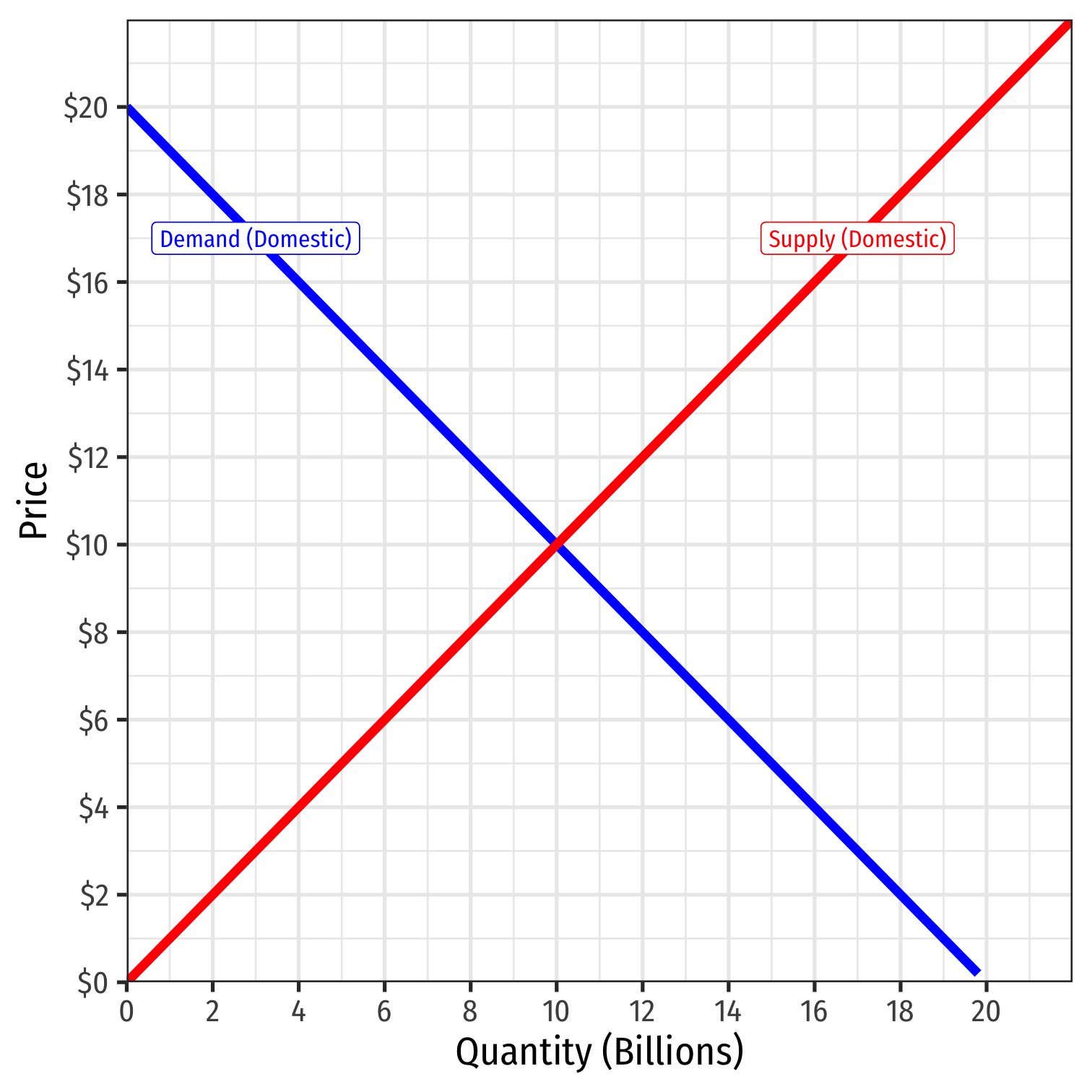

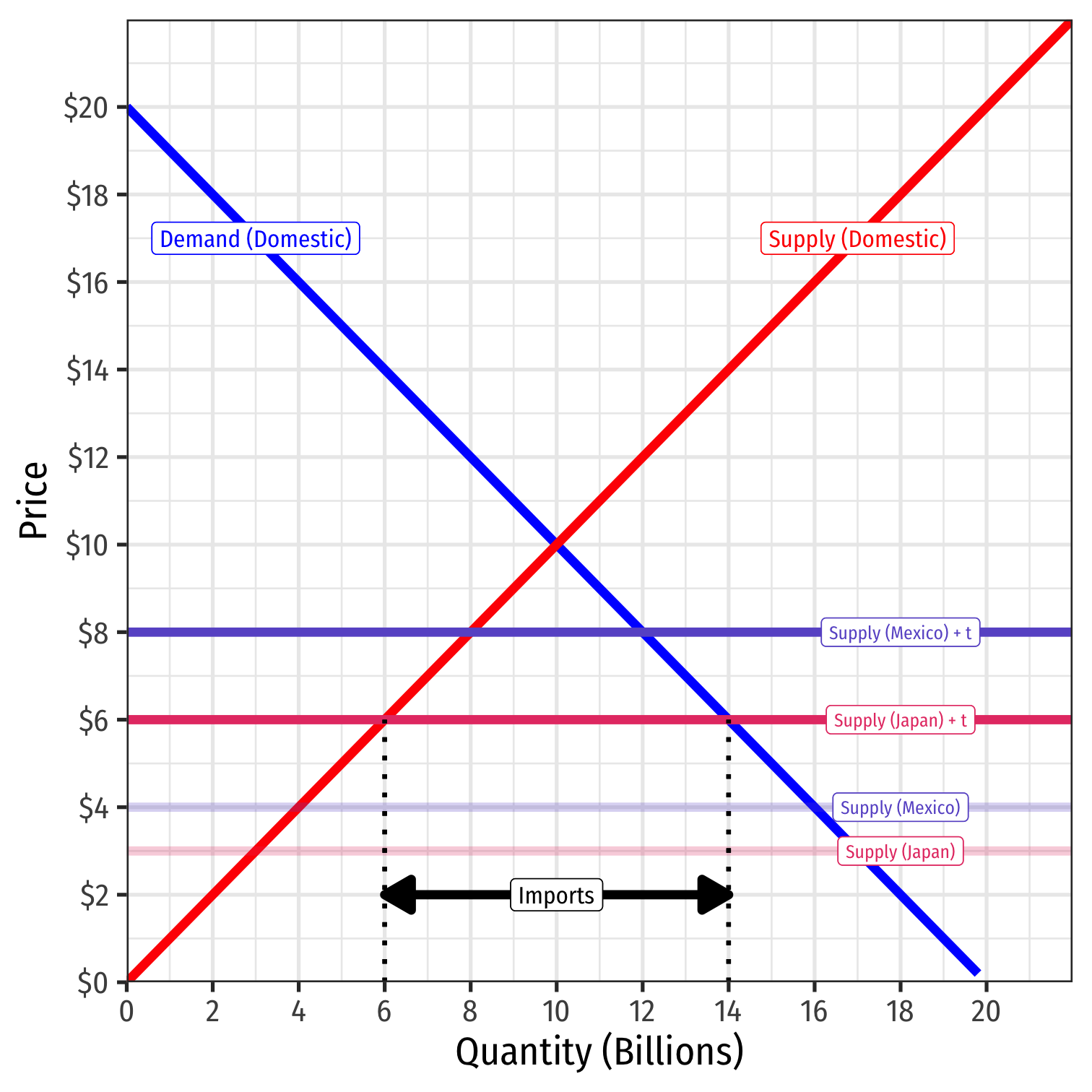

- Consider the market for T-shirts in the United States

Trade Creation & Trade Diversion

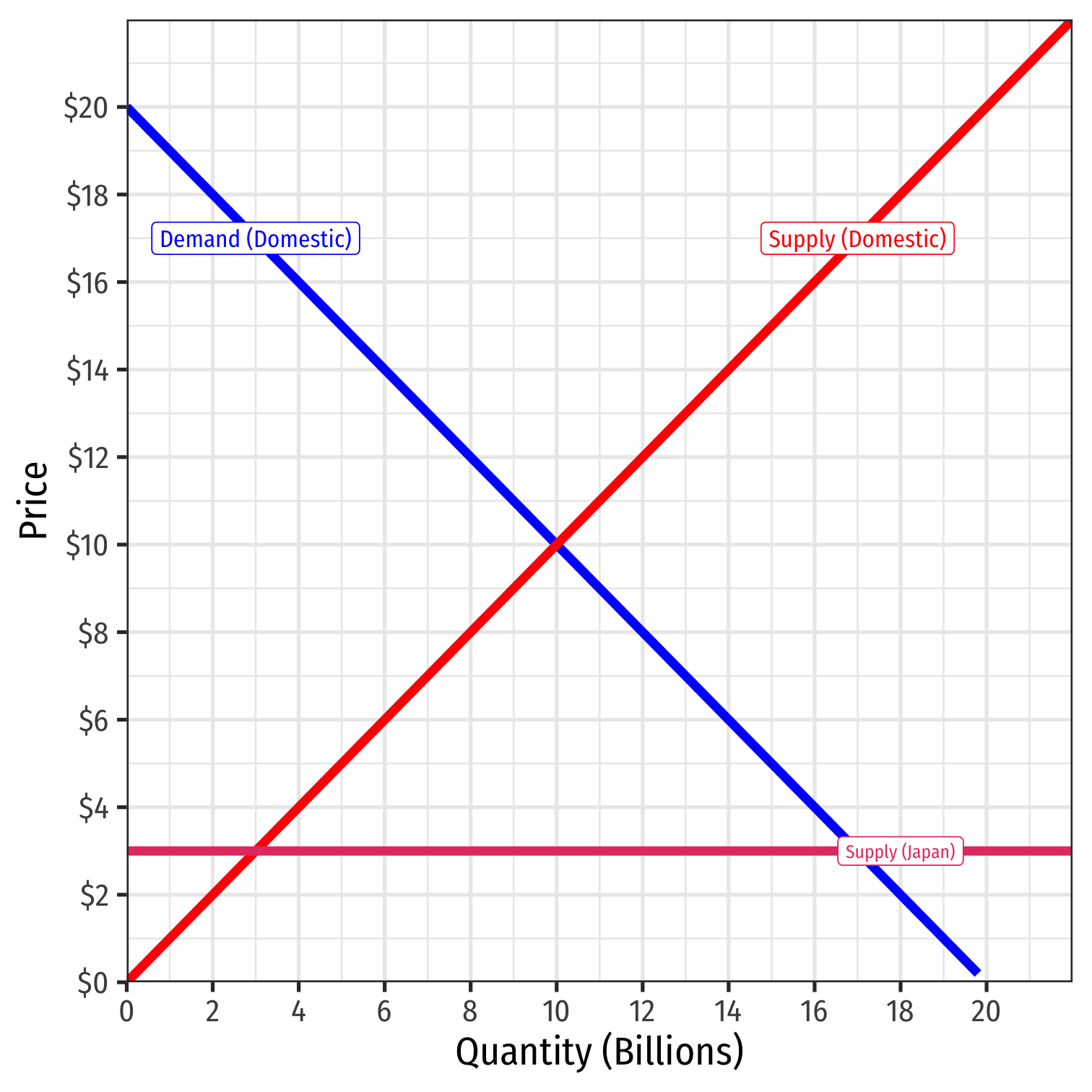

