1.12 — New Trade Theory II

ECON 324 • International Trade • Spring 2023

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/tradeS23

tradeS23.classes.ryansafner.com

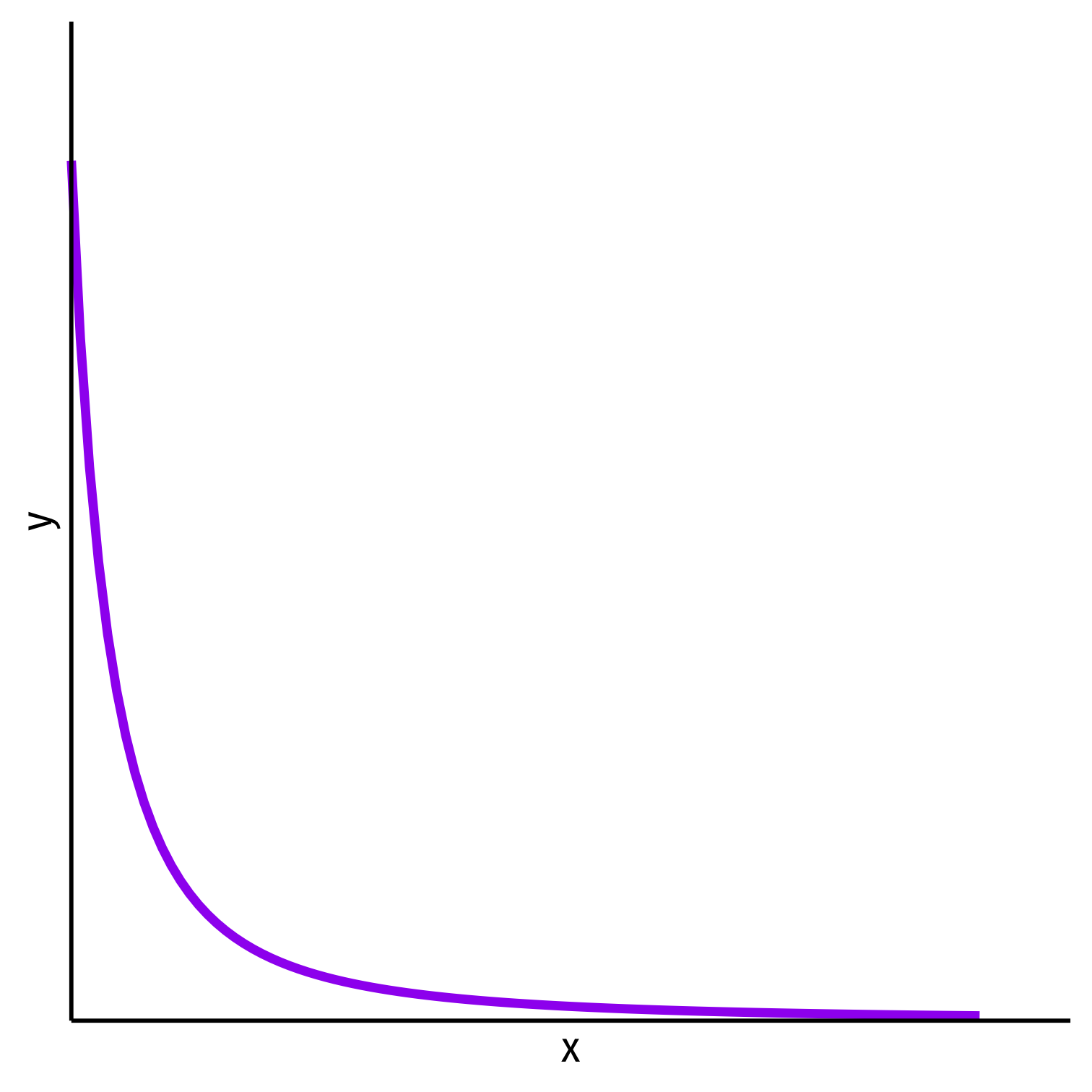

Increasing Returns

PPF: Decreasing Costs

Increasing returns ⟺ decreasing costs

PPF is convex to origin

Marginal rate of transformation (MRT) decreases as we produce more of a good

- Again: “slope”, “relative price of x”, “opportunity cost of x”

