1.8 — The Specific Factors Model

ECON 324 • International Trade • Spring 2023

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/tradeS23

tradeS23.classes.ryansafner.com

Assumptions of the Specific Factors Model

Assumptions of the Specific Factors Model

Until now, we've assumed (within each country), factors are mobile

But in truth, some factors are specific or immobile: can only be used for the production of a specific set of goods or industry

- e.g. programmers can only work in software, not in pro-football

- e.g. equipment used to make beer barrels cannot switch to producing computer chips

Opening up trade will affect the distribution of income between fixed and mobile factors

Assumptions of the Specific Factors Model

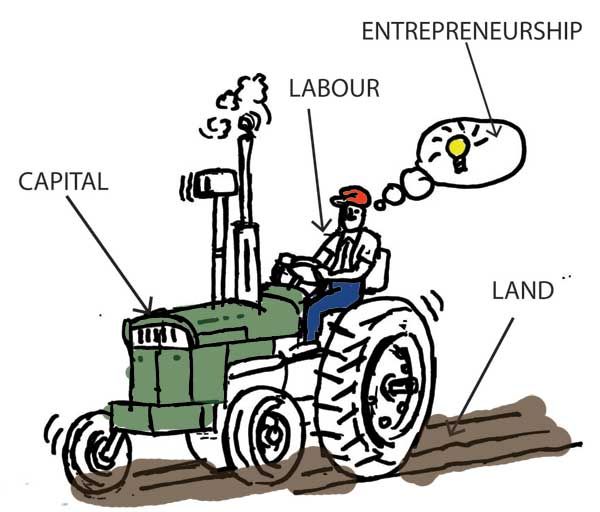

Imagine 2 countries, Home and Foreign

Countries have three factors of production:

- labor (L)

- capital (K)

- land (T)

Assumptions of the Specific Factors Model

Each country has two industries, manufacturing (M) and agriculture (A)

Manufacturing is produced using capital (K) and labor (L)

Agriculture is produced using land (T) and labor (L)

Land (T) and capital (K) are specific factors, only used to produce one good

Labor (L) is a mobile factor that can be used in either (or both) sectors

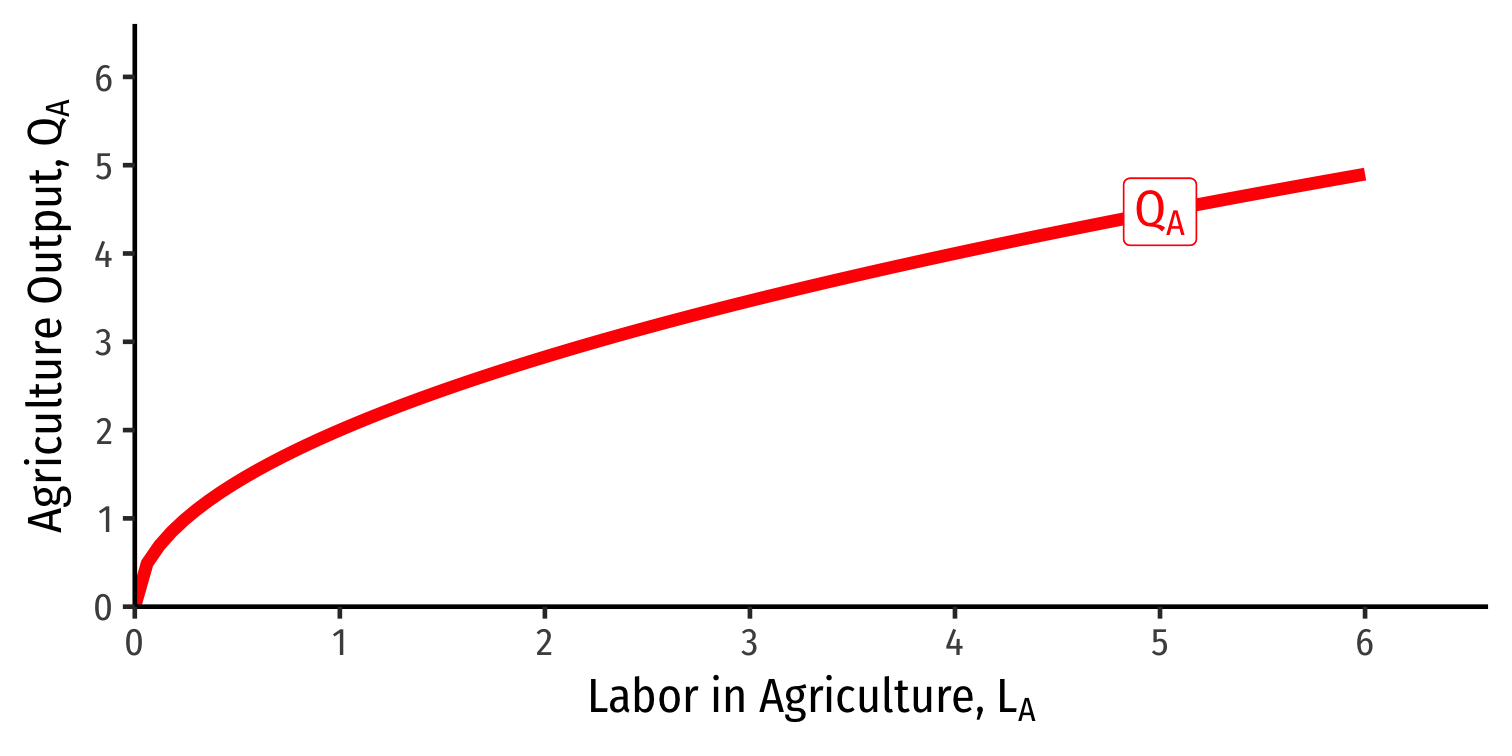

Setting up the Model: Production Function

- An economy's production can be described as a set of production functions for manufacturing (M) and agriculture (A)

QM=QM(K,LM)QA=QA(T,LA)

- Each country can only allocate its labor force between two industries

LM+LA=¯L

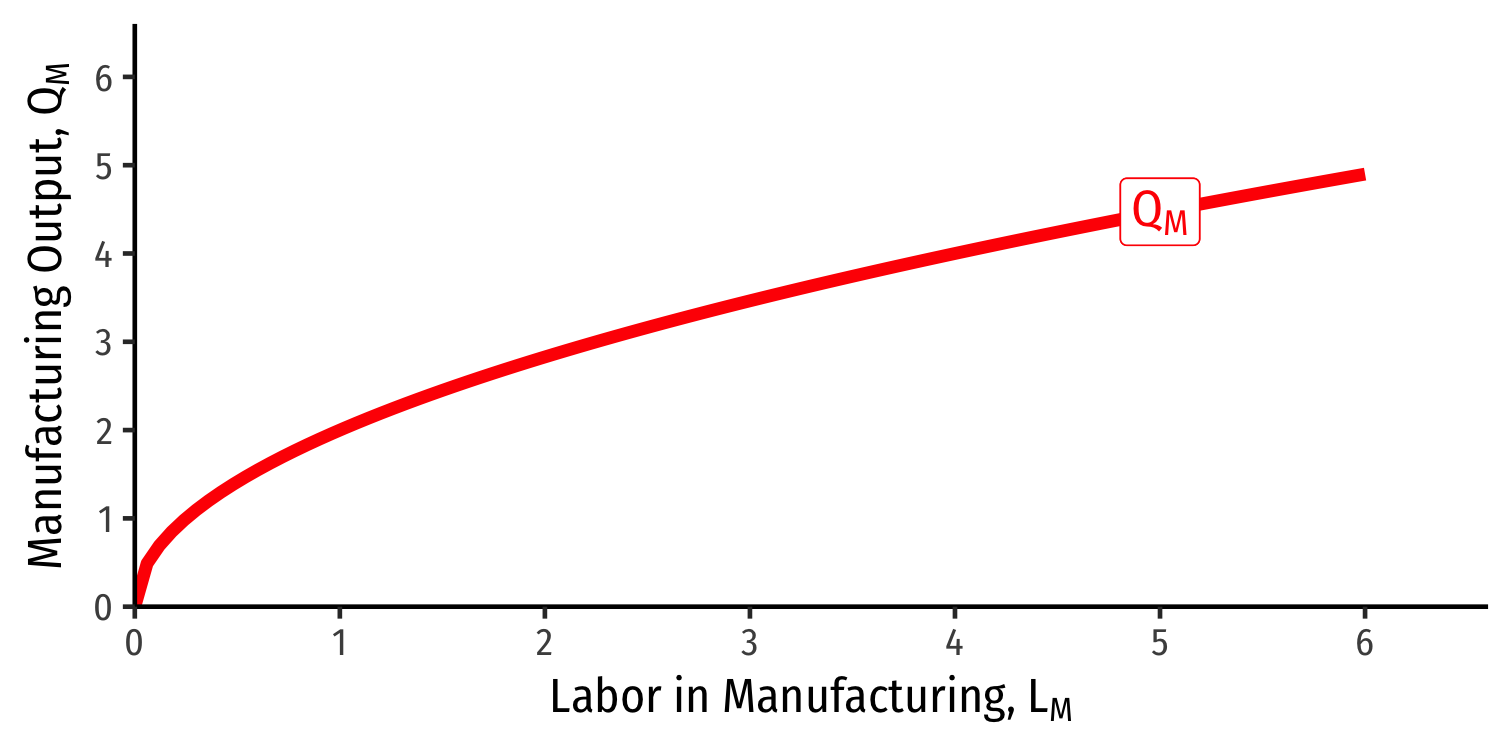

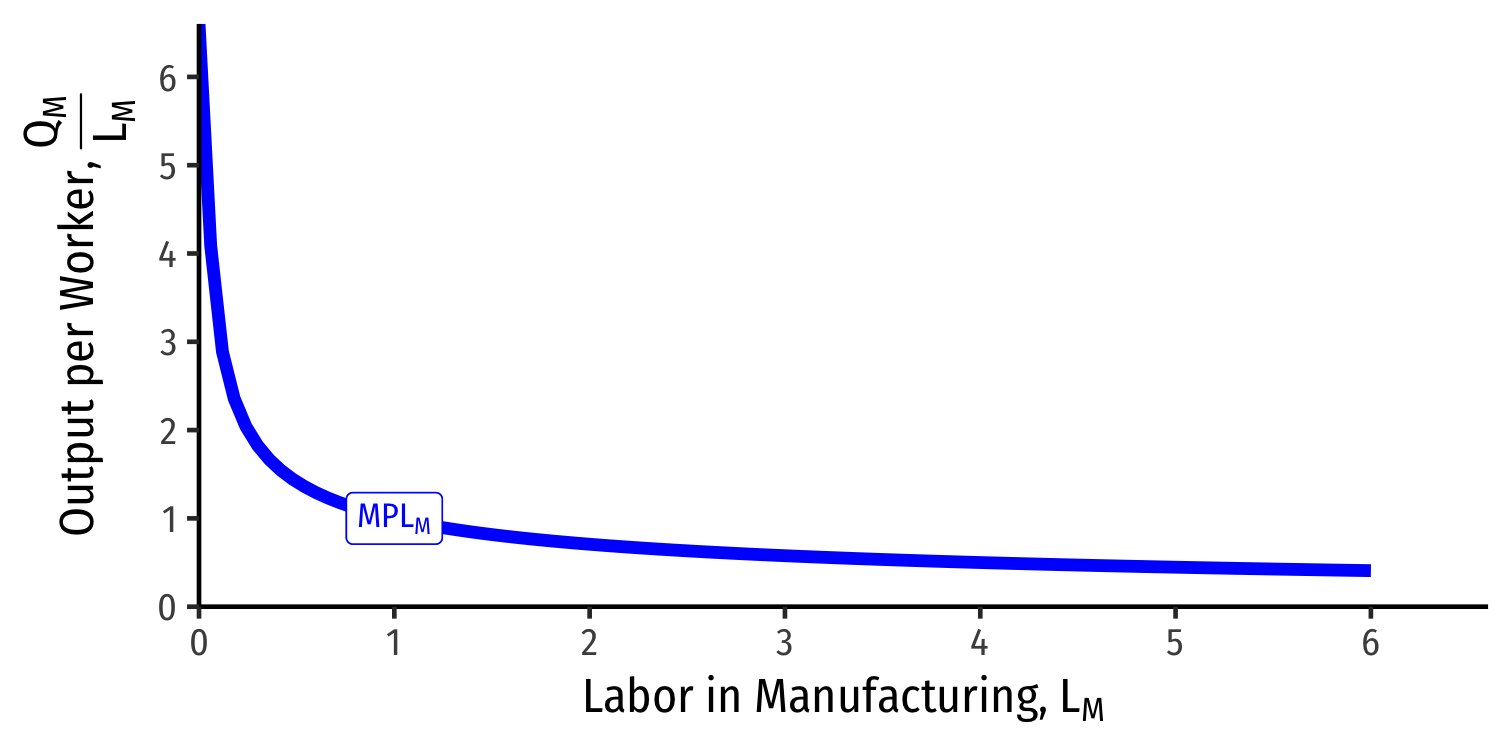

Diminishing Marginal Product of Labor

Each industry exhibits diminishing returns to labor

Marginal product of labor in manufacturing (MPLM): additional manufacturing output produced by adding one more unit of labor (holding K constant)

MPLM=ΔQMΔLM

- Declines as more L is added to manufacturing production

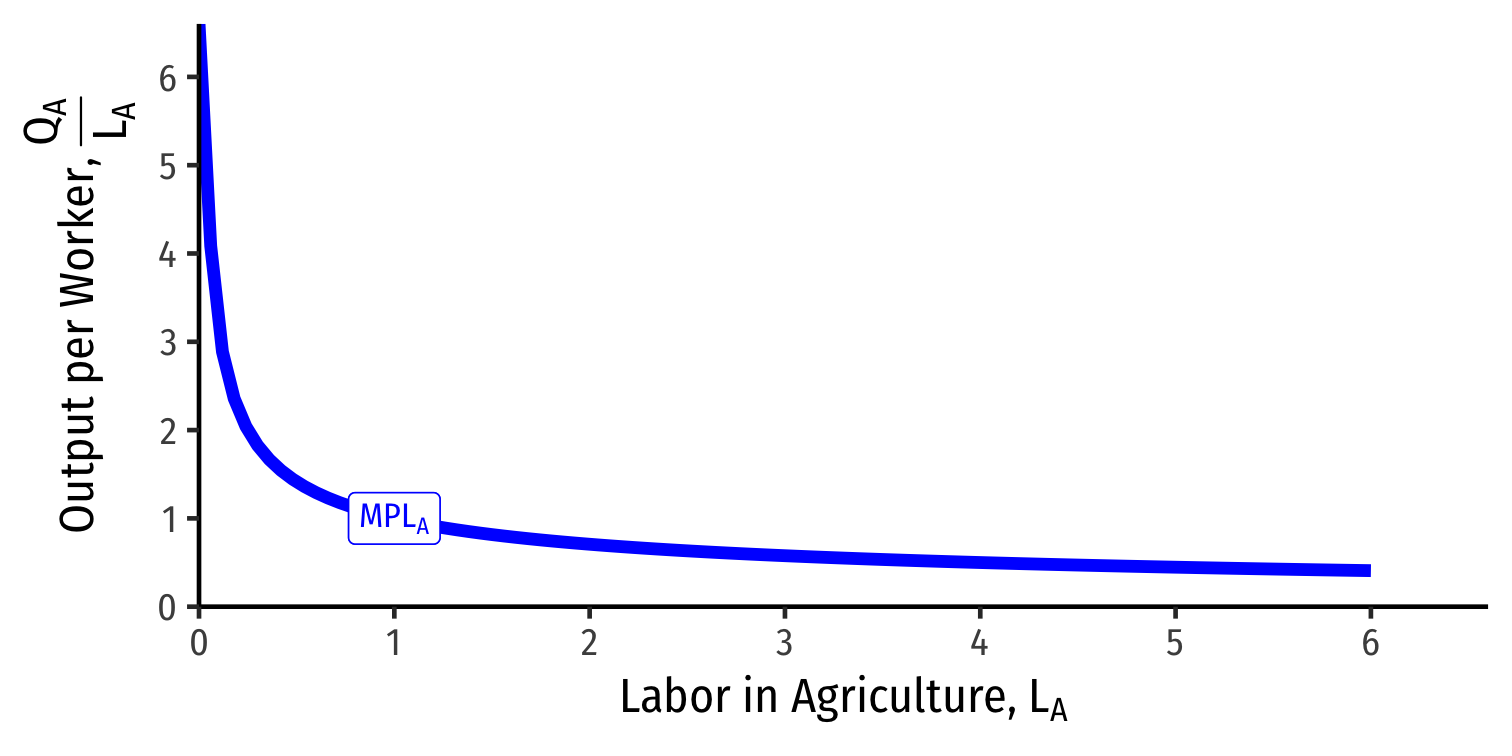

Diminishing Marginal Product of Labor

Each industry exhibits diminishing returns to labor

Marginal product of labor in agriculture (MPLA): additional agriculture output produced by adding one more unit of labor (holding T constant)