- Suppose the United States can import T-shirts from Japan

Trade Creation & Trade Diversion

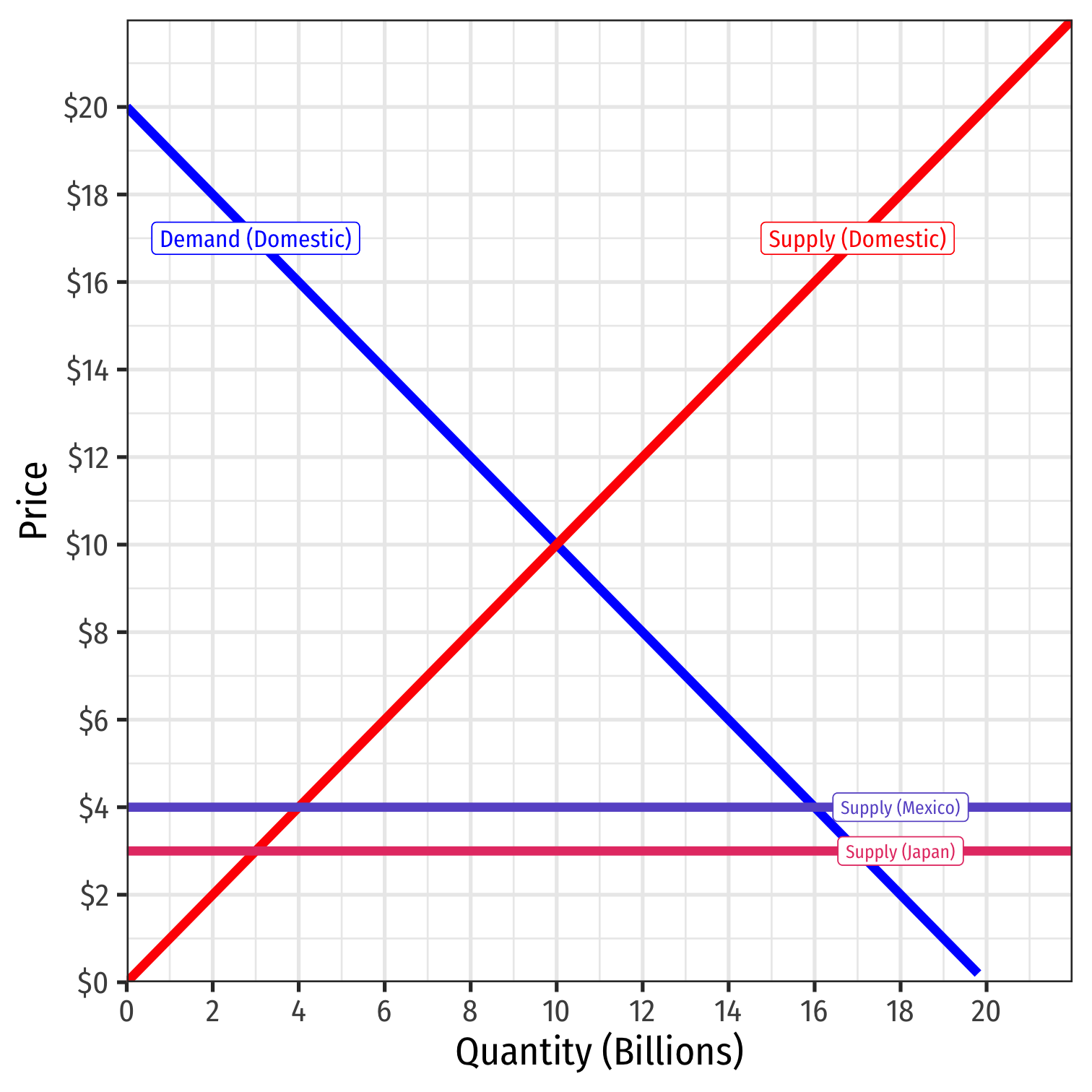

- Suppose the United States can import T-shirts from Japan or Mexico

- Japan is more efficient ($3/shirt) than Mexico ($4/shirt)