- Amount of y given up to get 1 more x

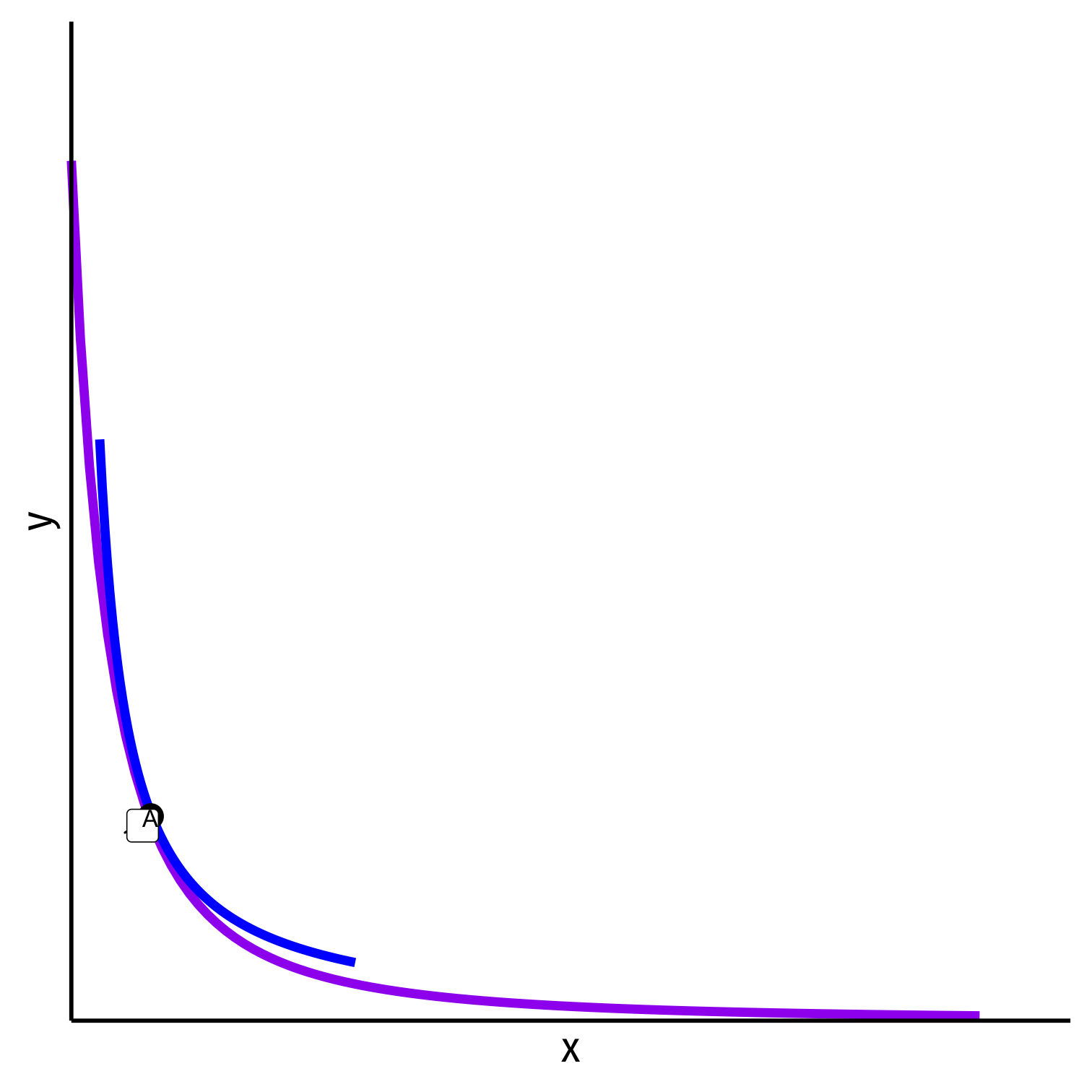

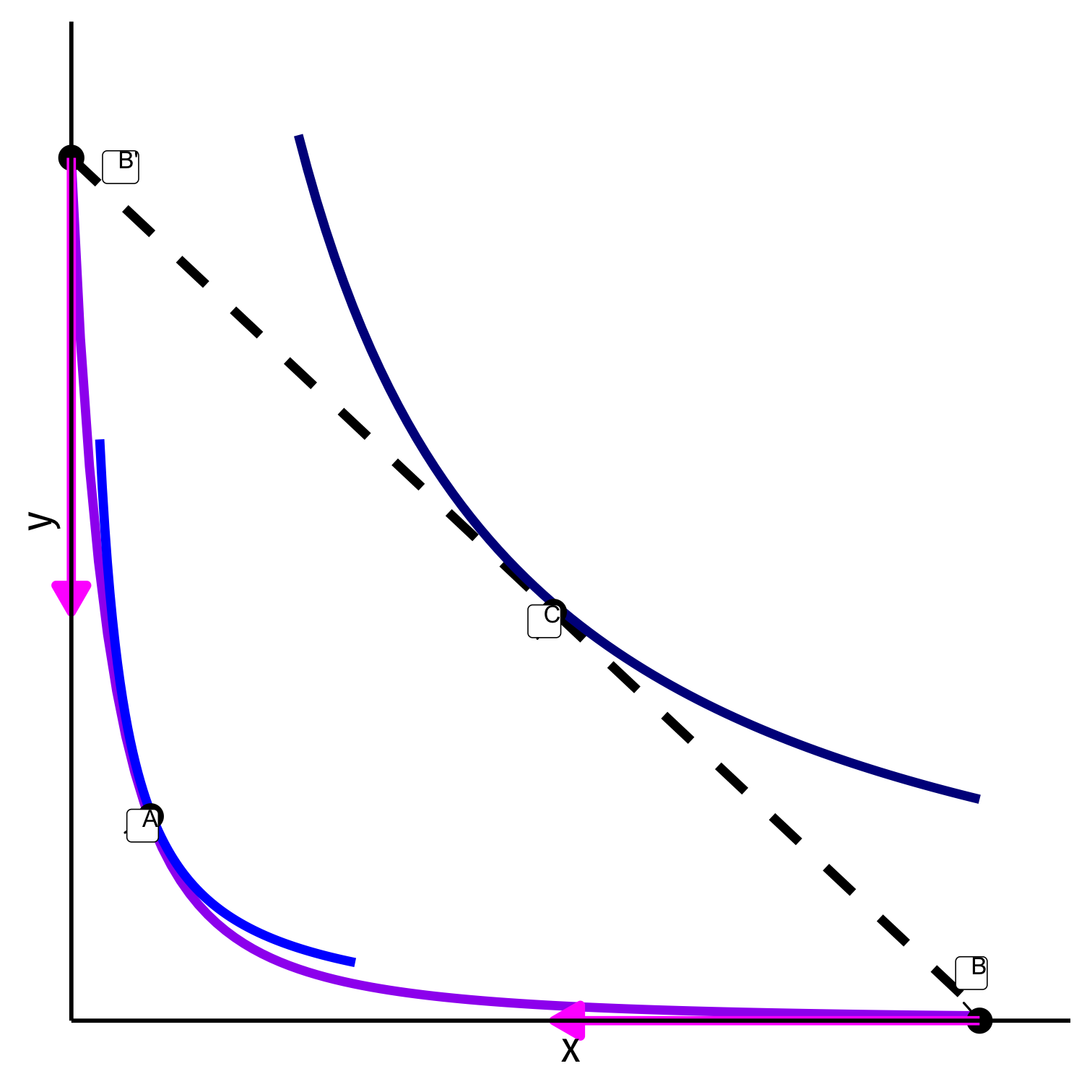

PPF: Decreasing Costs

- To simplify our graph, assume Home and Foreign have identical preferences (same indifference curve), and identical endowments (both start at A)