MPLA=ΔQAΔLA

- Declines as more L is added to agriculture production

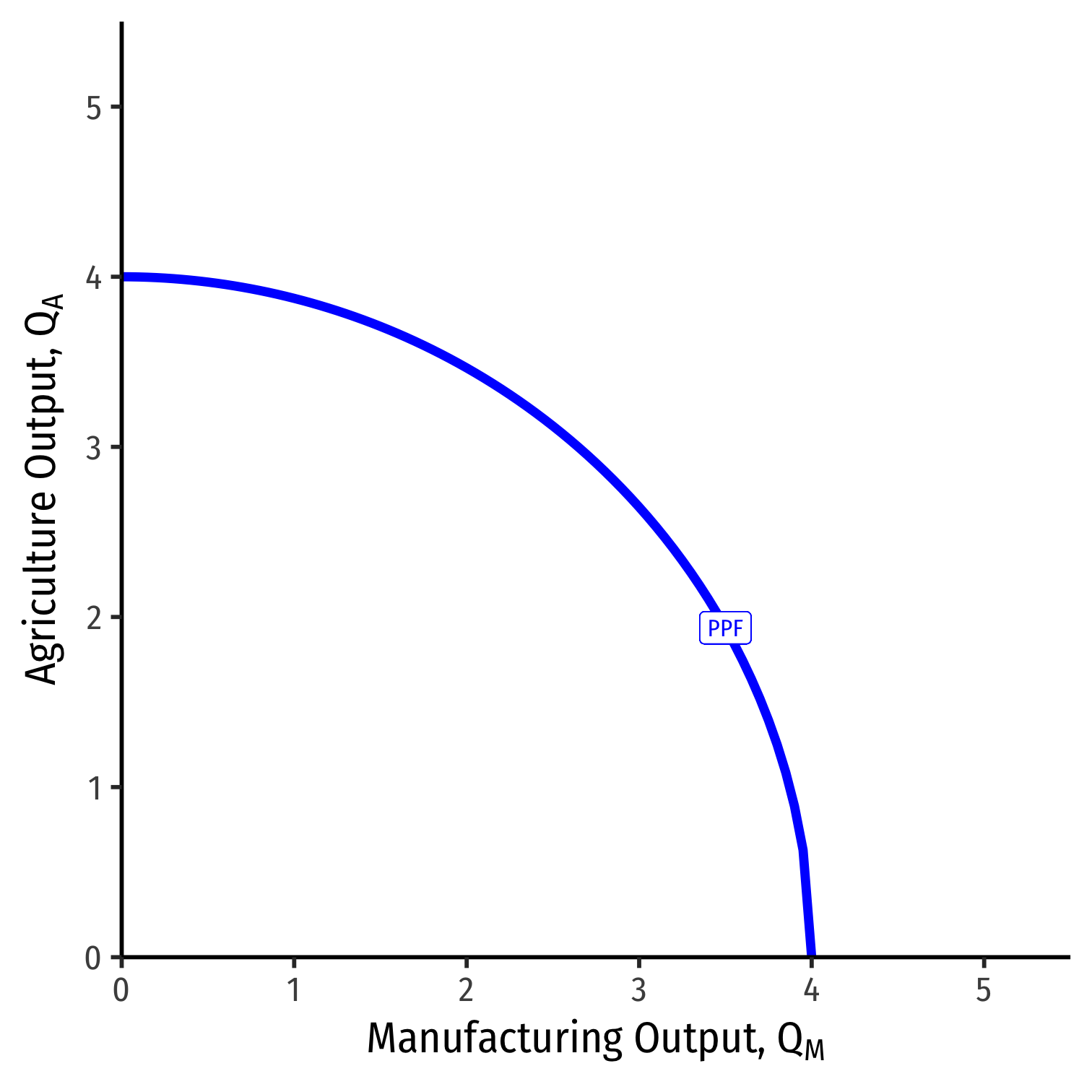

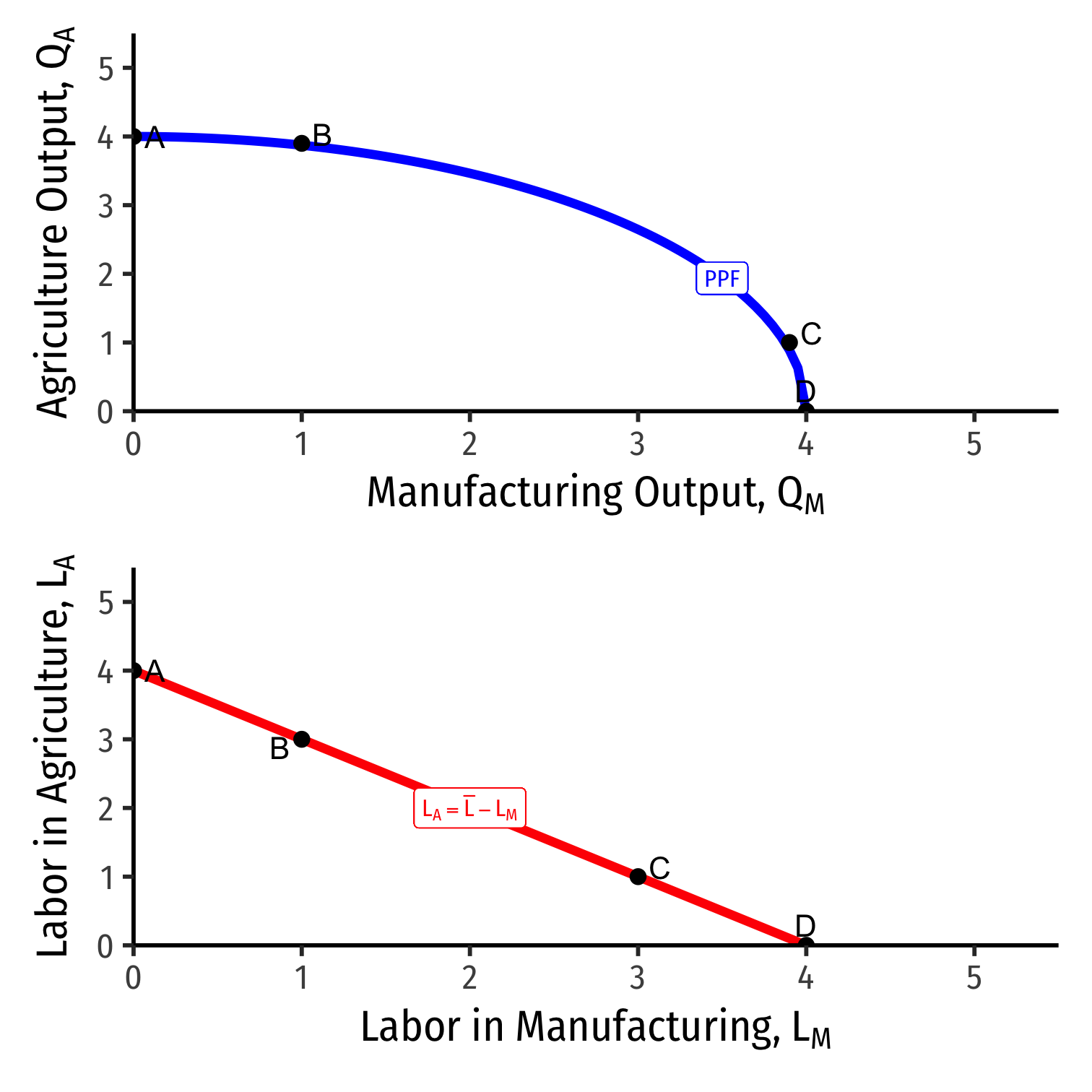

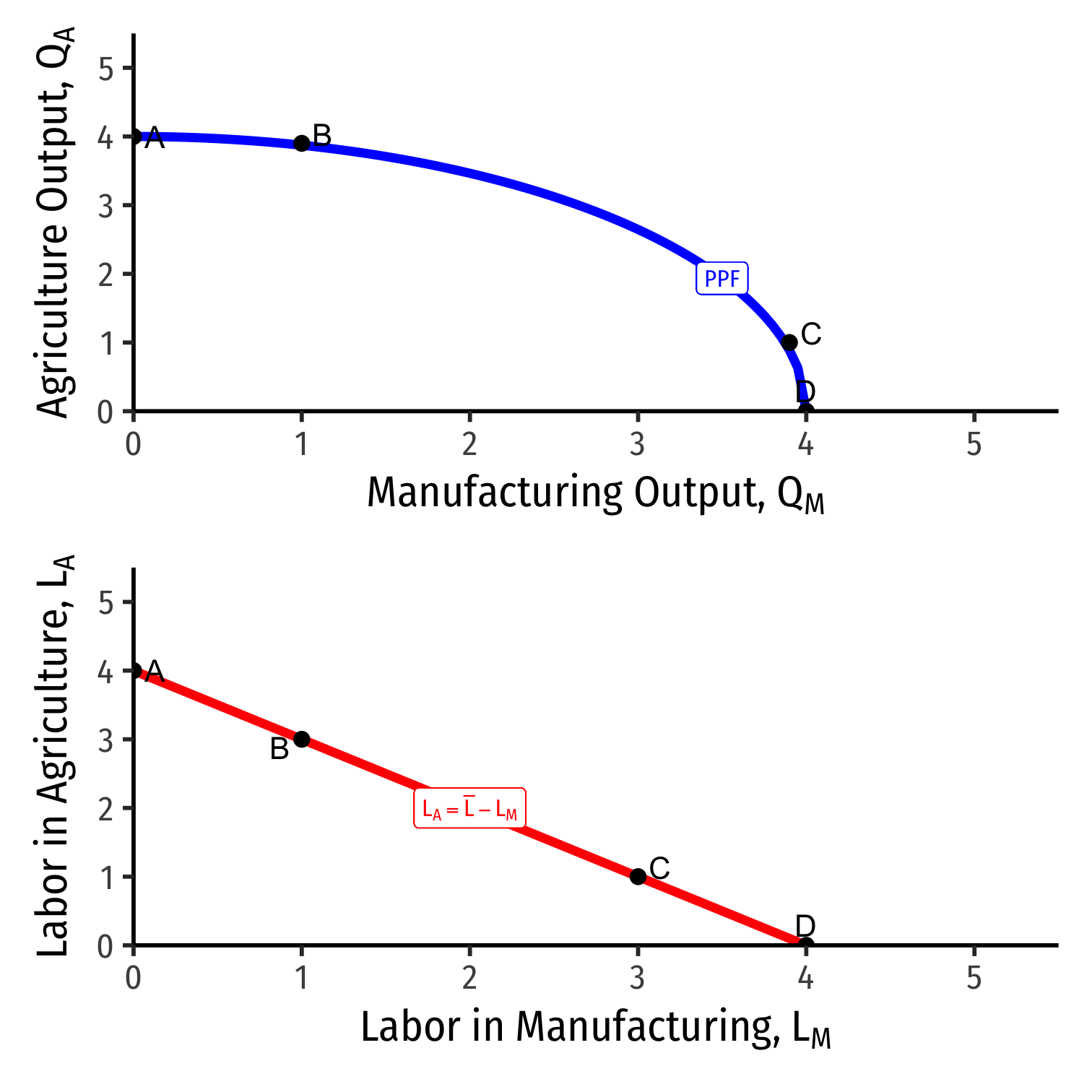

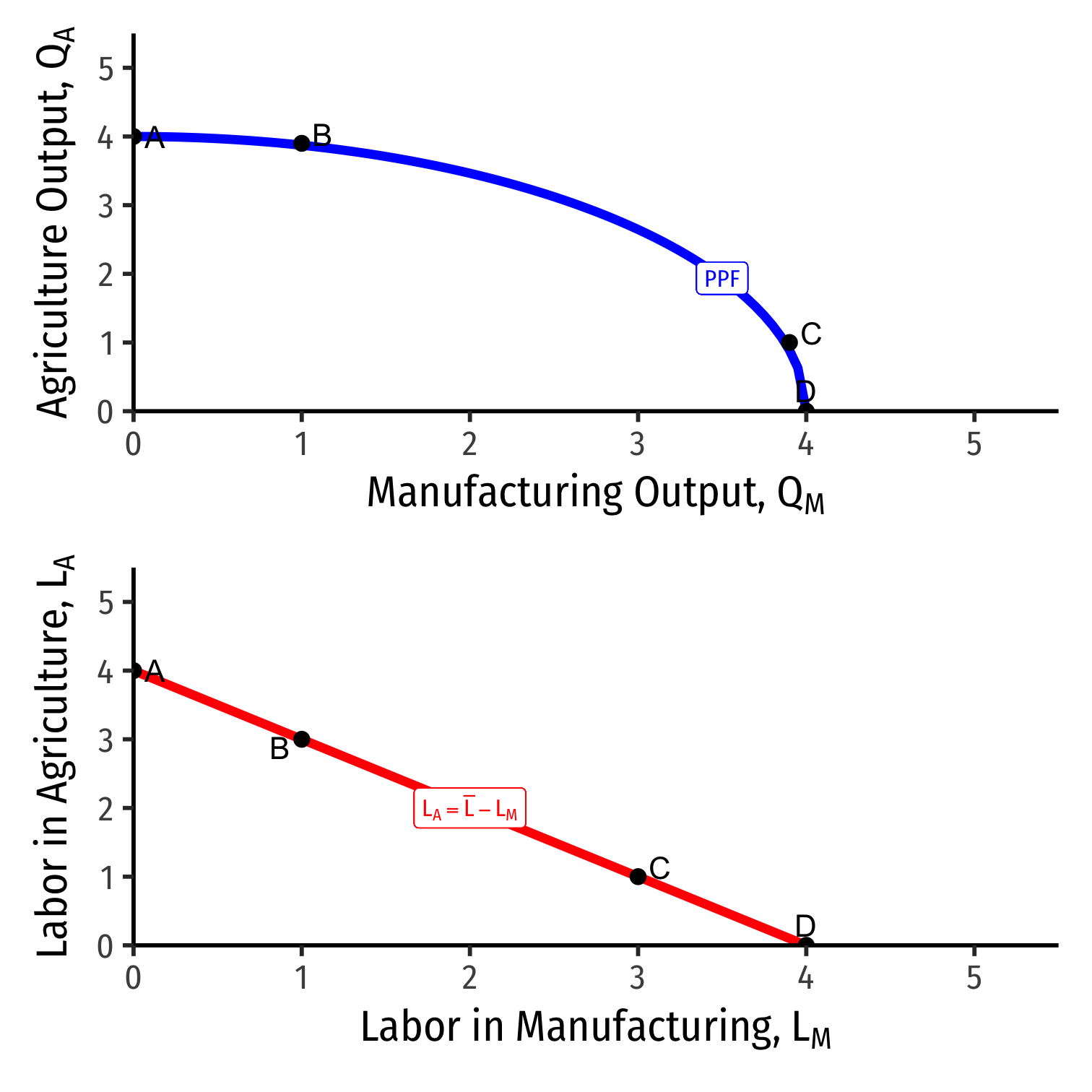

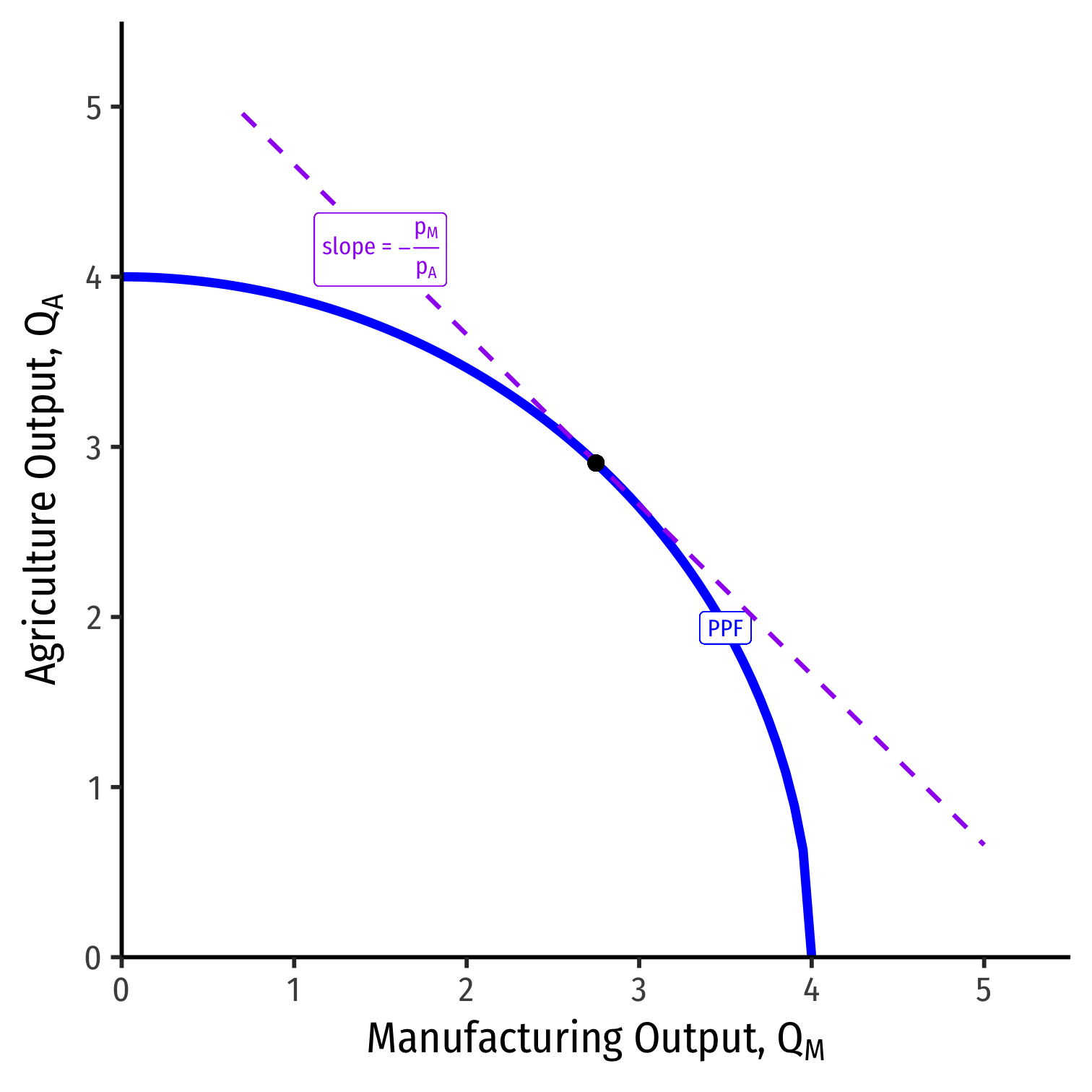

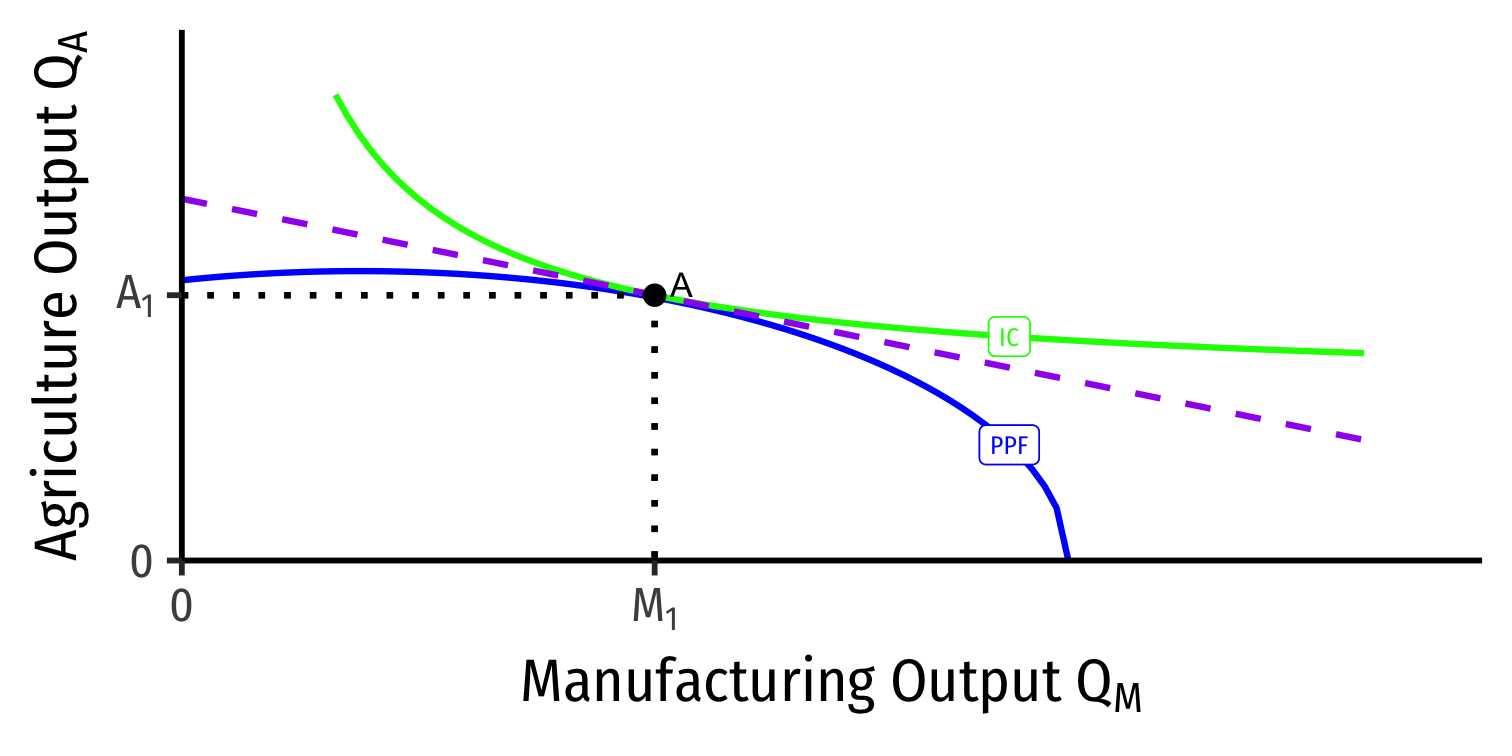

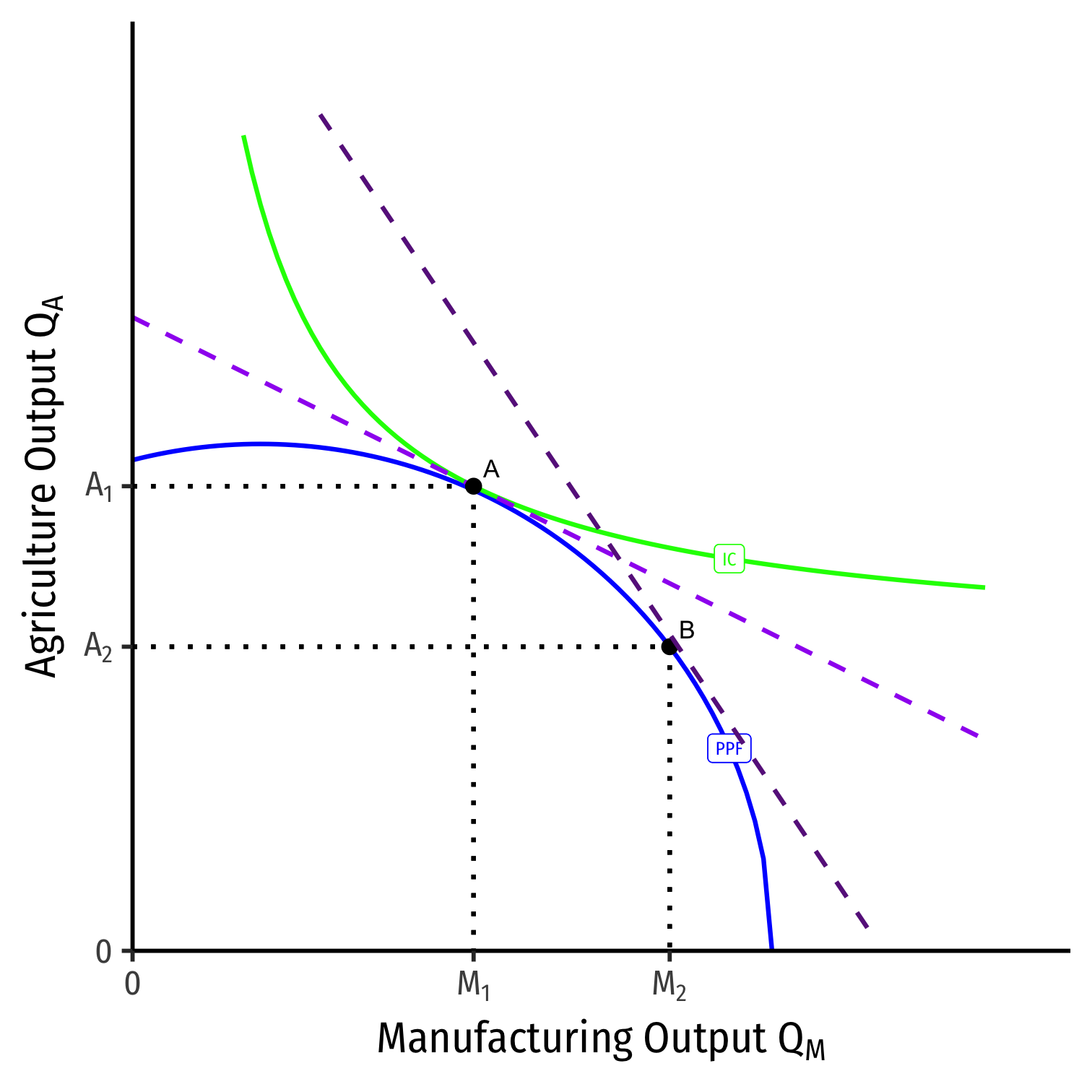

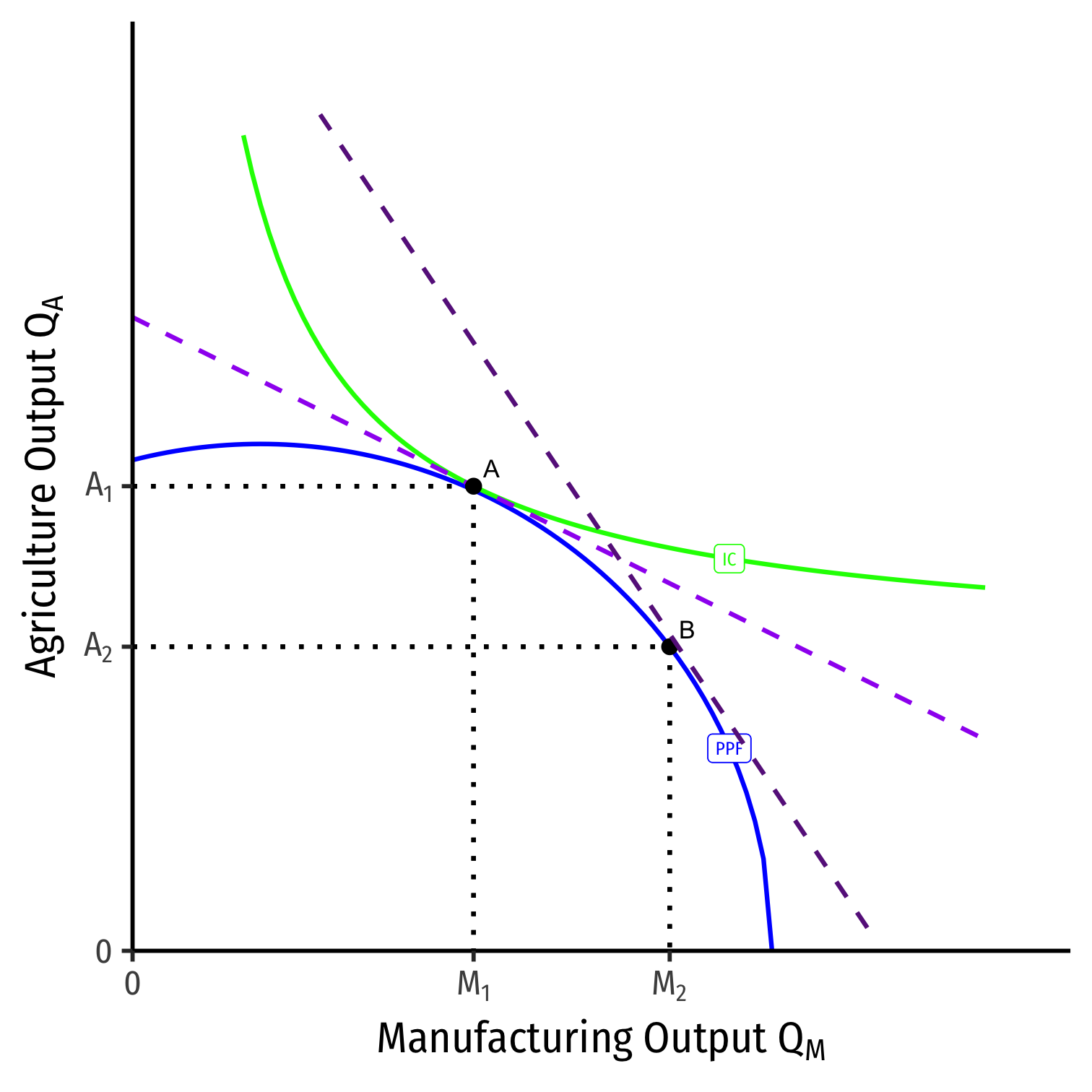

PPF

We get a PPF with increasing costs again

Let's examine more why

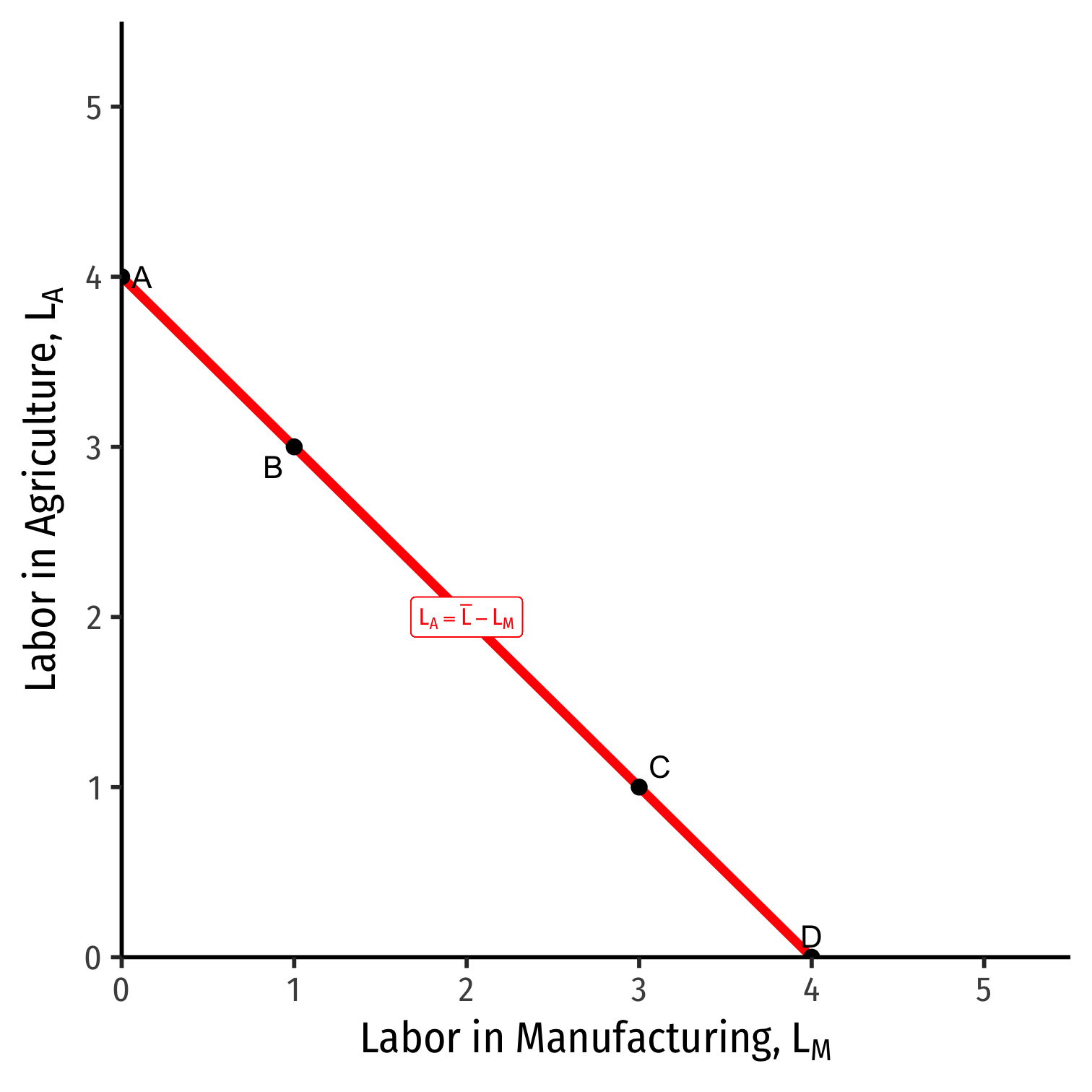

Allocating the Mobile Factor (Labor)

A Note About Labor

- A simple (and very Ricardian) assumption about labor: it is measured in hours, and can equally be applied to each industry

¯L=LM+LA

Every labor hour allocated to agriculture is a labor hour not allocated to manufacturing, and vice versa

- Opportunity cost of labor

Visualize a “labor budget constraint” to understand movements along the PPF

Allocating Labor

Shows relationship of moving along PPF ⟺ reallocating labor across industries

If all labor in A (point A), country only produces A, no M

If all labor in M (point D), country only produces M, no A

Remember, each industry has diminishing returns to labor, and will have a particular MPL depending on how much land or capital there are

- Hence, a 1 unit ↑↓ in L in one industry does not imply a 1 unit increase in output

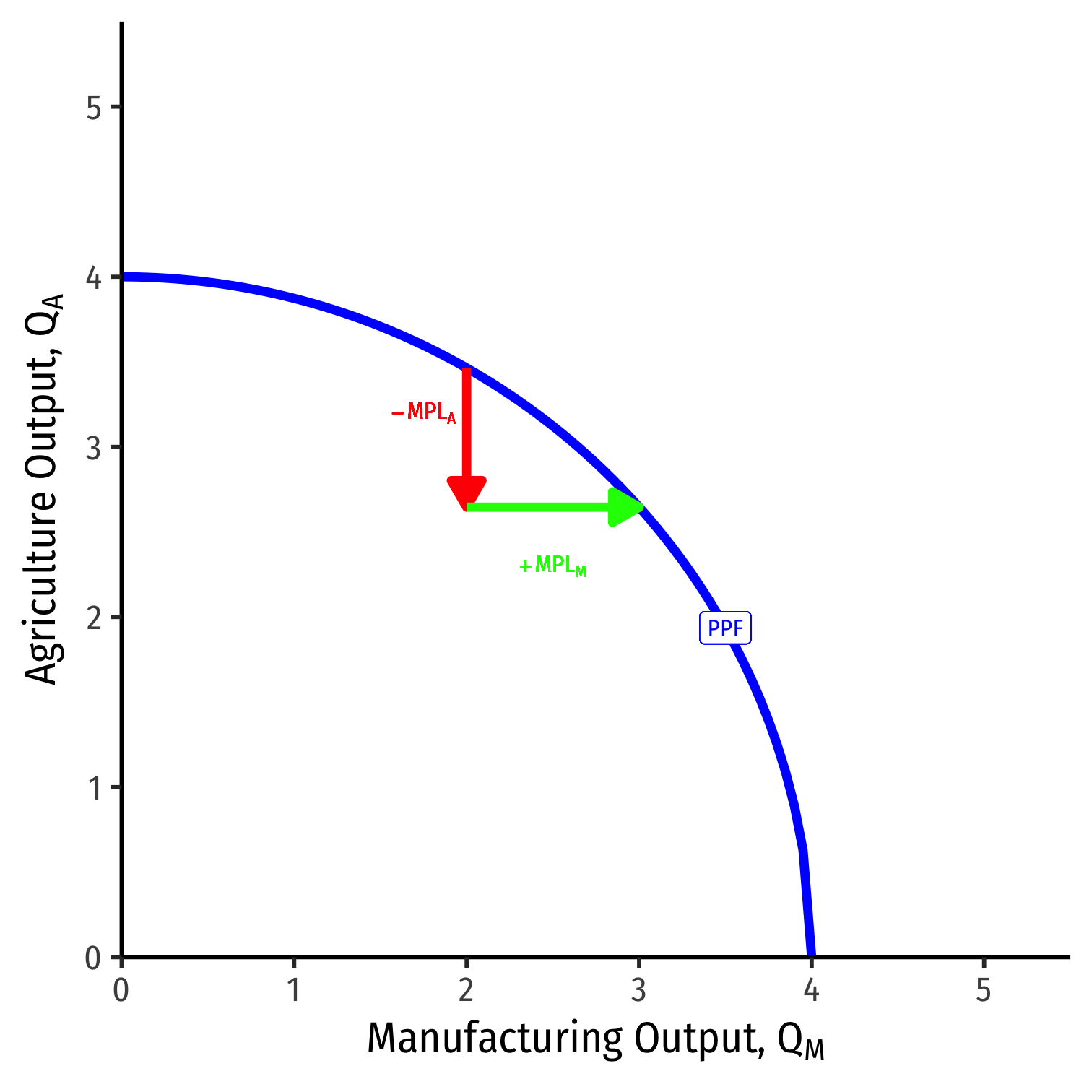

Allocating Labor

As we move to the right of the PPF, we are pulling labor out of agriculture and into manufacturing

Each single unit of labor we take out of A and put into M will:

- Lower ↓QA by MPLA

- Raise ↑QM by MPLM

Or to put it inversely, to produce 1 more unit of M:

- Reallocate ↓LA input by 1MPLA

- Reallocate ↑LM input by 1MPLM

Production Possibilities Frontier