Trade Creation & Trade Diversion

Suppose the United States can import T-shirts from Japan or Mexico

- Japan is more efficient ($3/shirt) than Mexico ($4/shirt)

Under free trade, U.S. would import 14 Bn from Japan (cheapest), and 0 from Mexico

Trade Creation & Trade Diversion

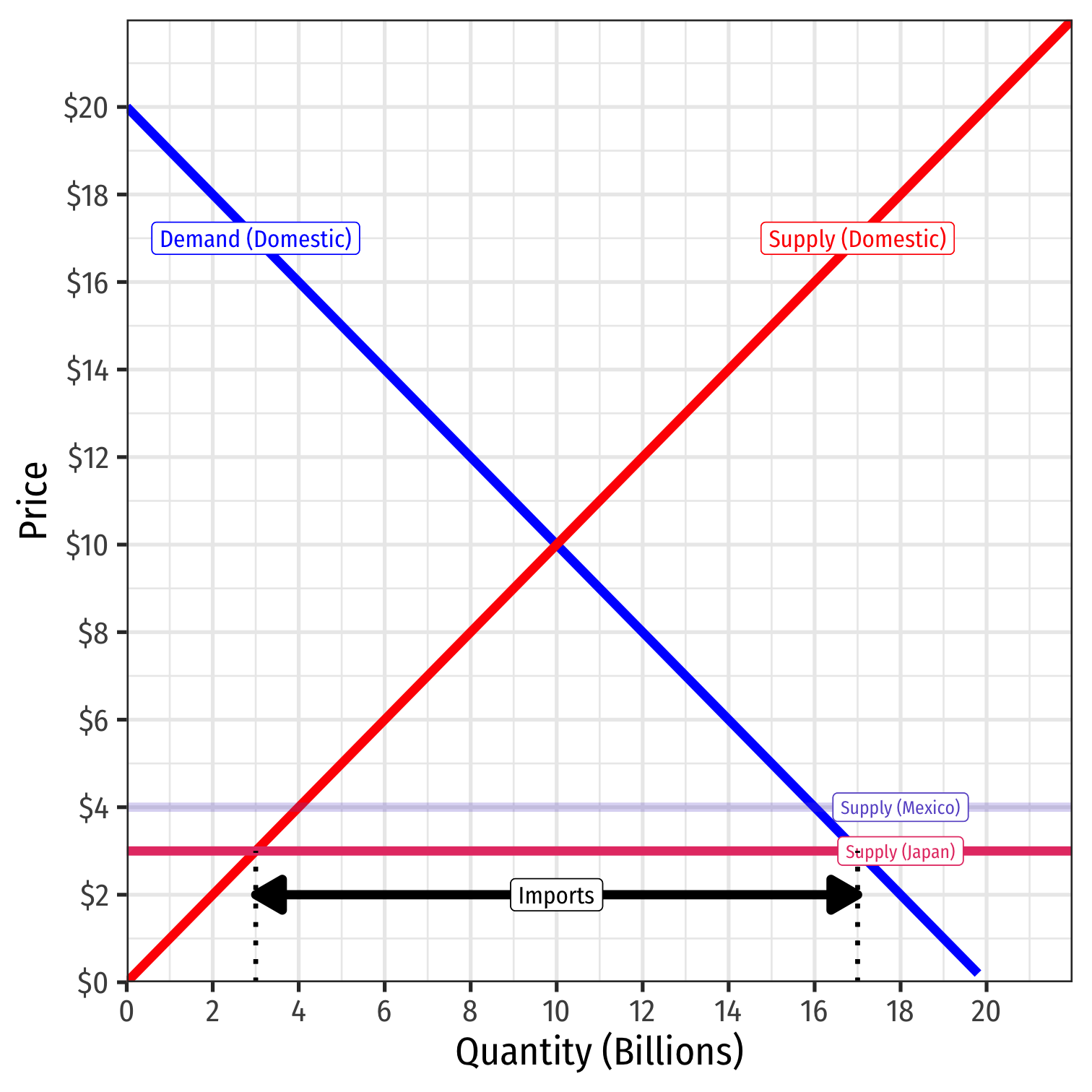

Suppose the United States can import T-shirts from Japan or Mexico

- Japan is more efficient ($3/shirt) than Mexico ($4/shirt)