PPF: Decreasing Costs

Countries open up trade, face same relative prices

Each country exploits economies of scale, producing only one good

- Home produces x, Foreign produces y

- Points B and B'

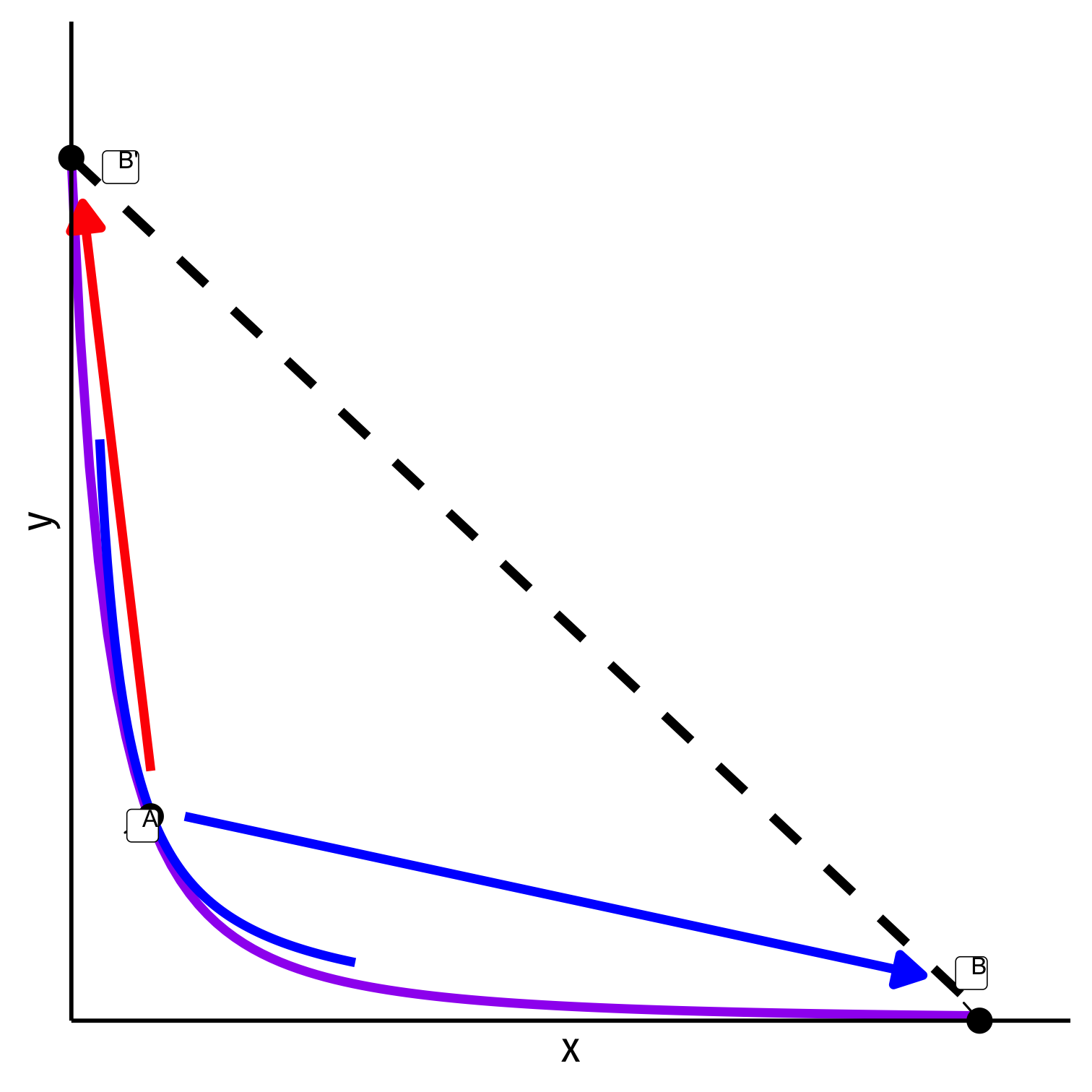

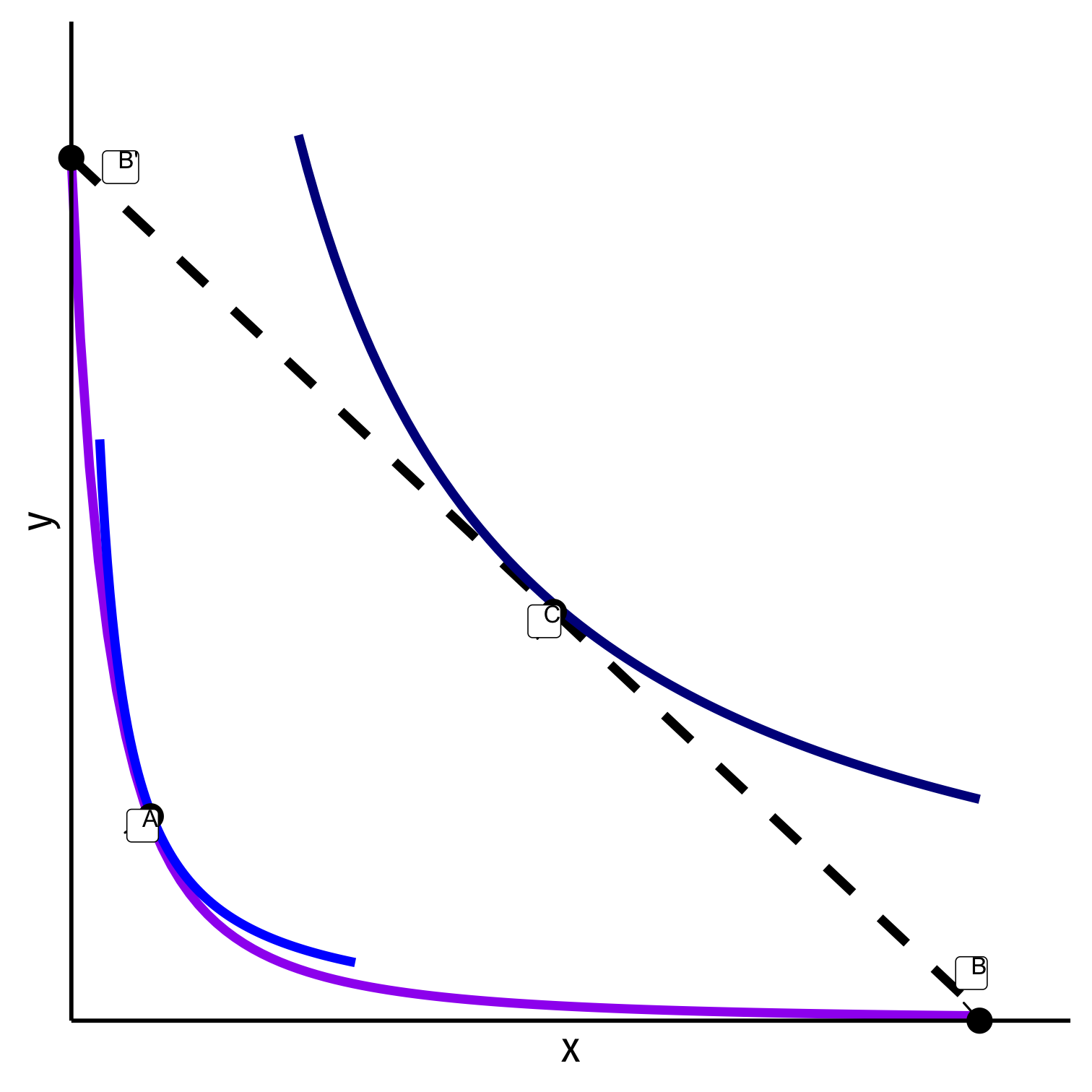

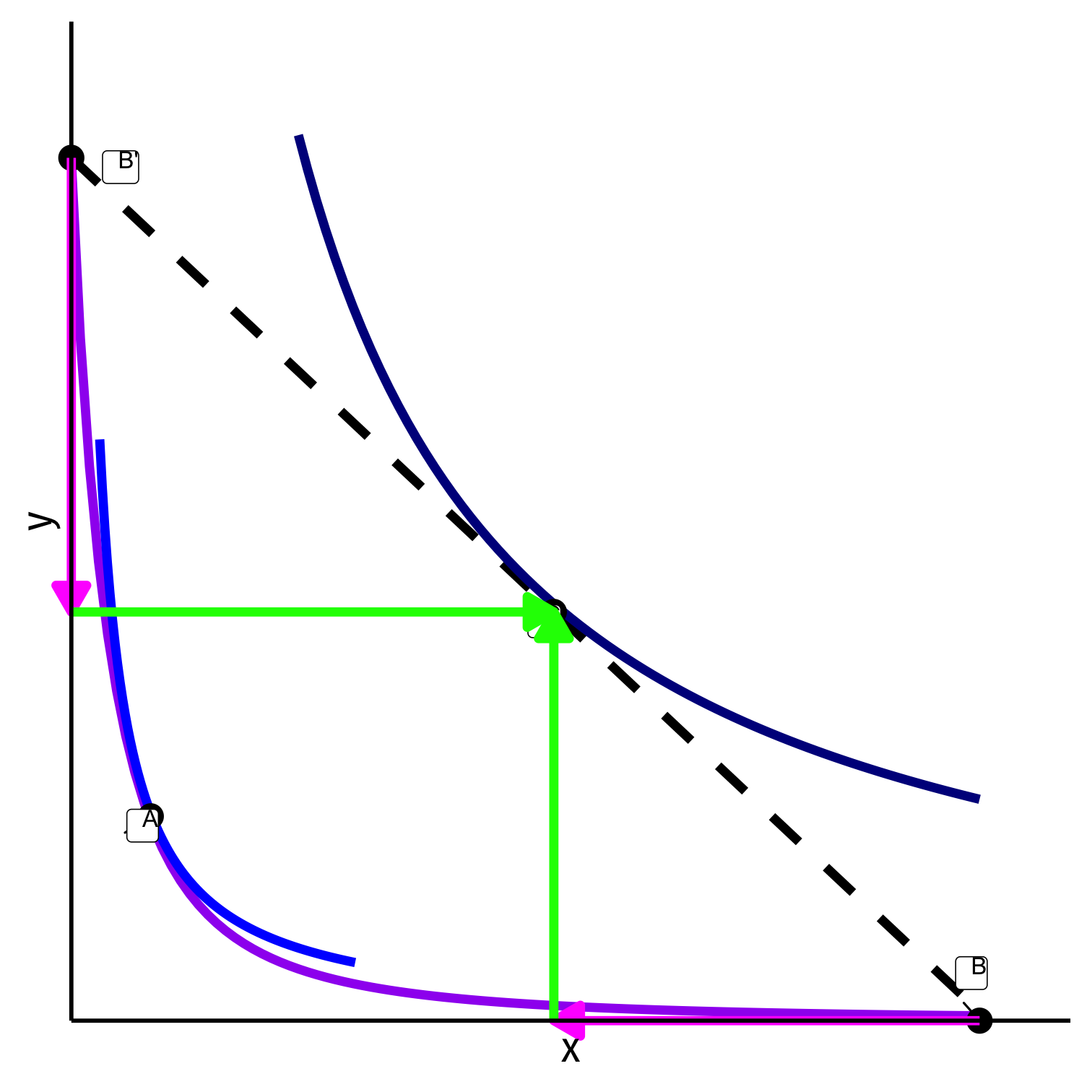

PPF: Decreasing Costs

Countries open up trade, face same relative prices

Each country exploits economies of scale, producing only one good

- Home produces x, Foreign produces y

- Points B and B'