- Marginal rate of transformation (MRT) increases as we produce more of a good

- Again: “slope”, “relative price of M”, “opportunity cost of M”

- Amount of A given up for 1 more M

MRTslope=−MPLAMPLM

- Note A(y) on top and M(x) on bottom!

- if you think in our Ricardian terms, lx=1MPLx and ly=1MPLy, so lxly⟹MPLyMPLx

Allocating Labor

Because of diminishing returns, as we move labor out of A and into M, we lower MPLM and raise MPLA

This is why the PPF has increasing opportunity costs, and is bent inwards the way it is!

For a given amount of T, K, and L, we can determine the economy's output bundle (QM,QA) by knowing how much labor is allocated across (LM,LA)

Now let's find how labor is allocated across industries

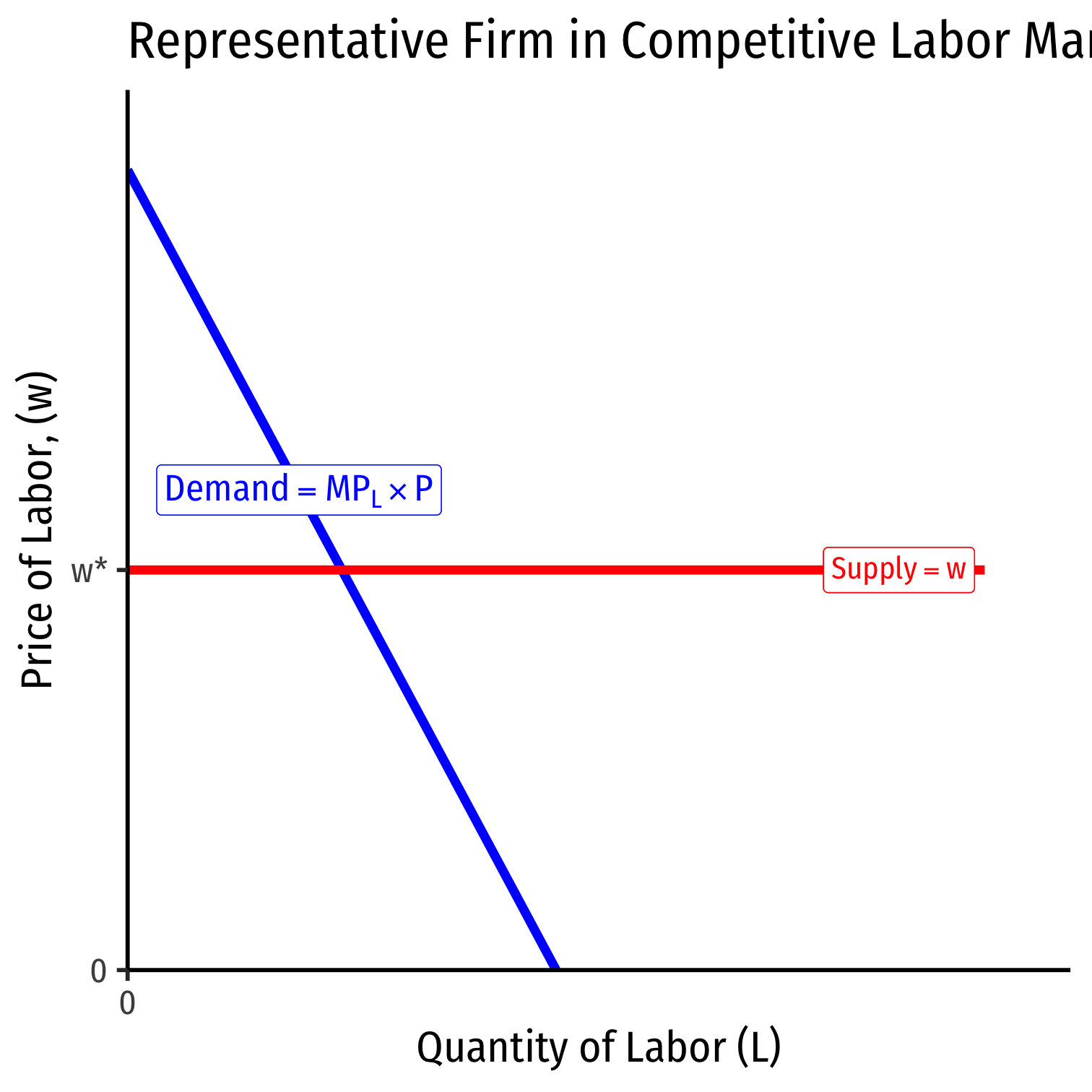

The Demand for Labor in Competitive Industries

Profit-maximizing firms in competitive labor markets will hire labor (hours) up to the point where the marginal benefit of hiring labor equals the marginal cost

- Marginal cost per labor-hour: wage w

- Marginal benefit per labor-hour: marginal revenue product (marginal product × price of output)

In manufacturing:

w=MPLM∗PM

- In agriculture:

w=MPLA∗PA

- Again, if you want to remember why, see my slides on Factor Markets

The Demand for Labor in Both Industries

Because we have assumed labor is mobile (and homogenous “labor hours”), workers will always move out of a lower-paying industry and into a higher-paying industry

Thus, in equilibrium, wages w must equalize across both industries, with the implication:

(w=)MPLM∗PM=MPLA∗PA(=w)−MPLAMPLM=−PMPA

Labor and the PPF

- Thus, we finally see how it is that the slope of the PPF is equivalent to the relative price of M:

MRT=−pMpA

- Opportunity cost of M, slope is amount of A given up for 1M

- (Back to x on top, y on bottom!)