Suppose instead the U.S. has a 100% tariff on any/all imported T-shirts

- Japanese imports are still cheapest (but at $6/shirt now, vs. $8 Mexican shirts)

- Imports 8 Bn from Japan and 0 Bn from Mexico

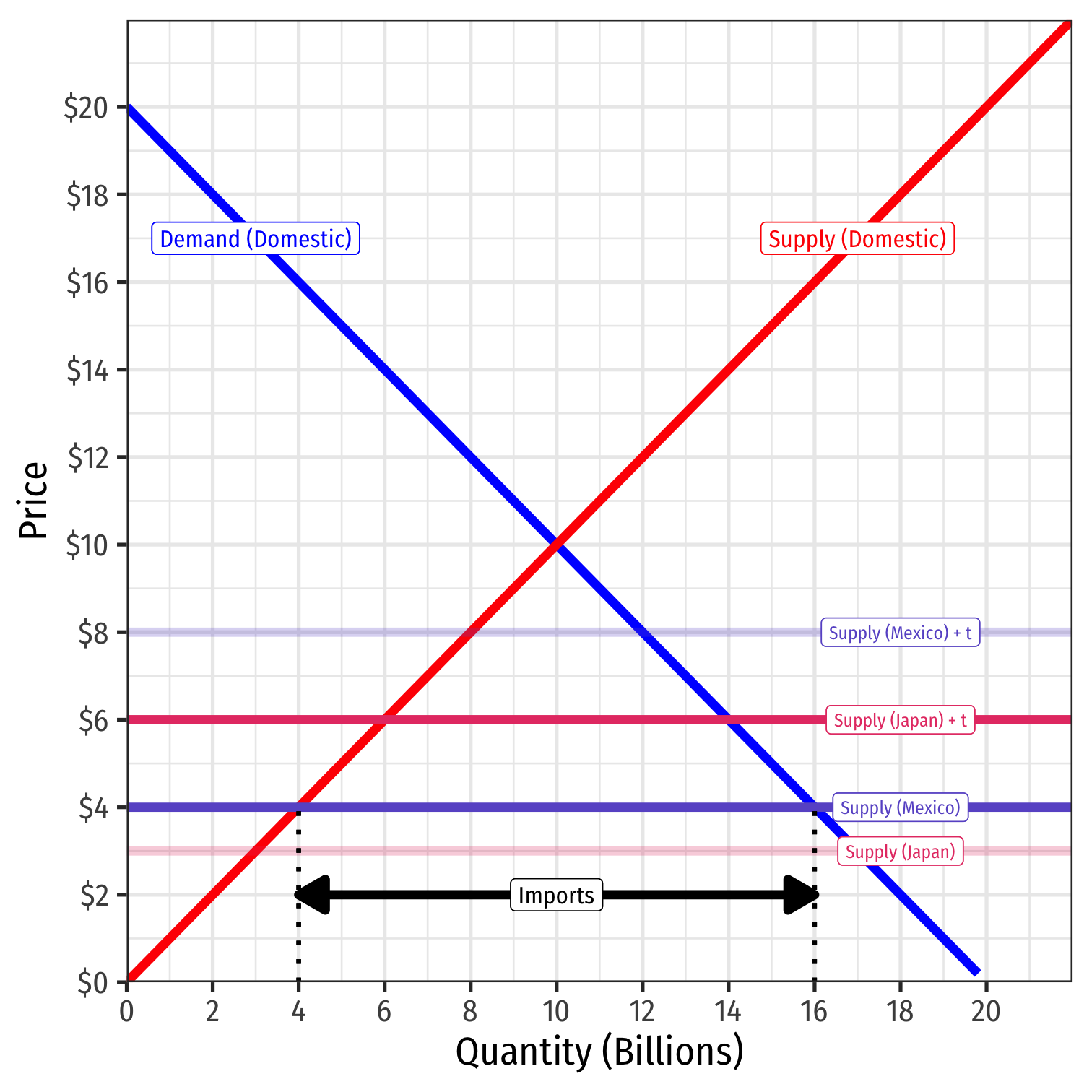

Trade Creation & Trade Diversion

Now suppose the U.S. and Mexico enter a free trade agreement

- U.S. drops tariffs on Mexico to 0%

- Keeps tariff on Japan

Now Mexican T-shirts (with no tariff) are cheaper at $4/shirt compared with Japan (still with tariff) at $6/shirt!

- U.S. imports 12 Bn from Mexico, imports 0 Bn from Japan

Trade Creation & Trade Diversion

- Effects from the free trade agreement (with Mexico):

Trade creation: U.S. imports more T-shirts (compared to under equal tariffs), all from Mexico

Trade diversion: Japan is actually a more efficient producer than Mexico (if no tariffs), but U.S. only trades with Mexico because Japan is outside free trade zone

- U.S. trade diverted from Japan to Mexico

Dynamic Benefits of Free Trade Agreements

Increase competition, limit domestic monopoly power

Access to larger markets creates economies of scale

More investment by outside countries to FTA-member countries (to take advantage of larger market) and avoid tariffs

- “tariff factories”: Foreign firms from non-FTA-member countries set up shop inside countries with agreement to avoid import tariffs

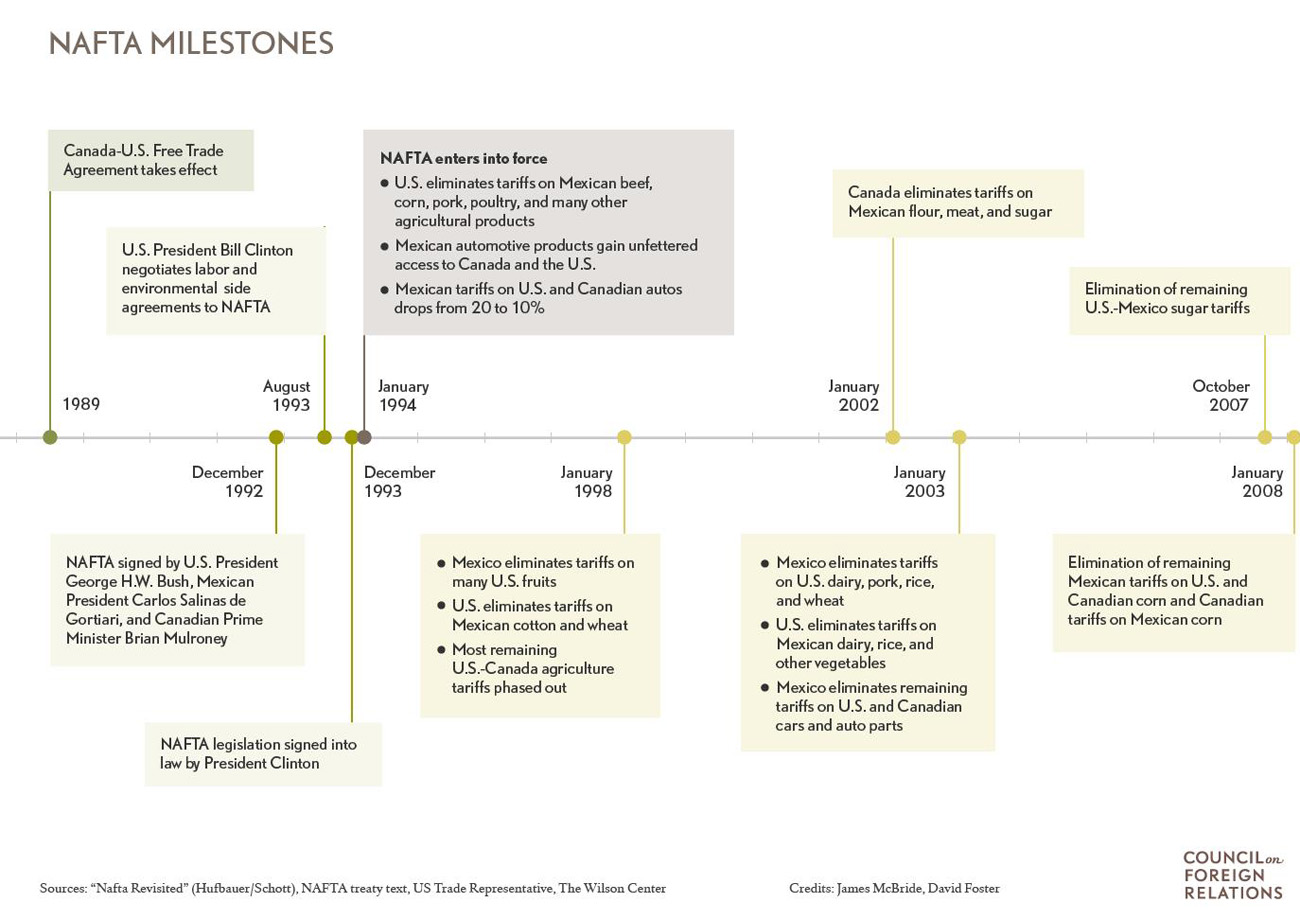

NAFTA

North American Free Trade Agreement (NAFTA) between U.S., Canada, and Mexico since 1994

U.S. had a free trade agreement with Canada since 1988/9, wanted to bring Mexico into the fold