- At the optimum production, PPF is tangent to a value line with slope the relative price of M

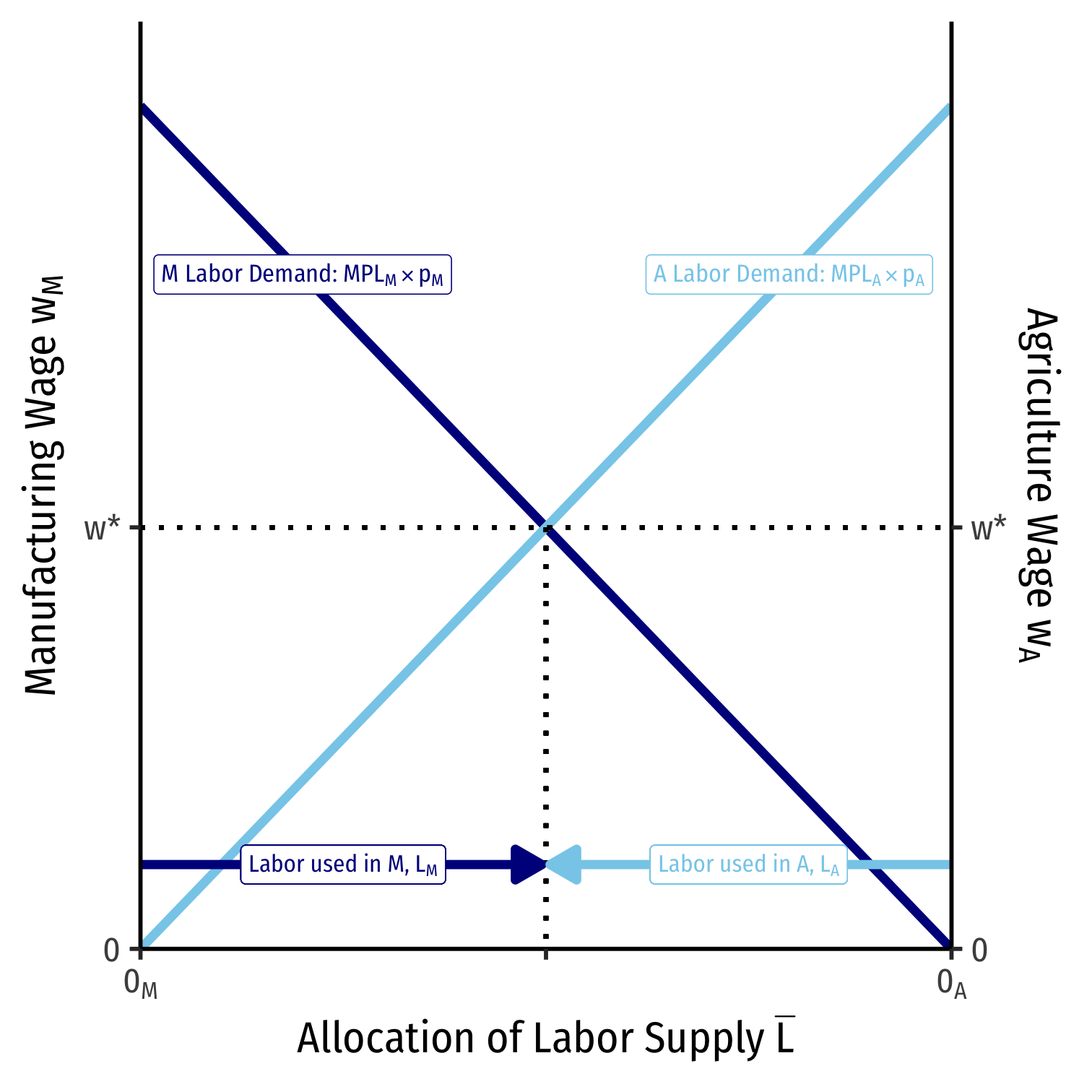

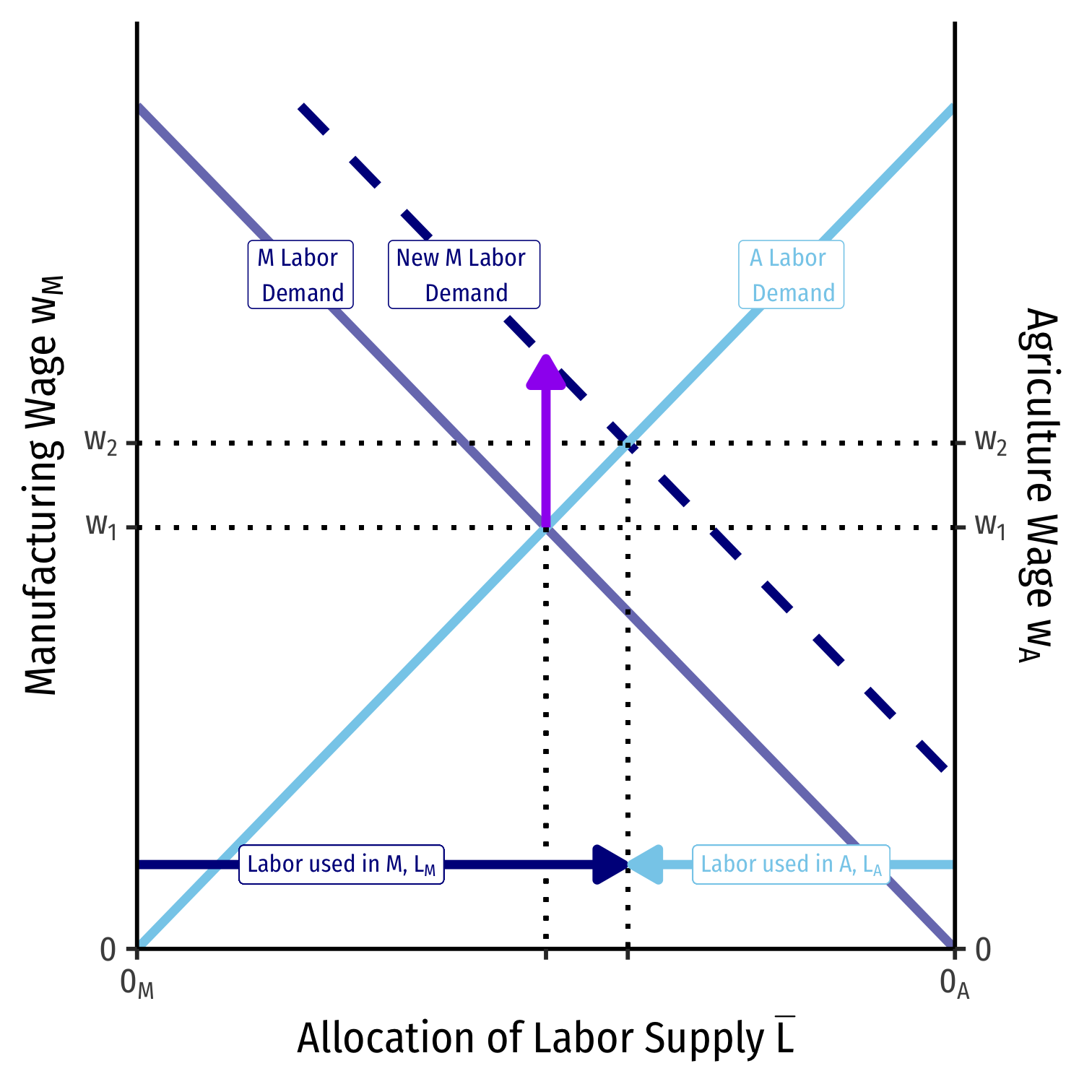

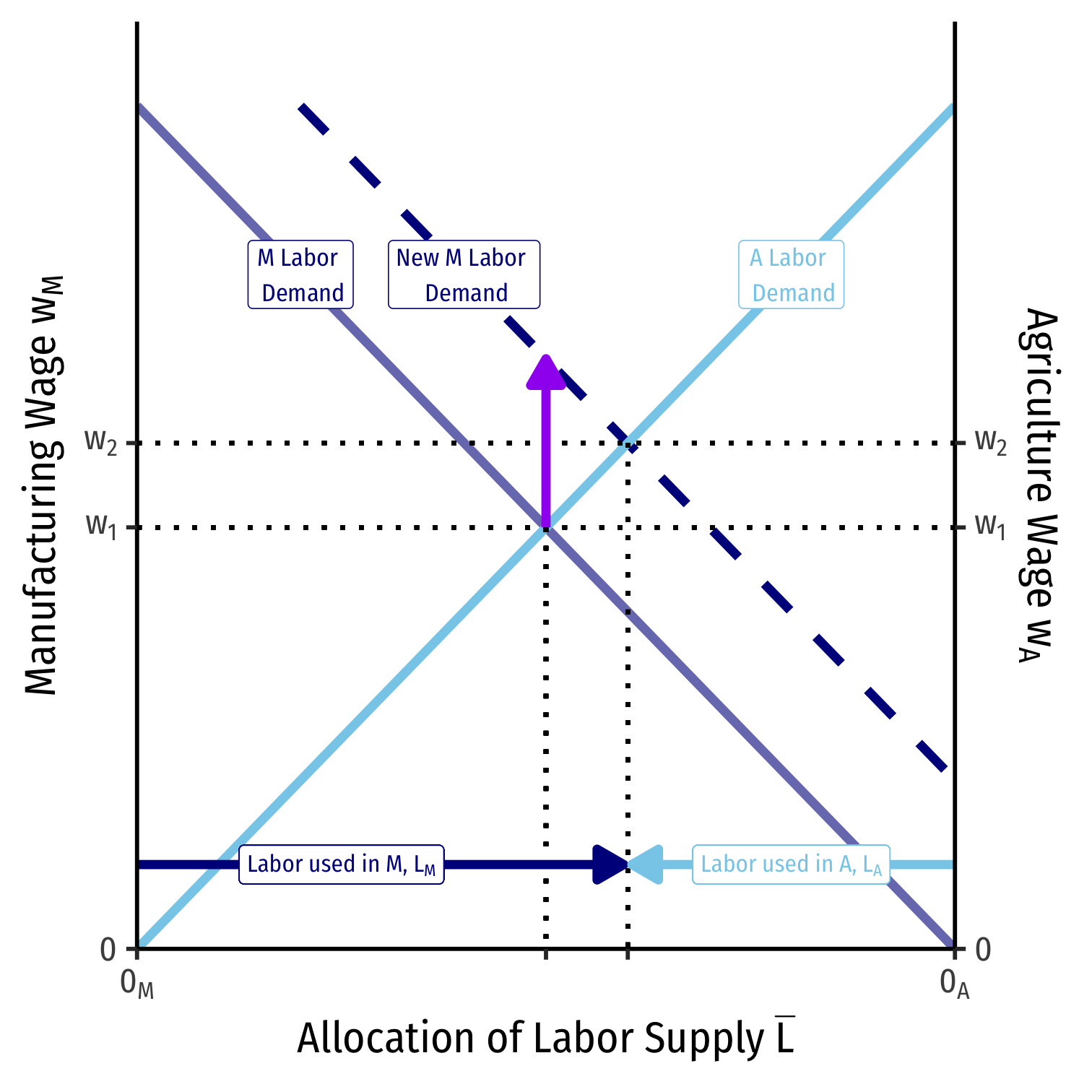

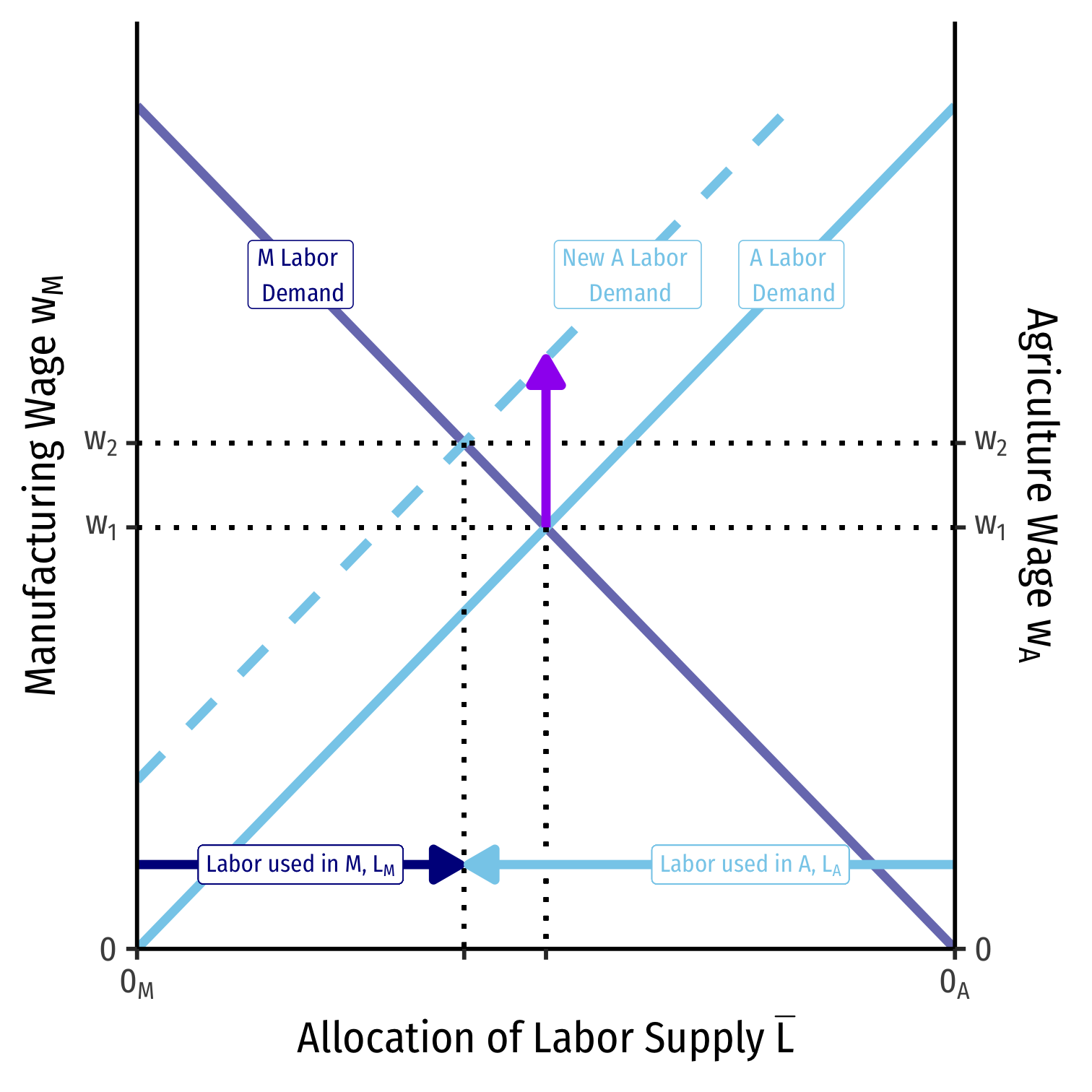

Labor Allocation

We can also visualize the allocation of labor in the country

Recall both industries in equilibrium must charge the same wage wM=wA=w⋆

Moving from left to right, labor allocated to manufacturing, LM

Moving from right to left, labor allocated to agriculture, LA

A Change in Relative Prices on Labor Allocation

An increase in the relative price of manufacturing (pMpA) will increase the demand for labor in manufacturing

Because both industries have to compete for labor, wages do increase, but not as much as the increase in the relative price of manufacturing

More labor will be used in manufacturing than in agriculture, and thus, the economy will produce more manufacturing and less agriculture

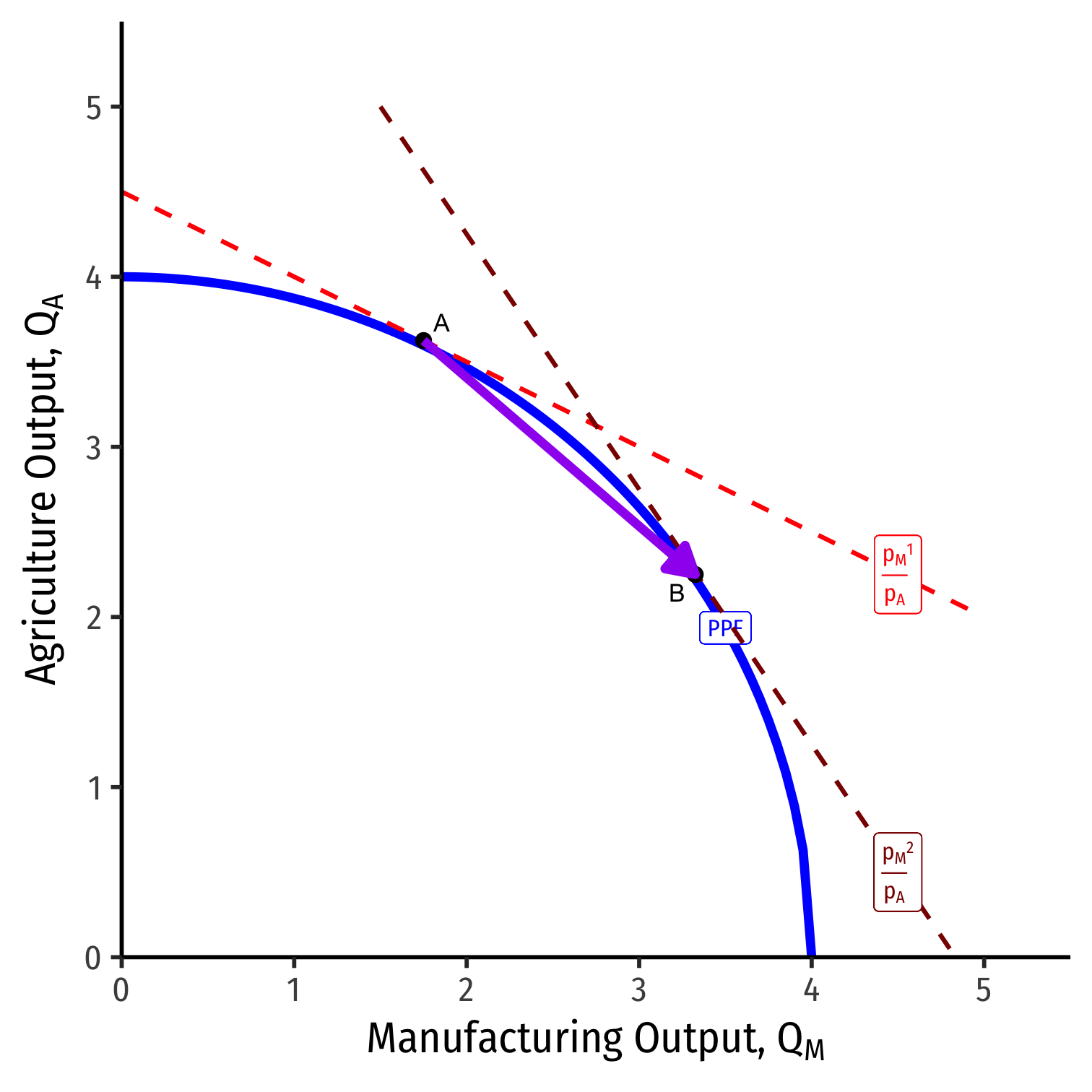

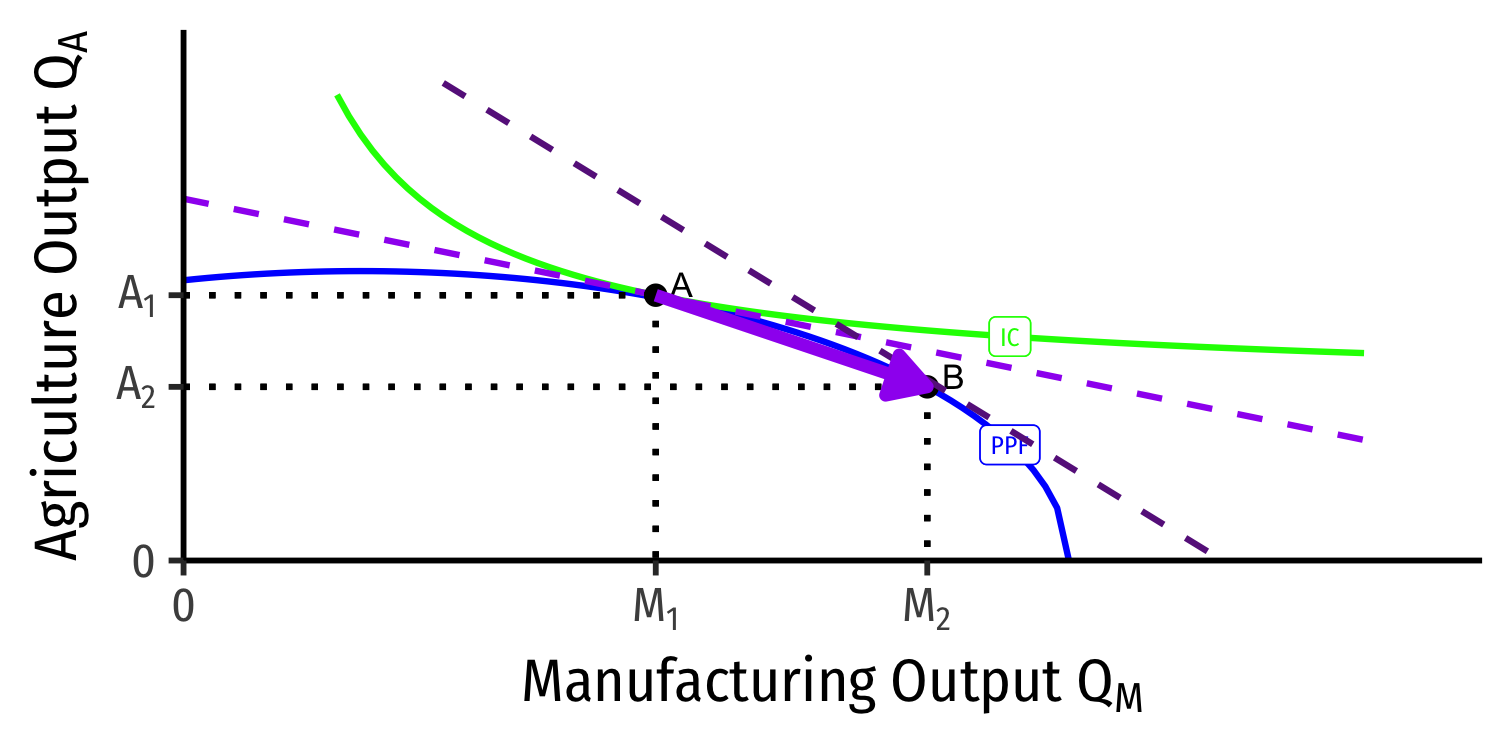

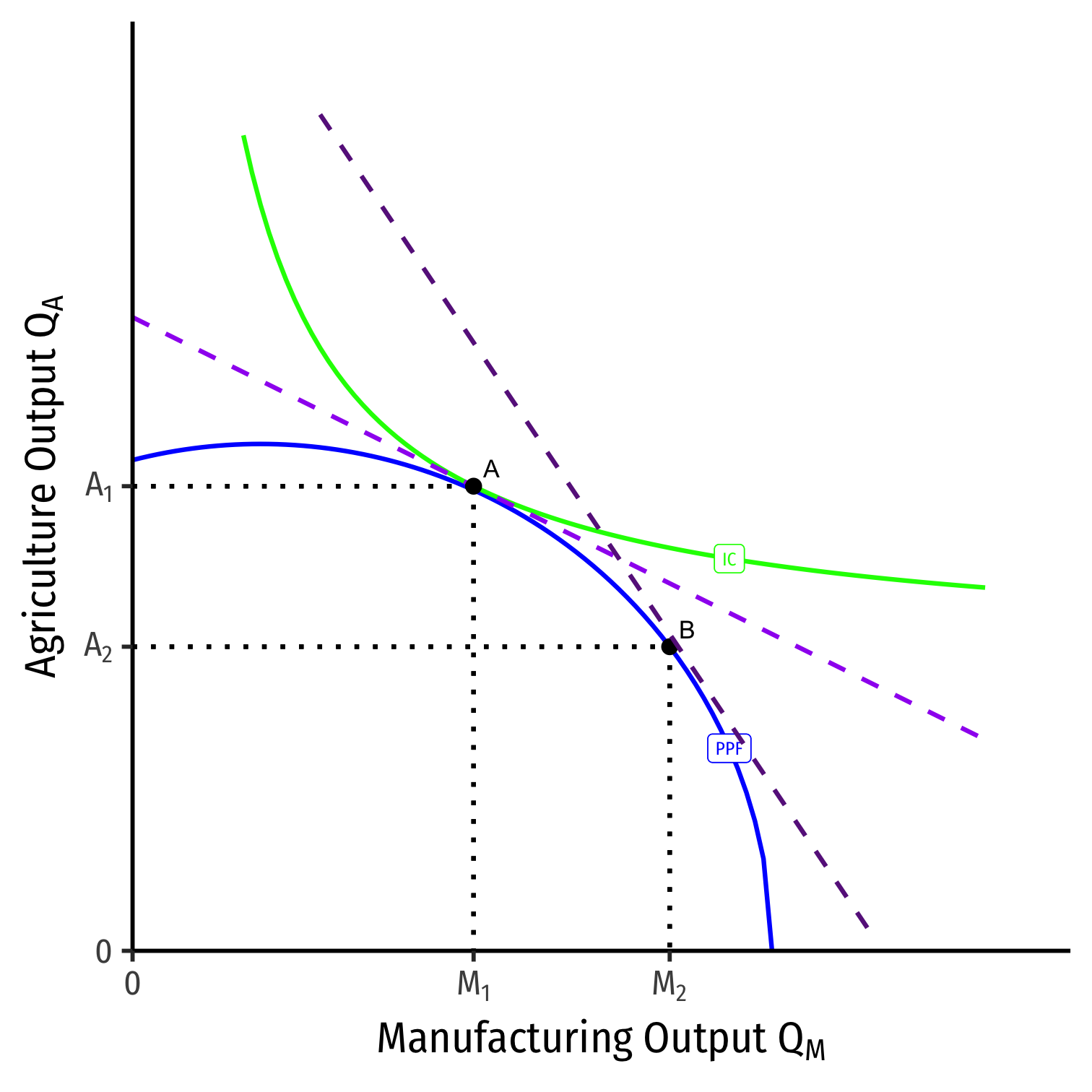

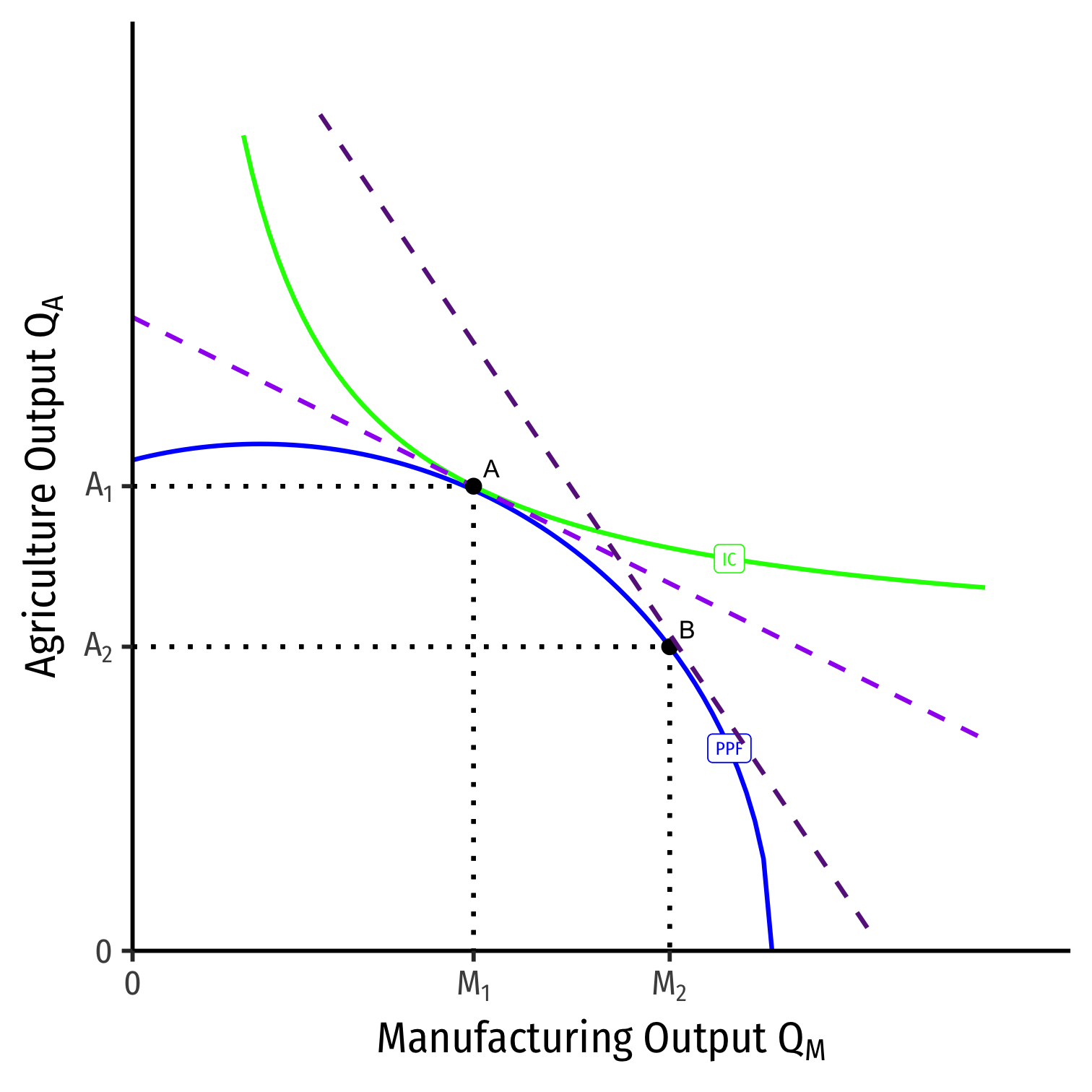

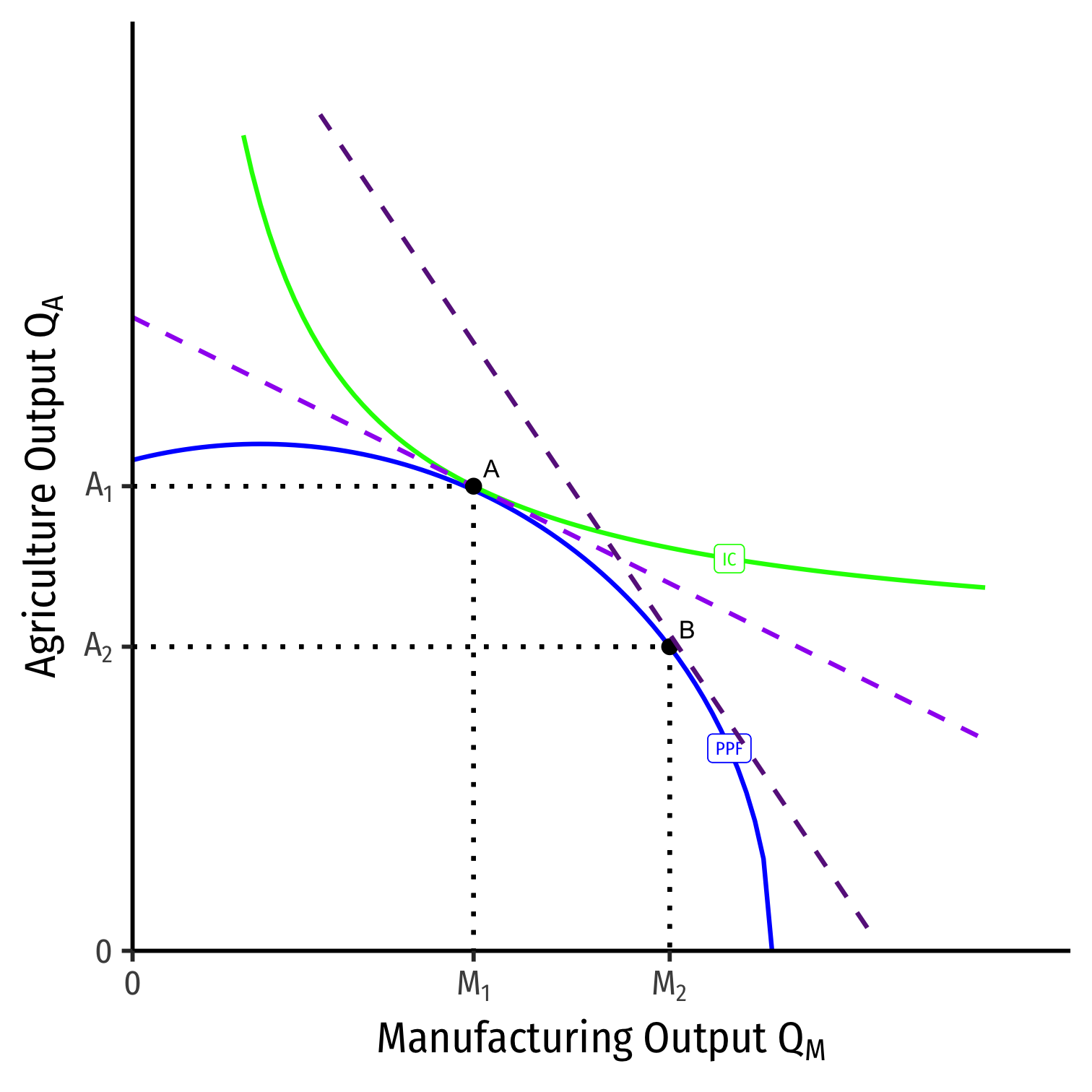

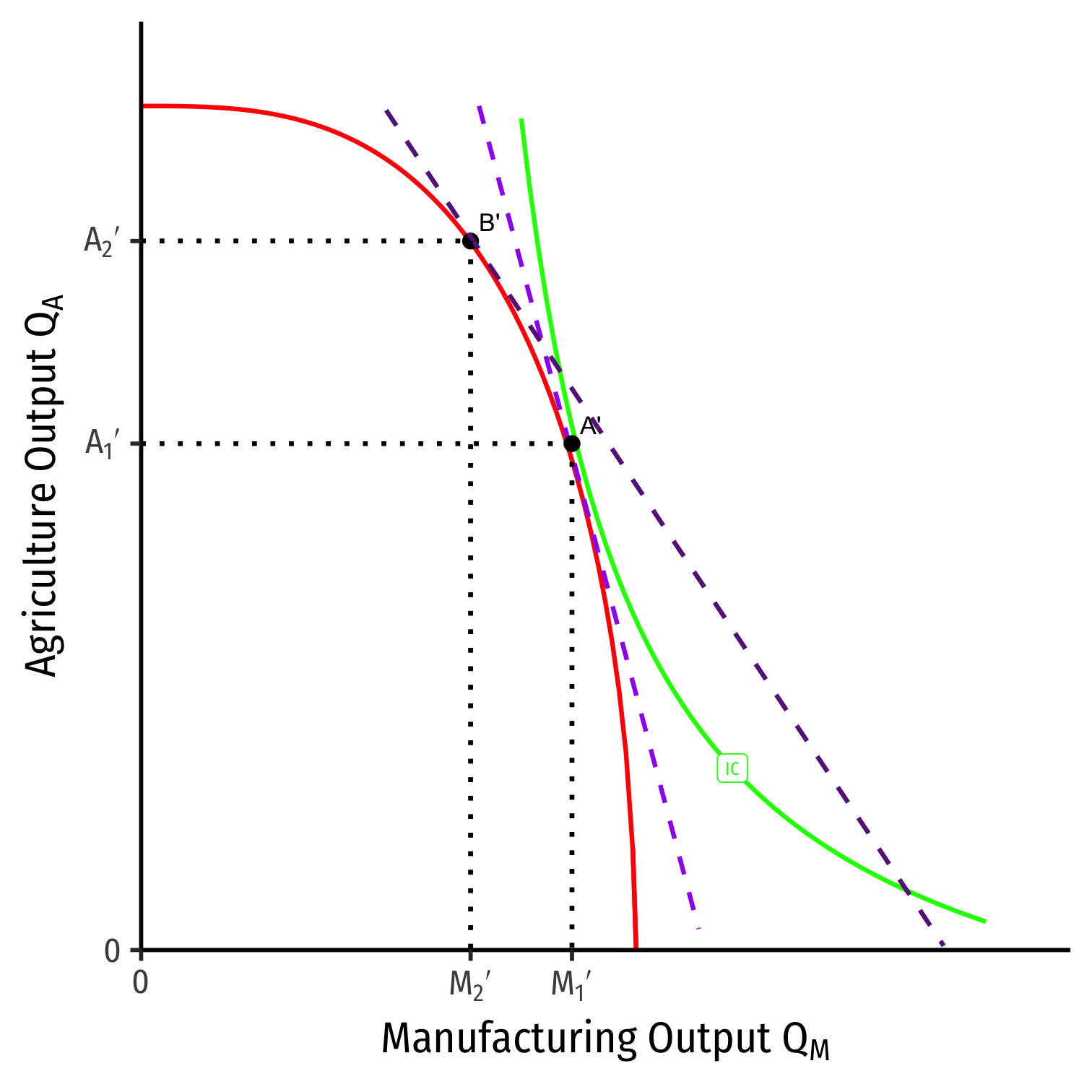

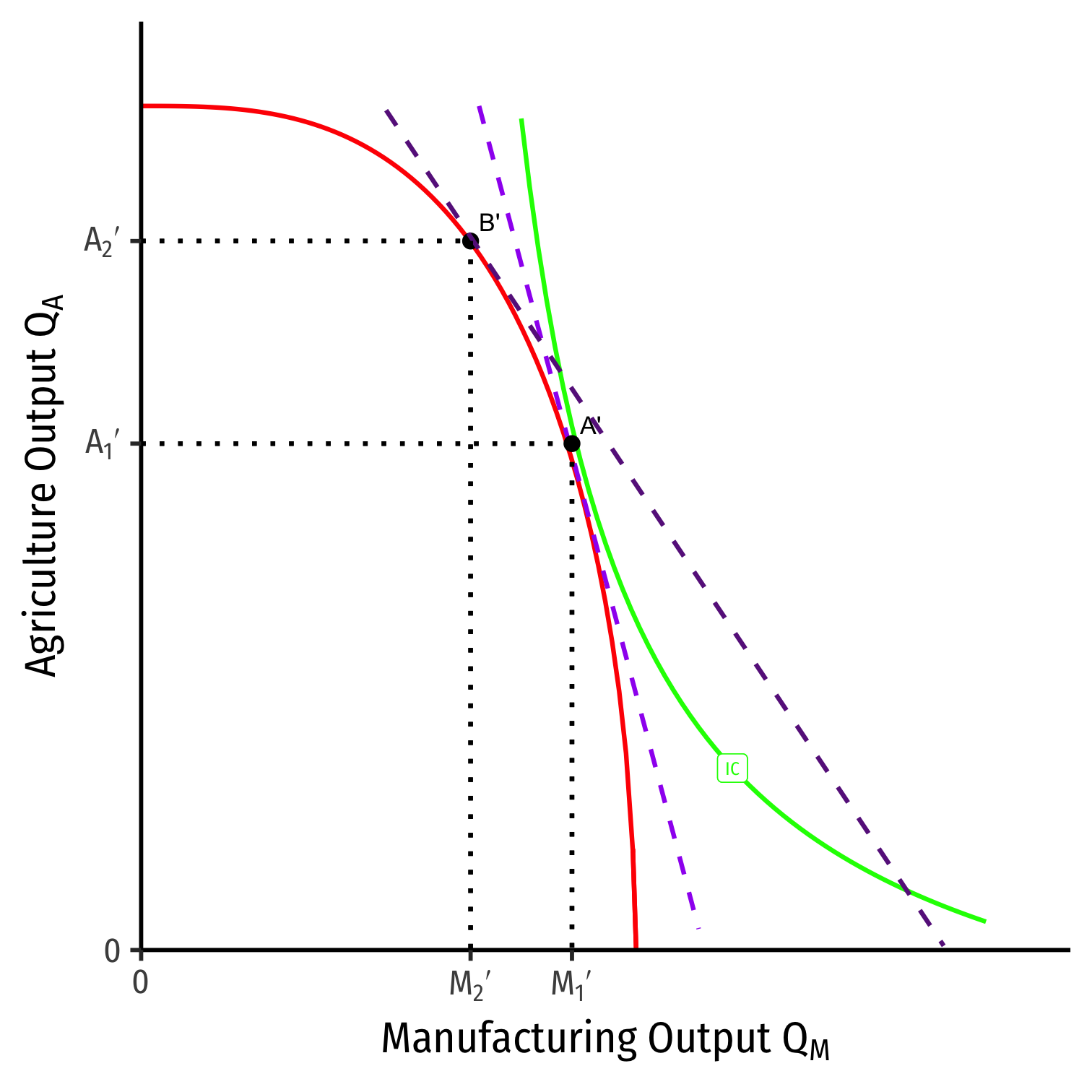

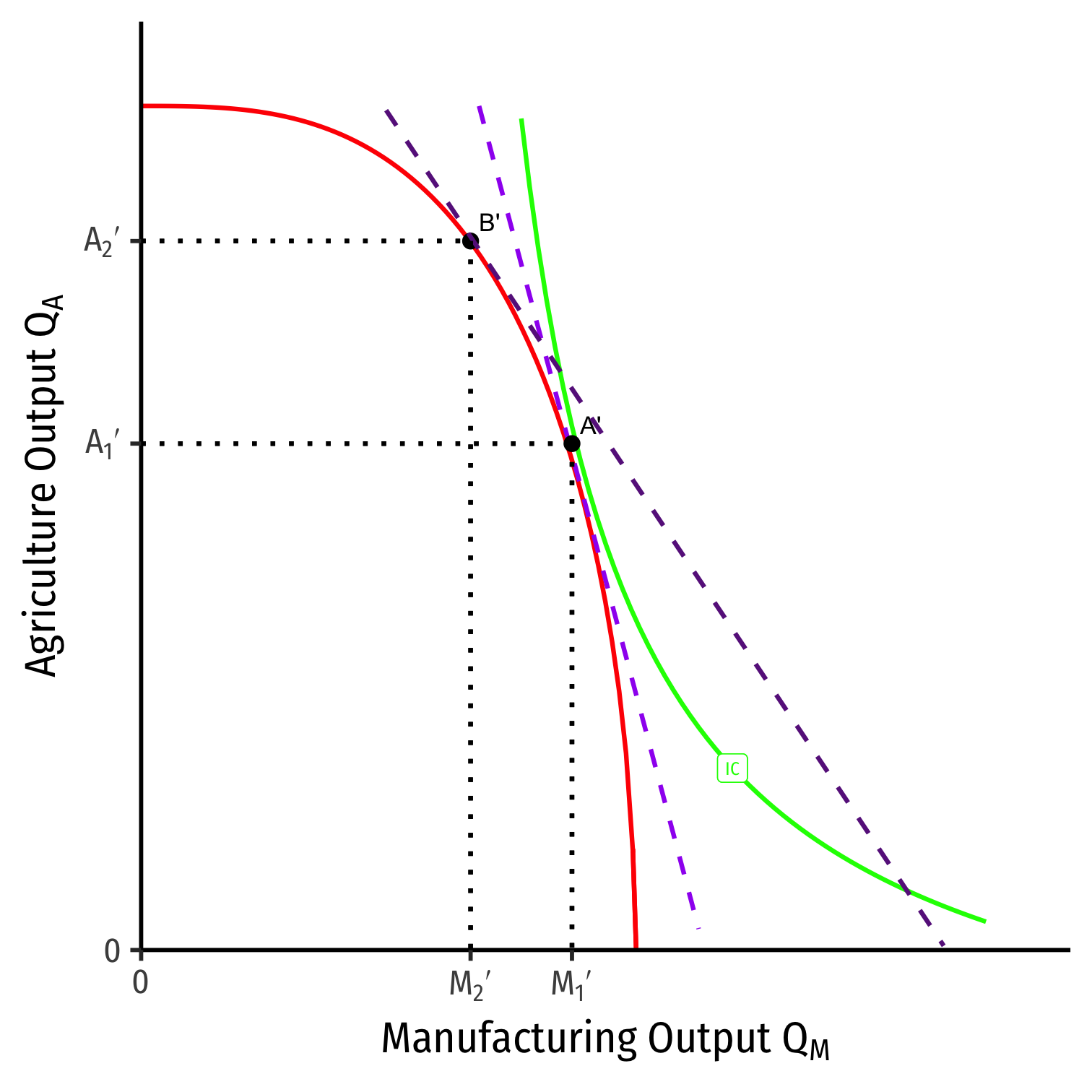

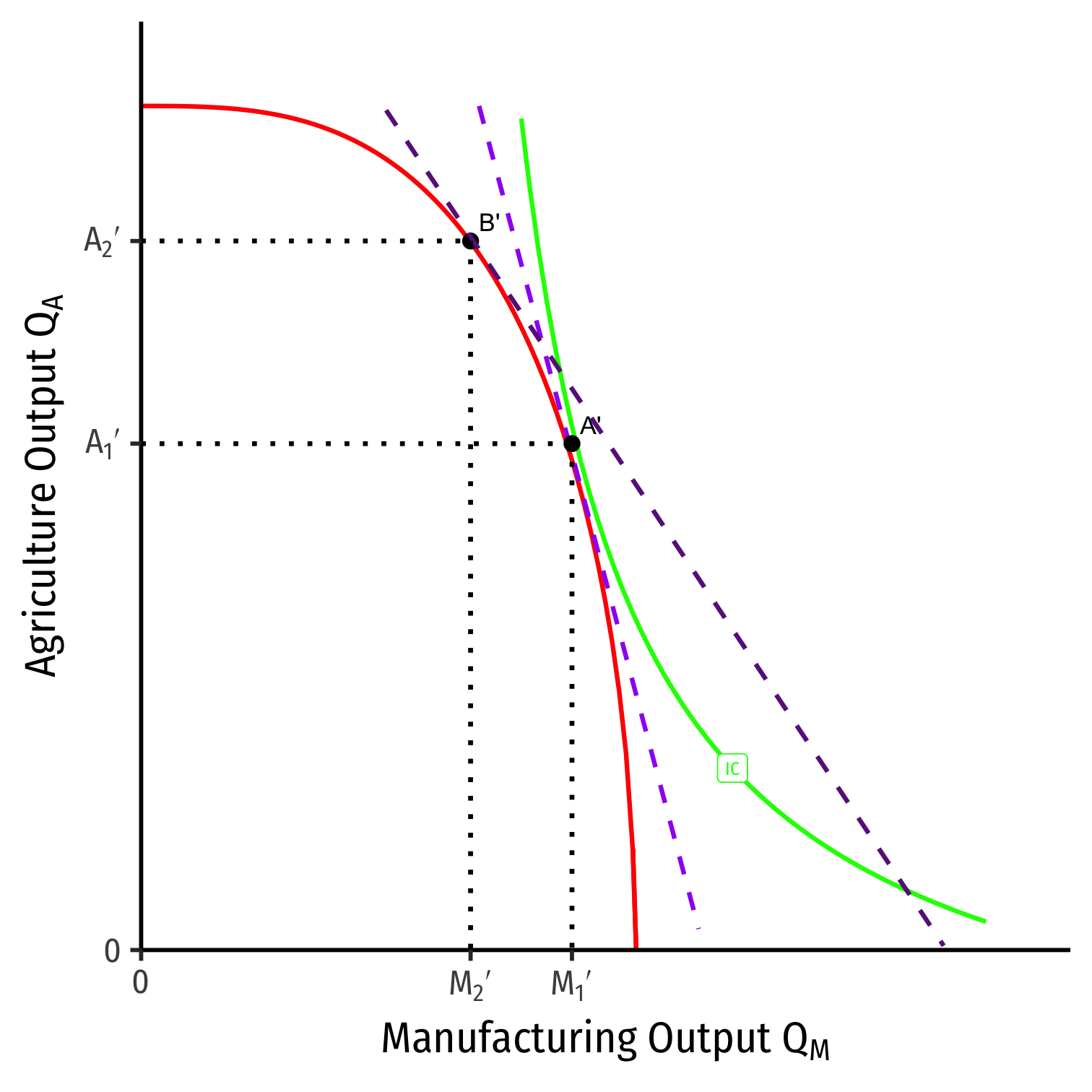

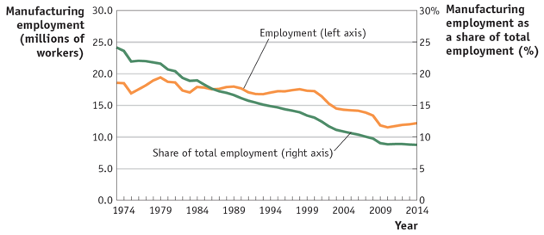

A Change in Relative Prices on PPF

We can equivalently see this on the PPF

Increase in the relative price of manufacturing

(pMpA)1→(pMpA)2

- Moving from A→B

- Slope steepens

- Country will produce less agriculture, more manufacturing

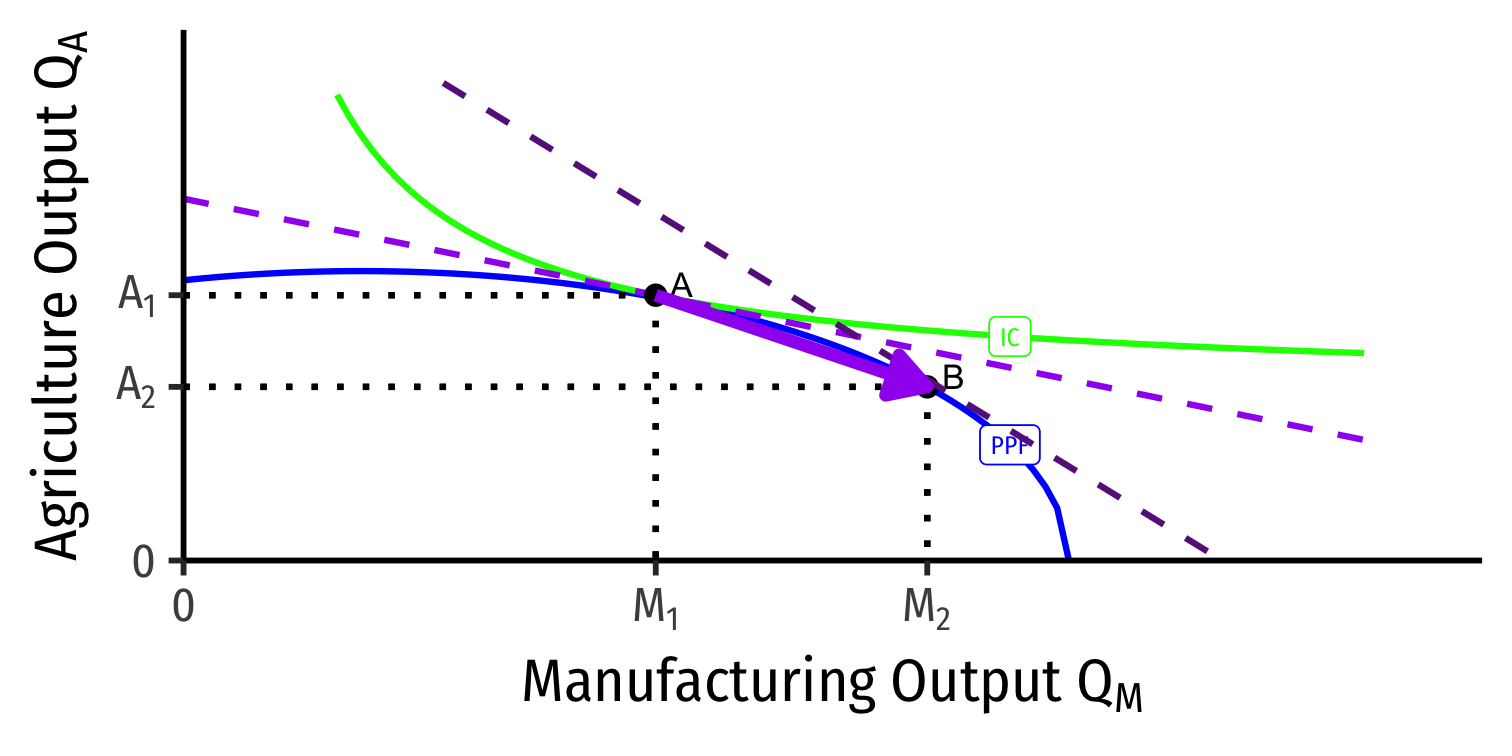

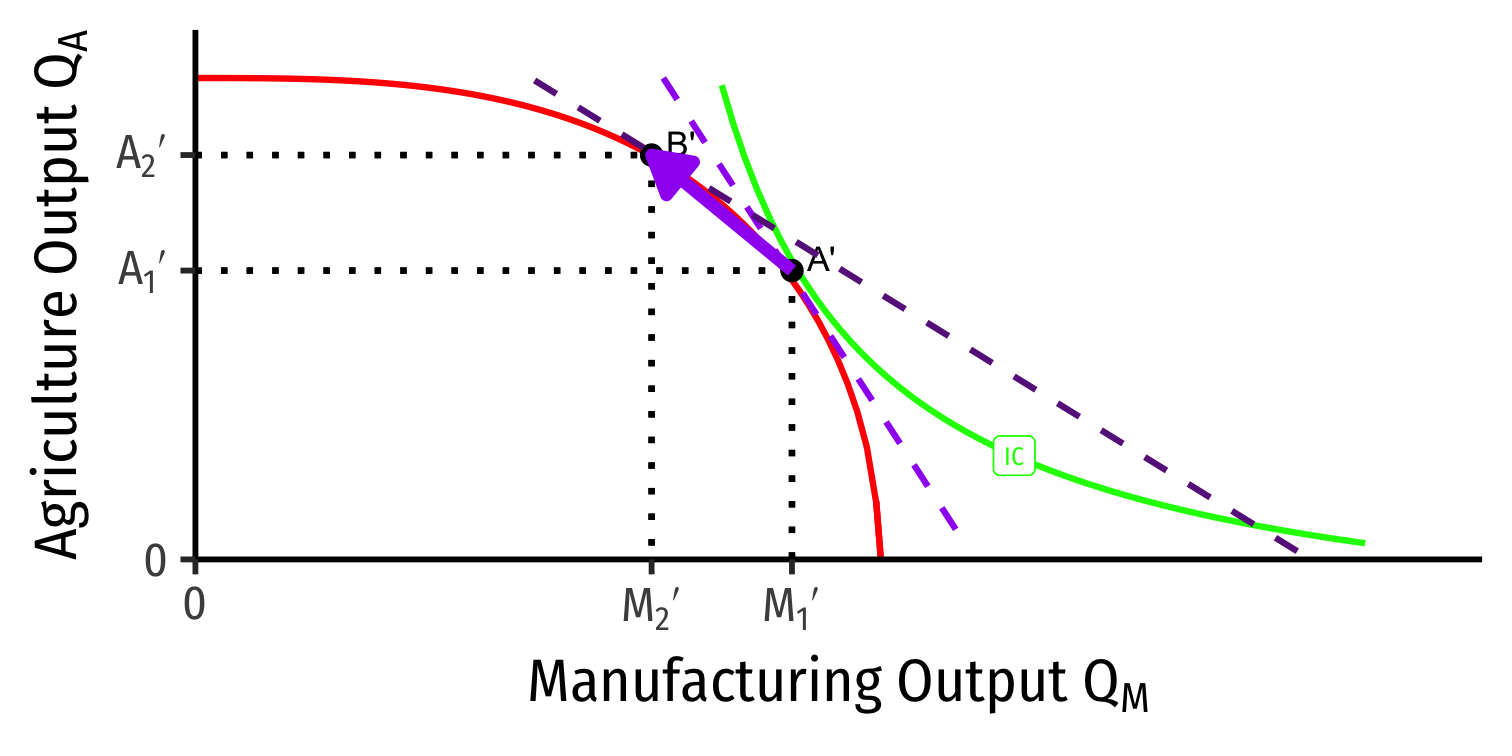

Distribution Effects Using our Two Country Trade Example

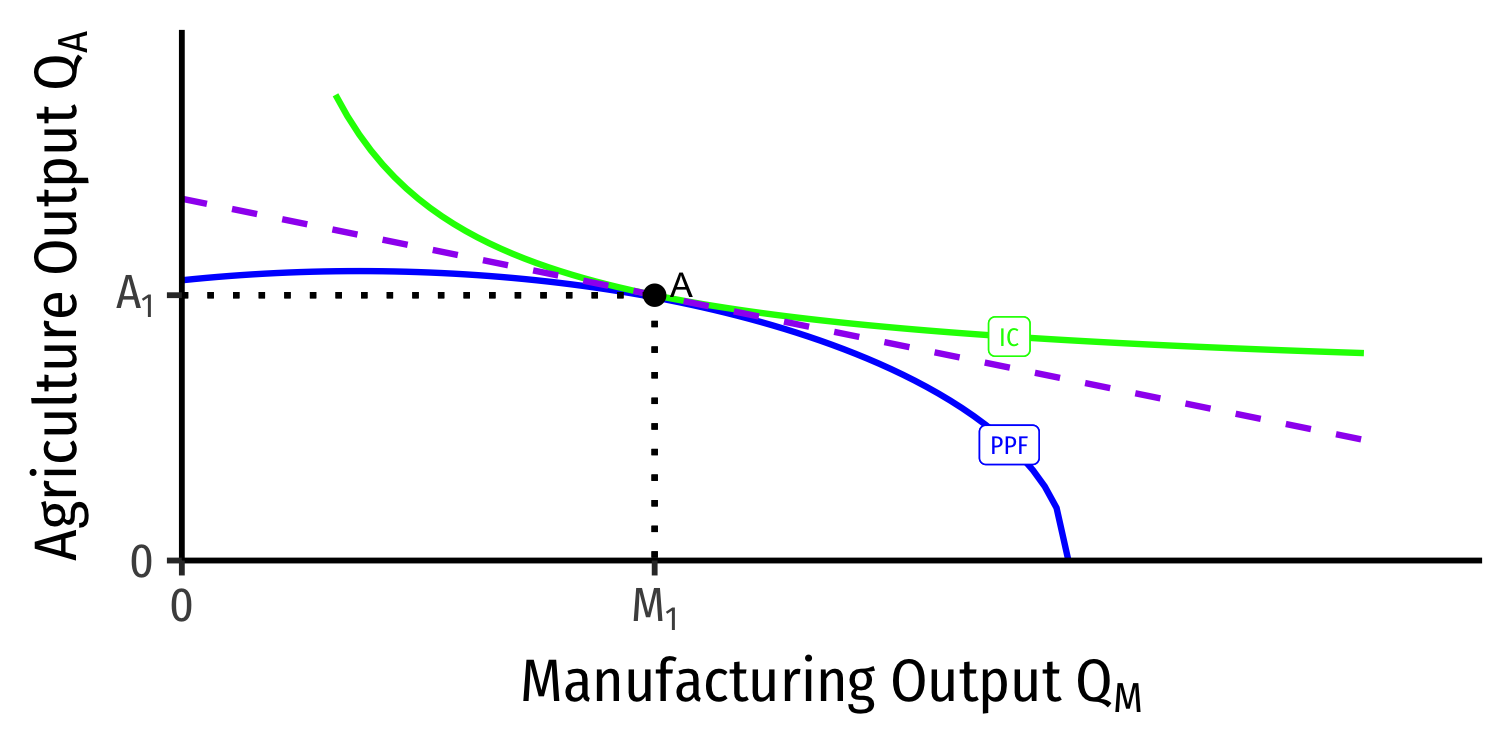

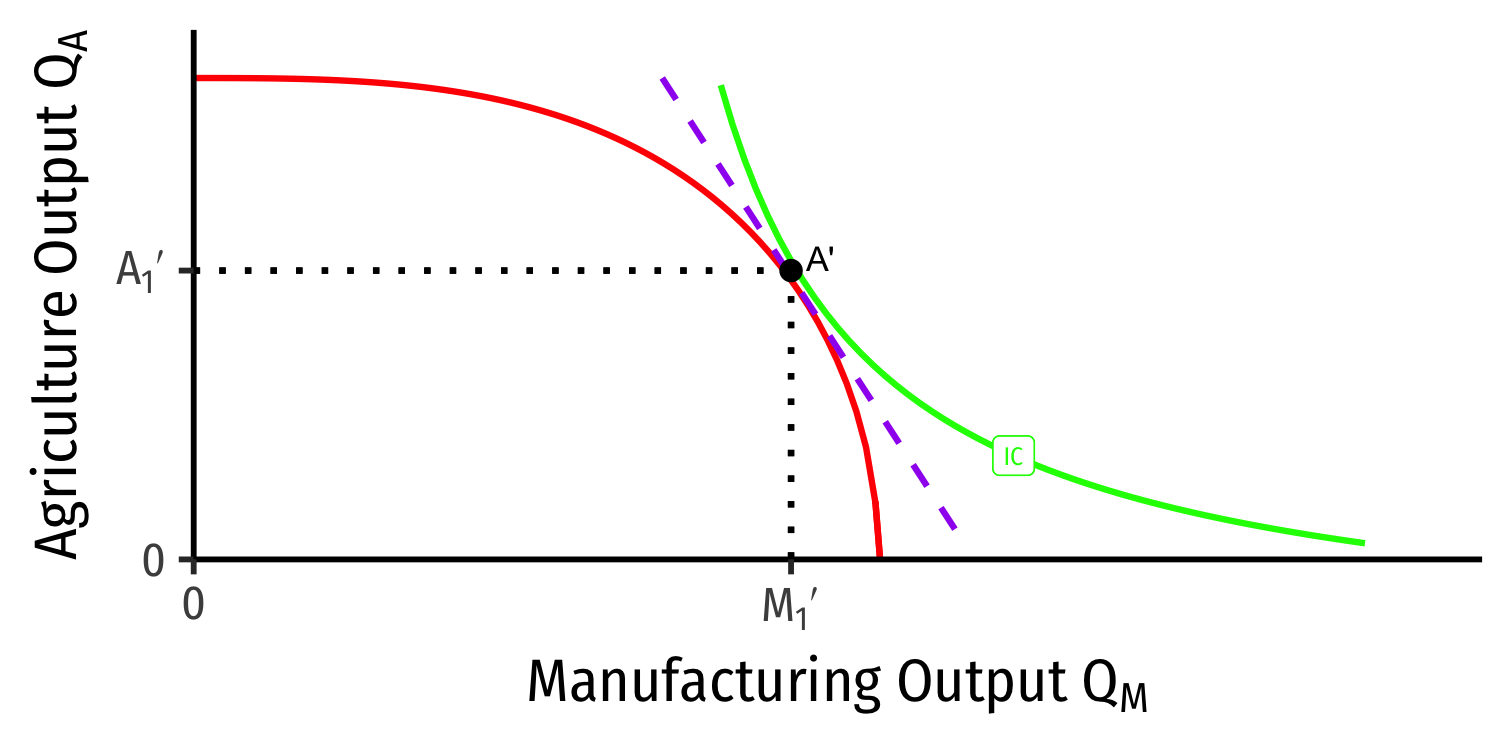

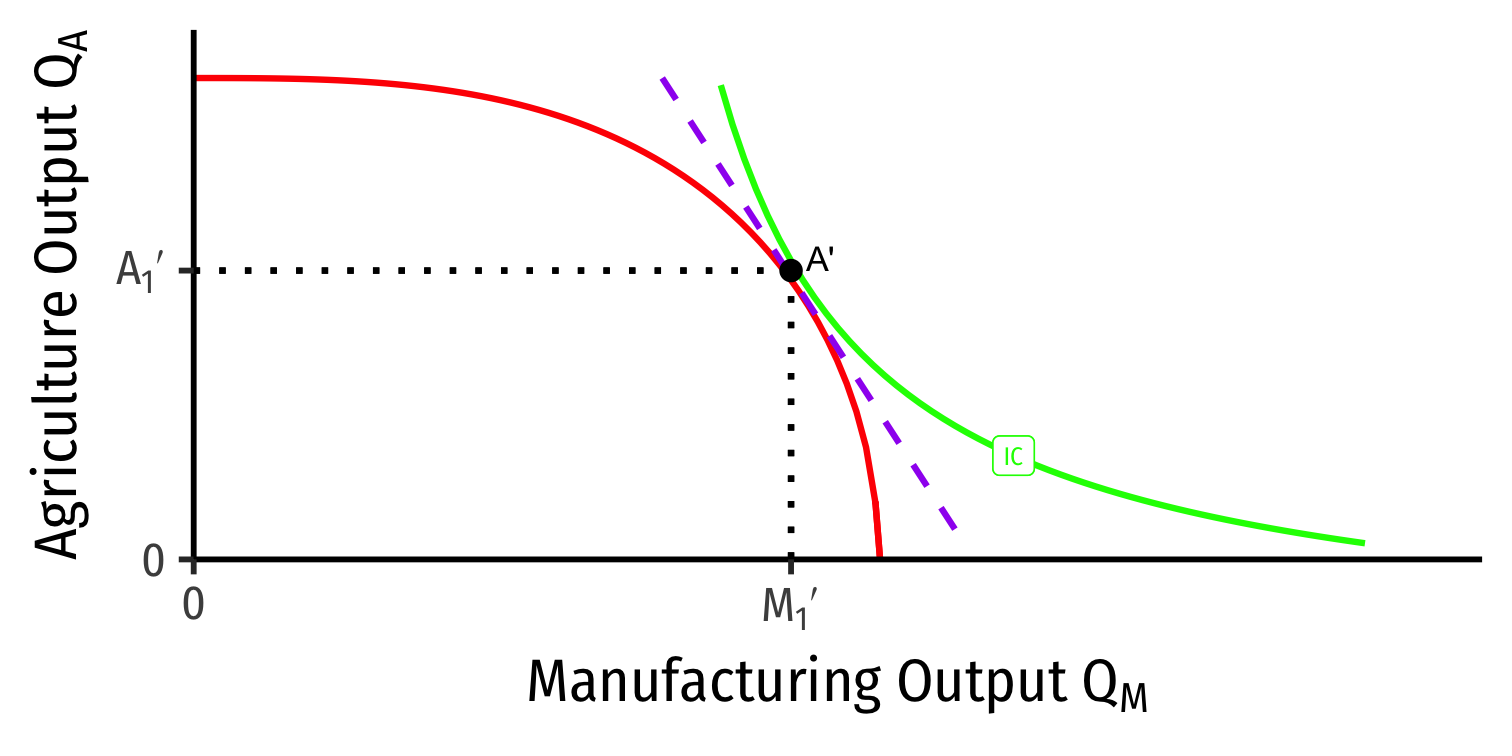

Our Two Country Trade Example: Autarky

Home

Foreign

- Countries begin in autarky optimum with different relative prices

- A is optimum for Home

- A' is optimum for Foreign

Our Two Country Trade Example: Specialization