2018: rebranded as U.S.-Mexico-Canada Agreement (USMCA)

NAFTA

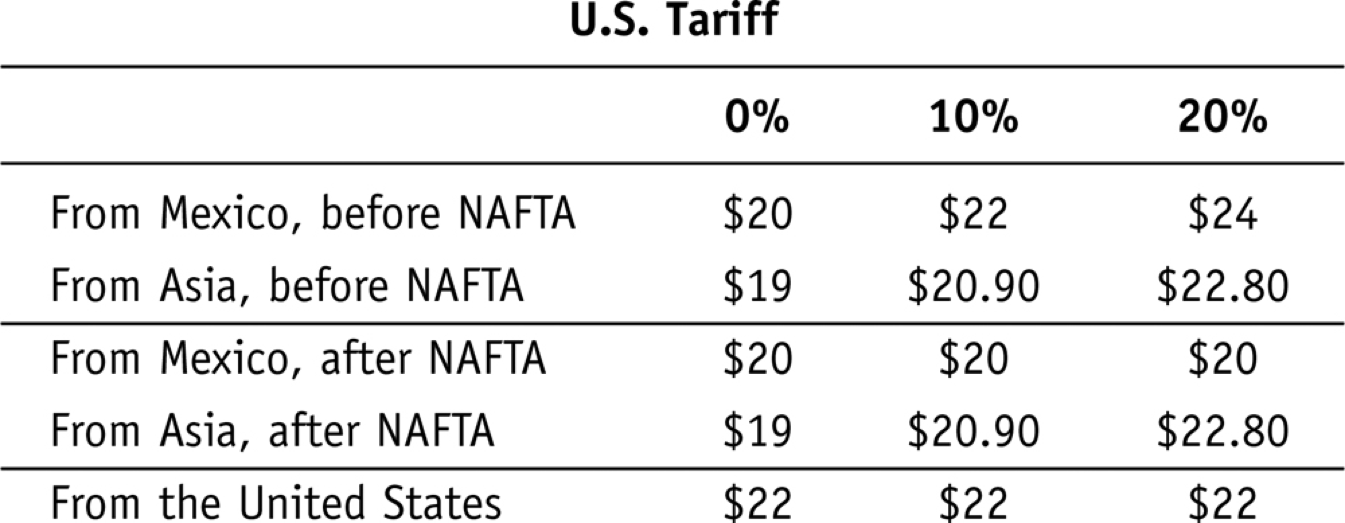

Trade Creation & Trade Diversion: NAFTA

Cost of Importing an Automobile Part to the U.S.

Feenstra & Taylor, pp.555-556

Effects of NAFTA

Tripled trade between U.S., Mexico, and Canada

- $290 billion in 1993 → $1.1 trillion in 2016

U.S. foreign investment in Mexico increased from $15 billion to $100 billion

Maquiladoras

Maquiladora: factories in Mexico that import goods from U.S. or abroad, manufacture output, and then export to the U.S. (or elsewhere)

- Often located near the border with U.S.

Lower wages and lower tariffs

Before NAFTA: 47% maquila employment growth (564 new plants)

- After NAFTA: 86% over next five years (1460 new plants)

Effects of NAFTA

Effects on U.S.: modest, increased GDP by 0.5%, or $80 billion

Concentrated costs (U.S. manufacturing & automobiles) but dispersed benefits to consumers

Est. 14 million jobs depend on trade with Canada and Mexico, 200,000 export related jobs created annually, paying 15-20% more on average than jobs lost to NAFTA

Companies moving many factories to Mexico, U.S. auto sector lost 350,000 jobs since 1994; Mexican auto sector increased from 120,000 to 500,000 jobs

Est. 15,000 net jobs lost each year but economy gains $450,000 in higher productivity gains and lower consumer prices

USMCA/NAFTA 2.0

USMCA/NAFTA 2.0

“Studies by both the International Monetary Fund and the International Trade Commission conclude the revamped pact won’t meaningfully goose economic growth: The ITC projects it will raise GDP by 0.35 percent after six years; and the IMF says its broad effects will be “negligible.”

“Indeed, economists say the agreement may be most important for what it prevents. Trump had threatened to pull the United States out of NAFTA if the three countries couldn’t reach a deal. That would have spelled a disastrous breakdown in cross-border commerce with the two most important U.S. trading partners. “At a time when slower global growth, rising protectionism, lingering policy uncertainty and a strong dollar are constraining activity, the deal prevents a negative impact worth 0.5% of GDP from a dissolution of Nafta,” Oxford Economics chief U.S. economist Gregory Daco writes in a note to clients.”