Home

Foreign

- Home has comparative advantage in manufacturing

- Foreign has comparative advantage in agriculture

Our Two Country Trade Example: Specialization

Home

Foreign

- Countries specialize: produce more of comparative advantaged good, less of disadvantaged good

- Home: A → B: produces more M, less A

- Foreign: A' → B': produces less M, more A

Relative Price Changes in Home

Let's look at three groups at Home:

- Laborers (L)

- Capitalists (owners of K)

- Landowners (owners of T)

Increase in the relative price of manufacturing from trade

- decrease in relative price of agriculture

Effects of Trade on Home's Income Distribution: L

Workers find their wage has increased (but less than increase in relative price of M) Δww1<Δ(PMPA)(PMPA)1

Amount of manufactures QM that can be purchased with wages has fallen!

- Real wage in terms of manufacturing, ↓wpM

Amount of agriculture QA that can be purchased with wages has risen!

- Real wage in terms of agriculture, ↑wpA

Effect on workers is ambiguous

- Depends on their consumption preferences between M and A

Effects of Trade on Home's Income Distribution: K

What about capital owners?

Total income to capitalists =(PM∗QM)Revenues in M−(W∗LM)Labor costs

As more labor used in manufacturing, ↑MPK: Each machine has more workers to work it.

Capital owners gain

- We saw (1) ↑ relative price of manufacturing and (2) ↓ real wage in terms of manufacturing

- Thus, income to capital will rise more than proportionately to the rise in relative price of manufacturing

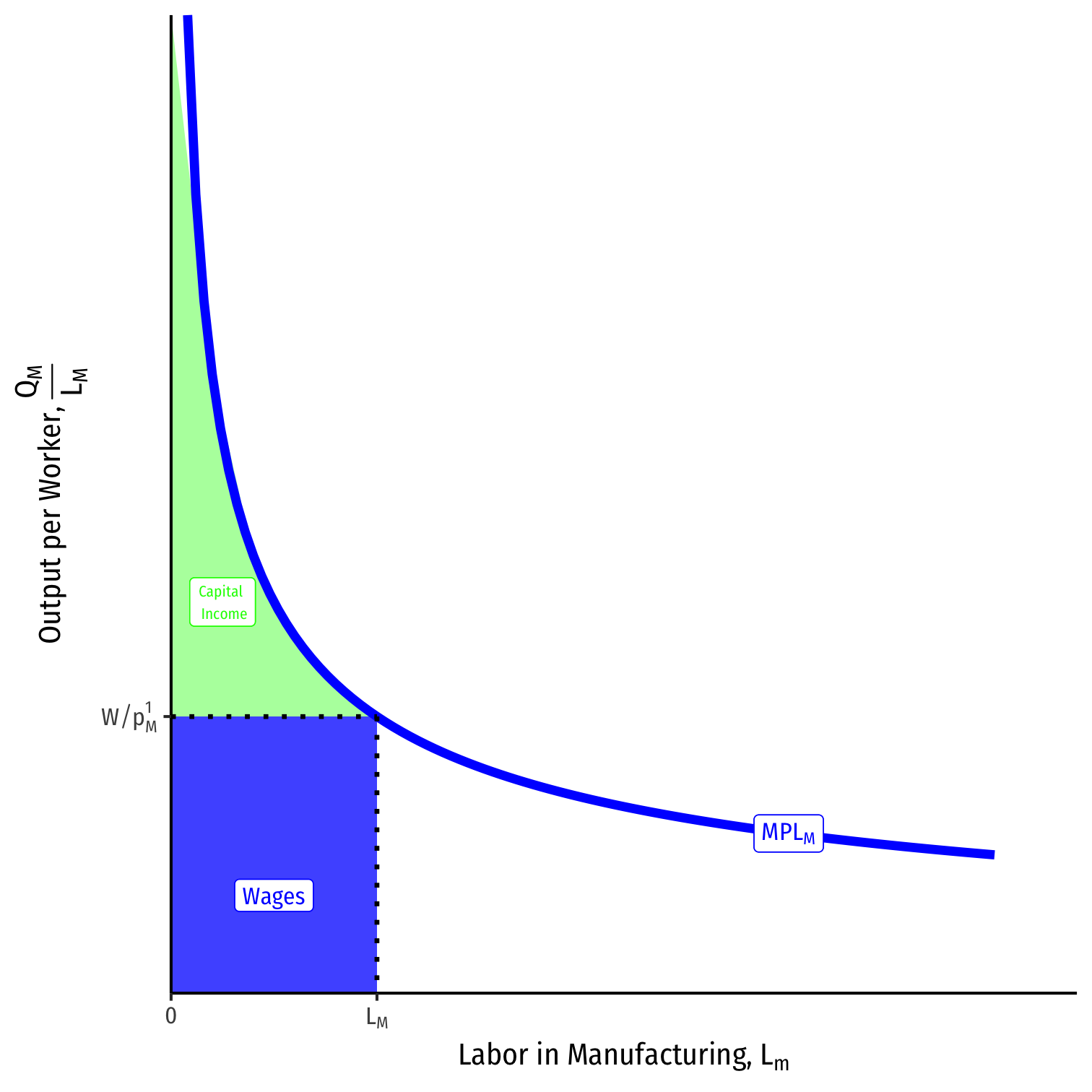

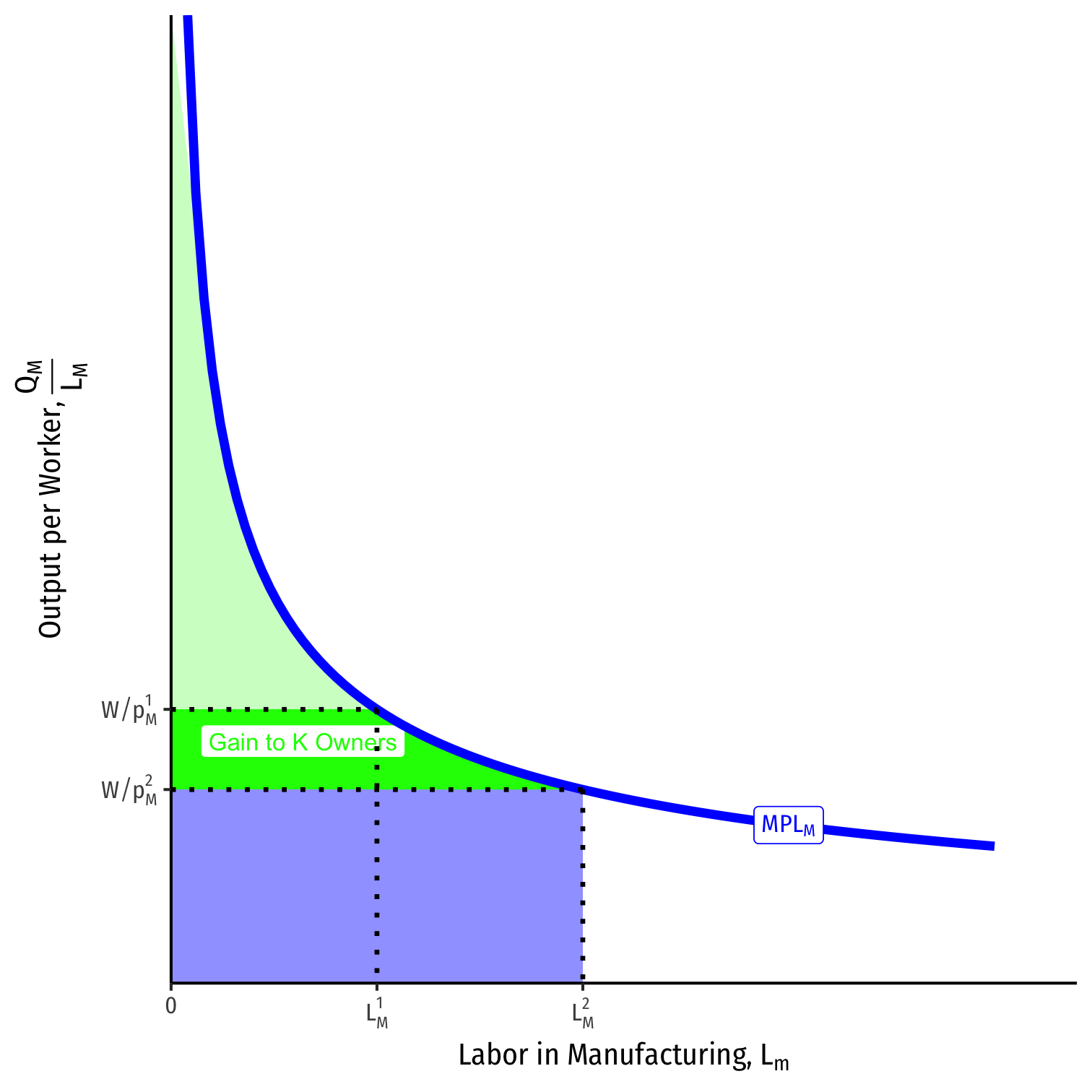

Advanced Explanation for Capital

Manufacturing is produced with capital and labor, QM=QM(K,LM)

Total output QM using LM is equal to the area under the MPLM curve up to LM

Labor is paid w=MPLM∗pM

- Rewrite as real wage (in terms of M): wPM

- This times the total number of workers LM equals the total wages paid

All residual income goes to capital owners

Advanced Explanation for Capital

Because trade raises the relative price of manufacturing, pMpA, we saw:

- Increase in labor LM, and increase in nominal wage w, but

- Decrease in real wage in terms of m, wpM

Capital owners gain

Effects of Trade on Home's Income Distribution: T

What about land owners?

Total income to landowners =(PAM∗QA)Revenues in A−(W∗LA)Labor costs

As less labor used in agriculture, ↓MPT: Each piece of land has fewer workers to work it.

Land owners lose

- We saw (1) ↓ relative price of agriculture and (2) ↑ real wage in terms of agriculture

- Thus, income to landowners will fall more than proportionately to the fall in relative price of agriculture

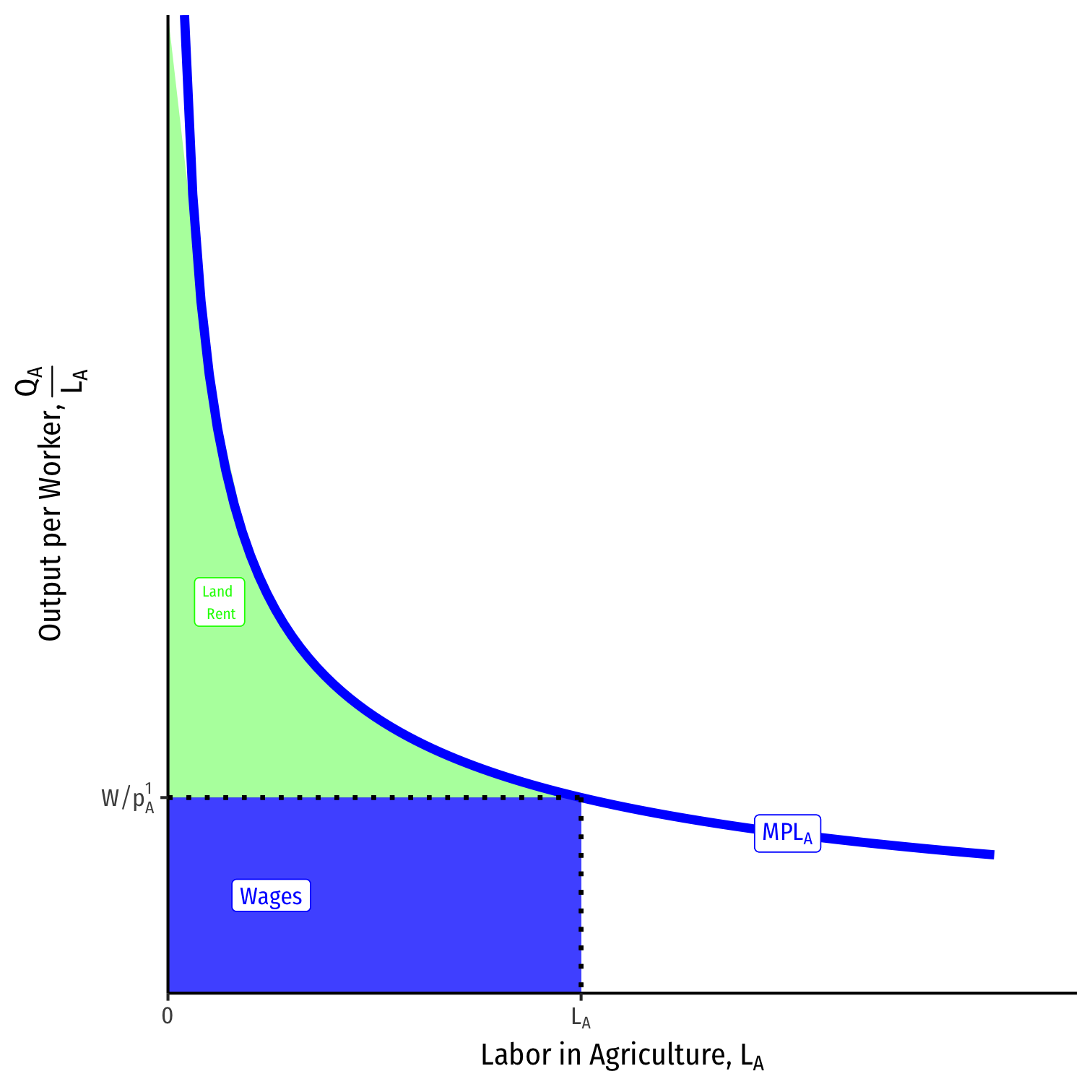

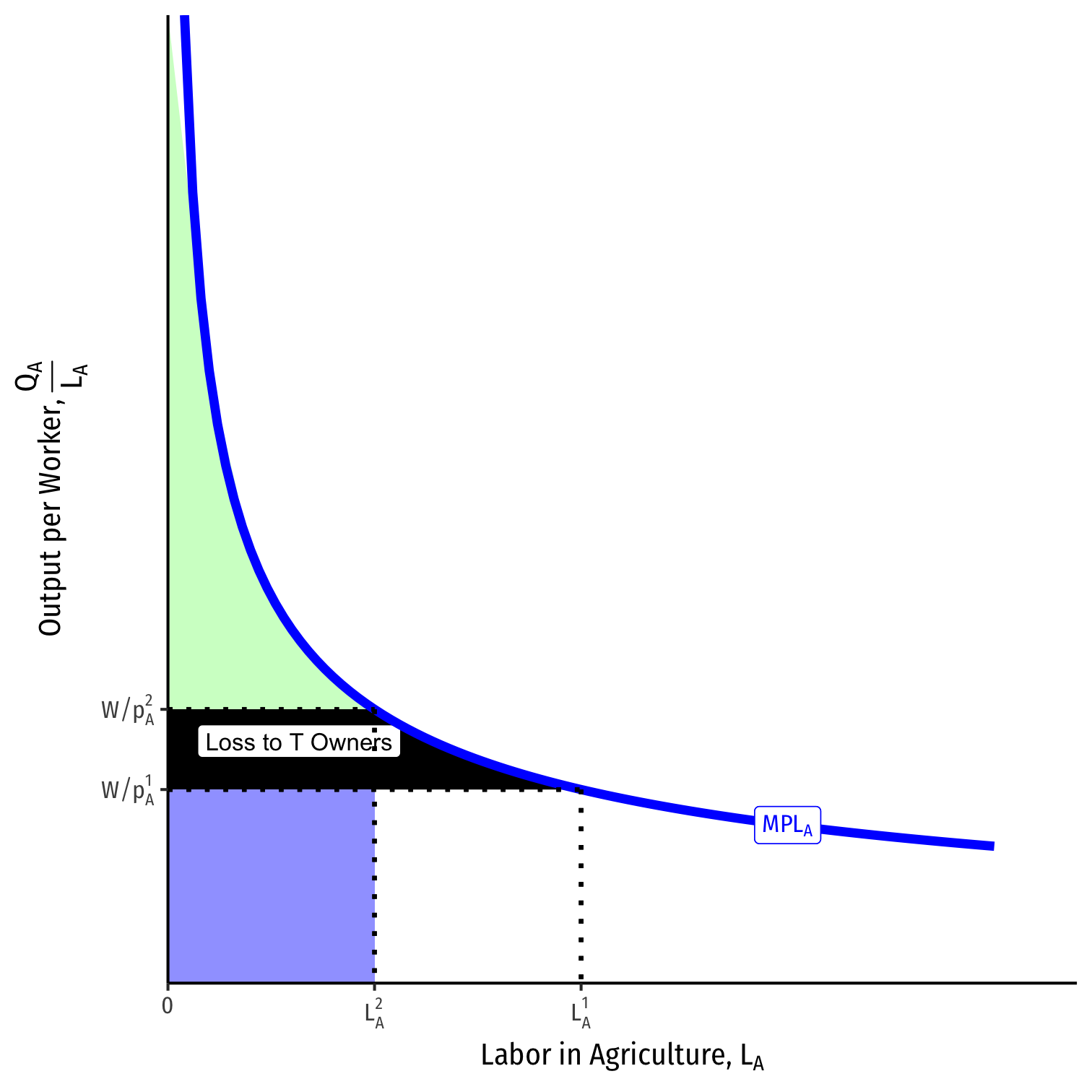

Advanced Explanation for Land

Agriculture is produced with land and labor, QA=QA(T,LA)

Total output QA using LA is equal to the area under the MPLA curve up to LA

Labor is paid w=MPLA∗pA

- Rewrite as real wage (in terms of A): wPA

- This times the total number of workers LA equals the total wages paid

All residual income goes to land owners (as rent)

Advanced Explanation for Land

Because trade lowers the relative price of agriculture, pApM, we saw:

- Decrease in labor LA, but increase in nominal wage w, so

- Increase in real wage in terms of A, wpA

Land owners lose

Effects of Trade on Home's Income Distribution

EFfects of trade on Home's:

Labor: ambiguous

- real wage rises in terms of M, falls in terms of A

Capital: income rises more than proportionate to M relative price increase

Land: income falls more than proportionate to A relative price fall

Effects of Trade on Home Income Distribution

Factor specific to the sector whose relative price rises is better off with trade

- Capital for manufacturing

Factor specific to the sector whose relative price falls is worse off with trade

- Land for agriculture

The mobile factor is not clearly better or worse off with trade.

- Labor

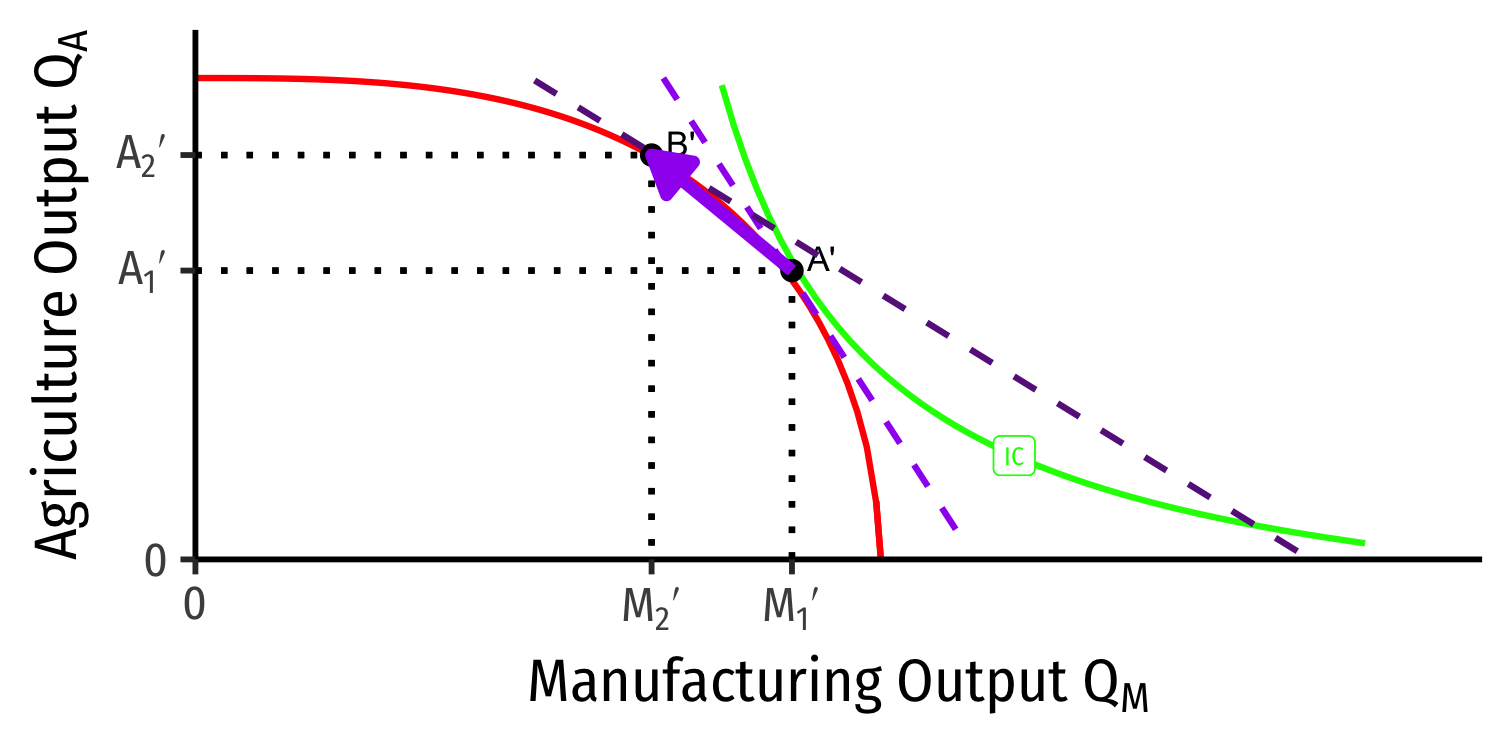

Specialization (Again)

Home

Foreign

- Countries specialize: produce more of comparative advantaged good, less of disadvantaged good

- Home: A → B: produces more M, less A

- Foreign: A' → B': produces less M, more A

Relative Price Changes in Foreign

Let's look at three groups at Foreign:

- Laborers (L)

- Capitalists (owners of K)

- Landowners (owners of T)

Decrease in the relative price of manufacturing from trade

- increase in relative price of agriculture

Effects of Trade on Foreign's Income Distribution: L

Workers find their wage has increased (but less than increase in relative price of A) Δww1<Δ(PAPM)(PAPM)1

Amount of manufactures QM that can be purchased with wages has risen!

- Real wage in terms of manufacturing, ↑wpM

Amount of agriculture QA that can be purchased with wages has fallen!

- Real wage in terms of agriculture, ↓wpA

Effect on workers is ambiguous

- Depends on their consumption preferences between M and A

Effects of Trade on Foreign's Income Distribution: K

What about capital owners?

Total income to capitalists =(PM∗QM)Revenues in M−(W∗LM)Labor costs

As less labor used in manufacturing, ↓MPK: Each machine has fewer workers to work it.

Capital owners lose

- We saw (1) ↓ relative price of manufacturing and (2) ↑ real wage in terms of manufacturing

- Thus, income to capital will fall more than proportionately to the fall in relative price of manufacturing

Effects of Trade on Foreign's Income Distribution: T

What about land owners?

Total income to landowners =(PA∗QA)Revenues in A−(W∗LA)Labor costs

As more labor used in agriculture, ↑MPT: Each piece of land has more workers to work it.

Land owners gain

- We saw (1) ↑ relative price of agriculture and (2) ↓ real wage in terms of agriculture

- Thus, income to landowners will rise more than proportionately to the rise in relative price of agriculture

Effects of Trade on Foreign's Income Distribution

EFfects of trade on Foreign's:

Labor: ambiguous

- real wage rises in terms of M, falls in terms of A

Capital: income falls more than proportionate to M relative price fall

Land: income rises more than proportionate to A relative price increase

Effects of Trade on Foreign's Income Distribution

Factor specific to the sector whose relative price rises is better off with trade.

- Land for agriculture

Factor specific to the sector whose relative price falls is worse off with trade.

- Capital for manufacturing

The mobile factor is not clearly better or worse off with trade.

- Labor

Takeways from The Specific Factors Model

Takeways from The Specific Factors Model

Changes in trade fall mainly upon the fixed/specific factors of production

- Increase in relative prices (exports) benefit fixed factor producing exports

- Decrease in relative prices (imports) harm fixed factor competing with imports

Mobile factors face ambiguous change

- Can move from low-income industries to high-income industries

Takeways from The Specific Factors Model

Of course, our simple model aggregates labor into a single mobile factor

In reality, different types of labor, some may be mobile and some may be immoble and specific

Changes in trade patterns and relative prices will affect specific and mobile factors differently

Example of Mobile vs. Specific Labor

Example: Auto-workers in Detroit in the 1980s were a relatively specific and immobile factor

Geographically concentrated

Skills specific to car assembly-lines

Example of Mobile vs. Specific Labor

Japan begins exporting cheap cars in 1980s, U.S. consumers import them

Relative price of cars falls in U.S., U.S. factories produce fewer cars, wages & jobs in U.S. auto manufacturing diminish

More mobile and nonspecific workers left Detroit for other industries

- e.g. maybe they went to Texas to work in booming oil industry

More immobile and specific workers lost jobs

- Maybe geographically stuck in Detroit

- Skills were too specific to auto industry, not transferrable to other industries

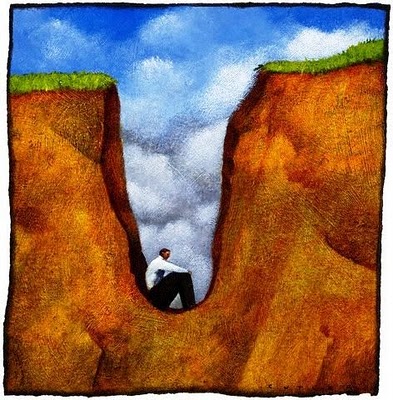

Some More Examples

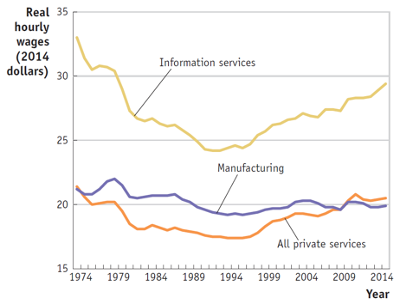

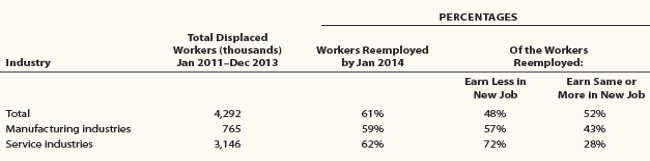

Source: Feenstra & Taylor (2017)

Some More Examples

Source: Feenstra & Taylor (2017)

Some More Examples

Source: Feenstra & Taylor (2017)

Takeways from The Specific Factors Model

Again, changes in trade fall mainly upon the fixed/specific factors of production

- Increase in relative prices (exports) benefit fixed factor producing exports

- Decrease in relative prices (imports) harm fixed factor competing with imports

Mobile factors face ambiguous change

- Can move from low-income industries to high-income industries

Policy implication: if governments wish to protect domestic groups from adverse trade shocks, increase mobility and non-specific skills/uses

- make labor, capital, land markets more flexible to reduce shocks from trade on domestic workers, capital-, & land-owners