Newmyer, Tory, 2019, “The Finance 202: USMCA isn't expected to have a big impact on the economy,” Washington Post, December 11 2019

USMCA/NAFTA 2.0

“The North-American Free Trade Agreement (NAFTA) between Canada, Mexico, and the United States has been in force since January 1994. When NAFTA negotiations were concluded in 1992, it was the most comprehensive free trade agreement ever negotiated, creating the world’s largest market for goods and services. The agreement eliminated almost all tariffs between the three countries and incorporated numerous other innovative provisions. NAFTA influenced other free trade agreements that the United States later negotiated and multilateral negotiations. It also initiated a new generation of trade agreements in the Western Hemisphere and other parts of the world, influencing negotiations in areas such as market access, rules of origin, intellectual property rights, foreign investment, dispute resolution, worker rights, and environmental protection.”

Burfisher, Mary E, Frederic Lambert, and Troy D Matheson, 2019, “NAFTA to USMCA: What is Gained?” IMF Working Paper

USMCA/NAFTA 2.0

“NAFTA fundamentally reshaped North American economic relations, driving unprecedented integration between Canada, the United States and Mexico and encouraging a dramatic increase in regional trade and cross-border investment between the three countries. Since the agreement came into effect, trade between the three NAFTA parties has increased from US$ 290 billion in 1993 to over US$ 1.1 trillion in 2017.”

Burfisher, Mary E, Frederic Lambert, and Troy D Matheson, 2019, “NAFTA to USMCA: What is Gained?” IMF Working Paper

USMCA/NAFTA 2.0

“Most economists agree that NAFTA has provided benefits to the North American economy by expanding trade and economic linkages between countries, creating more efficient production processes, increasing the availability of lower-priced consumer goods, and improving living standards. However, it has proven difficult to isolate the agreement’s beneficial effects from other factors, including rapid technological change, expanded trade with other countries such as China, and unrelated domestic developments in each of the countries. Debate also persists regarding NAFTA’s legacy on employment and wages, as some workers and industries have faced painful disruptions amid increased competition while others have gained from new market opportunities. This debate is evidenced in the fact that, after more than a quarter of a century, the impact of NAFTA remains a perennial topic of discussion in the broader debate over the benefits of free trade.”

Burfisher, Mary E, Frederic Lambert, and Troy D Matheson, 2019, “NAFTA to USMCA: What is Gained?” IMF Working Paper

USMCA/NAFTA 2.0

“Against this backdrop, the United States launched new trade negotiations with Canada and Mexico soon after President Trump’s inauguration in 2017, with the aim of supporting higher-paying jobs and growth. Those culminated in a new trilateral United States – Mexico – Canada trade agreement (USMCA) signed by U.S. President Trump, Canadian Prime Minister Trudeau, and Mexican President Peña Nieto, on November 30, 2018...It includes tighter rules of origin in the automobile, textile, and apparel sectors, a new labor value content requirement in the auto sector, higher U.S. access to Canadian supply-managed markets, further goods trade facilitation, updated provisions related to financial services, as well as a new currency provision and a provision about entering free trade agreements with non-market economies.”

Burfisher, Mary E, Frederic Lambert, and Troy D Matheson, 2019, “NAFTA to USMCA: What is Gained?” IMF Working Paper

USMCA/NAFTA 2.0

“The conclusion of USMCA is occurring in a dynamic trade environment for Canada and Mexico. In March 2018, they joined 9 other countries in the Asia Pacific region in signing the Comprehensive and Progressive Agreement for a Trans-Pacific Partnership (CPTPP). This agreement will provide preferential access by Canada, Mexico, Japan and other CPTPP members to each other’s markets. Also, in May 2018, the United States imposed import tariffs of 25 percent on steel and 10 percent on aluminum due to national security concerns, to which U.S. major trade partners (including Canada and Mexico) responded with surtaxes on imports of selected U.S. products. Finally, in April and August 2018, the United States levied additional tariffs on a combined US$ 50 billion of imports from China, which immediately triggered retaliation by China. The impact of USMCA is analyzed within this context”

Burfisher, Mary E, Frederic Lambert, and Troy D Matheson, 2019, “NAFTA to USMCA: What is Gained?” IMF Working Paper

USMCA/NAFTA 2.0

“This paper uses a global, multisector, computable-general-equilibrium model to provide an analytical assessment of five key provisions in the new agreement, including tighter rules of origin in the automotive, textiles and apparel sectors, more liberalized agricultural trade, and other trade facilitation measures. The results show that together these provisions would adversely affect trade in the automotive, textiles and apparel sectors, while generating modest aggregate gains in terms of welfare, mostly driven by improved goods market access, with a negligible effect on real GDP. The welfare benefits from USMCA would be greatly enhanced with the elimination of U.S. tariffs on steel and aluminum imports from Canada and Mexico and the elimination of the Canadian and Mexican import surtaxes imposed after the U.S. tariffs were put in place.”

Burfisher, Mary E, Frederic Lambert, and Troy D Matheson, 2019, “NAFTA to USMCA: What is Gained?” IMF Working Paper