Trade and reach a higher indifference curve at C

PPF: Decreasing Costs

Countries open up trade, face same relative prices

Each country exploits economies of scale, producing only one good

- Home produces x, Foreign produces y

- Points B and B'

Trade and reach a higher indifference curve at C

PPF: Decreasing Costs

Countries open up trade, face same relative prices

Each country exploits economies of scale, producing only one good

- Home produces x, Foreign produces y

- Points B and B'

Trade and reach a higher indifference curve at C

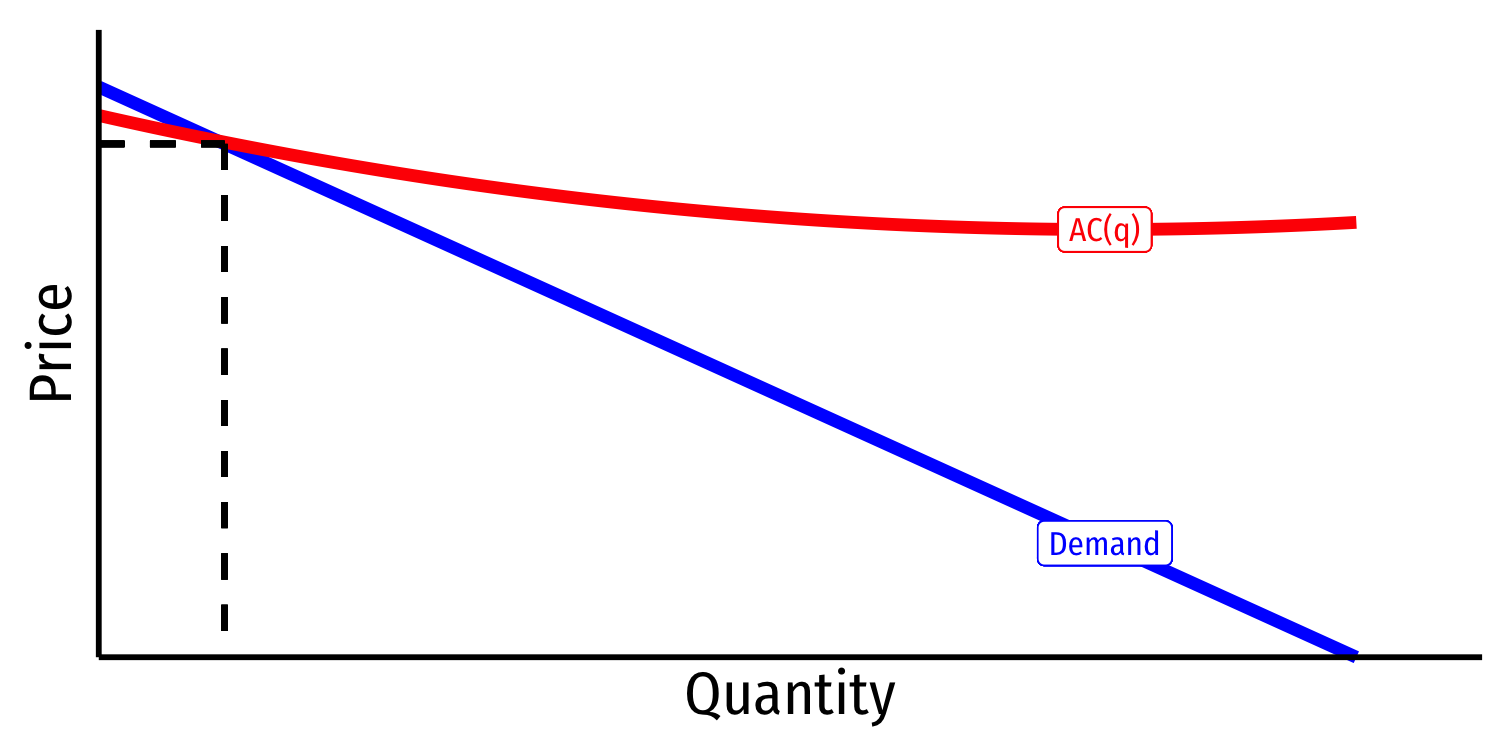

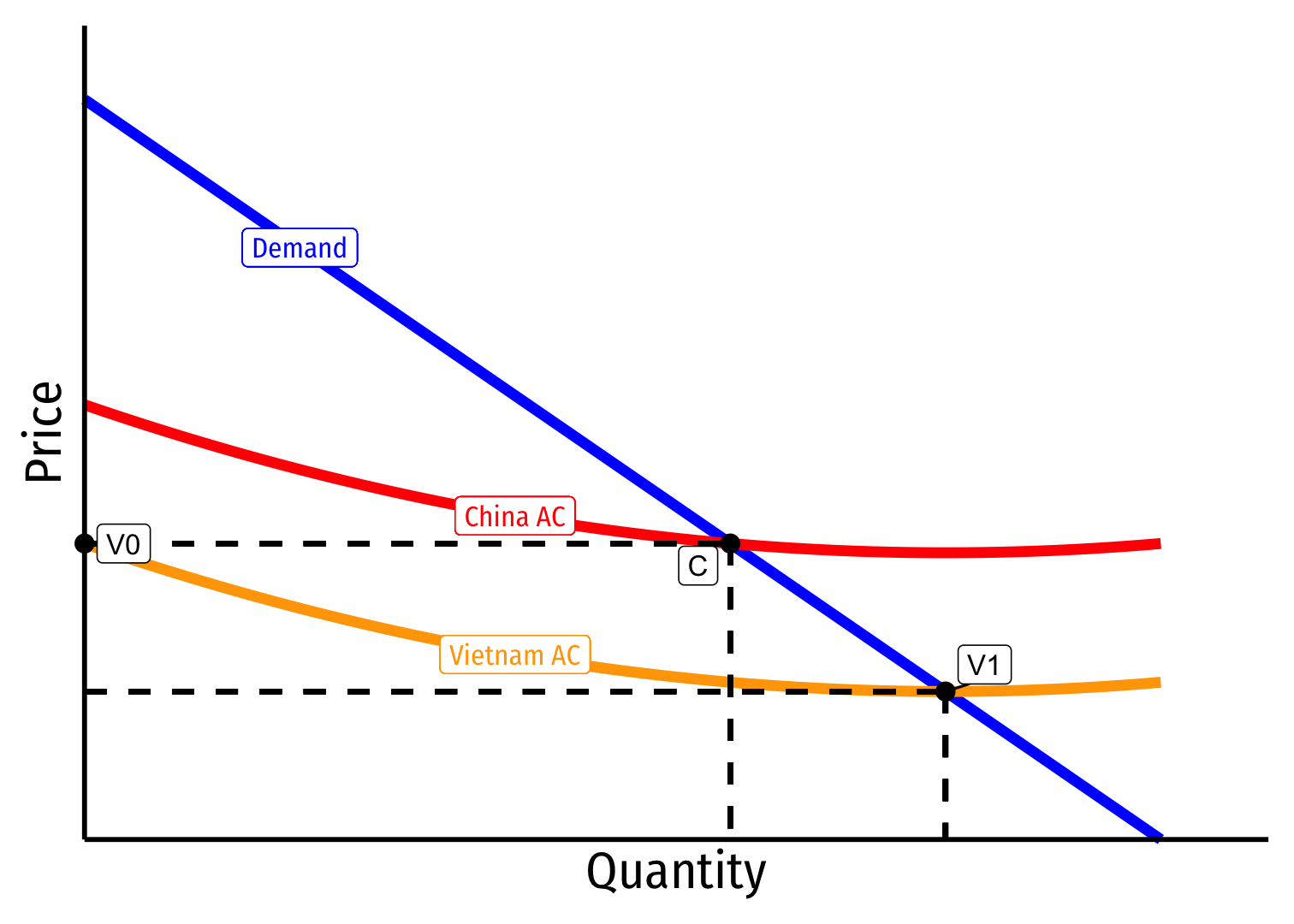

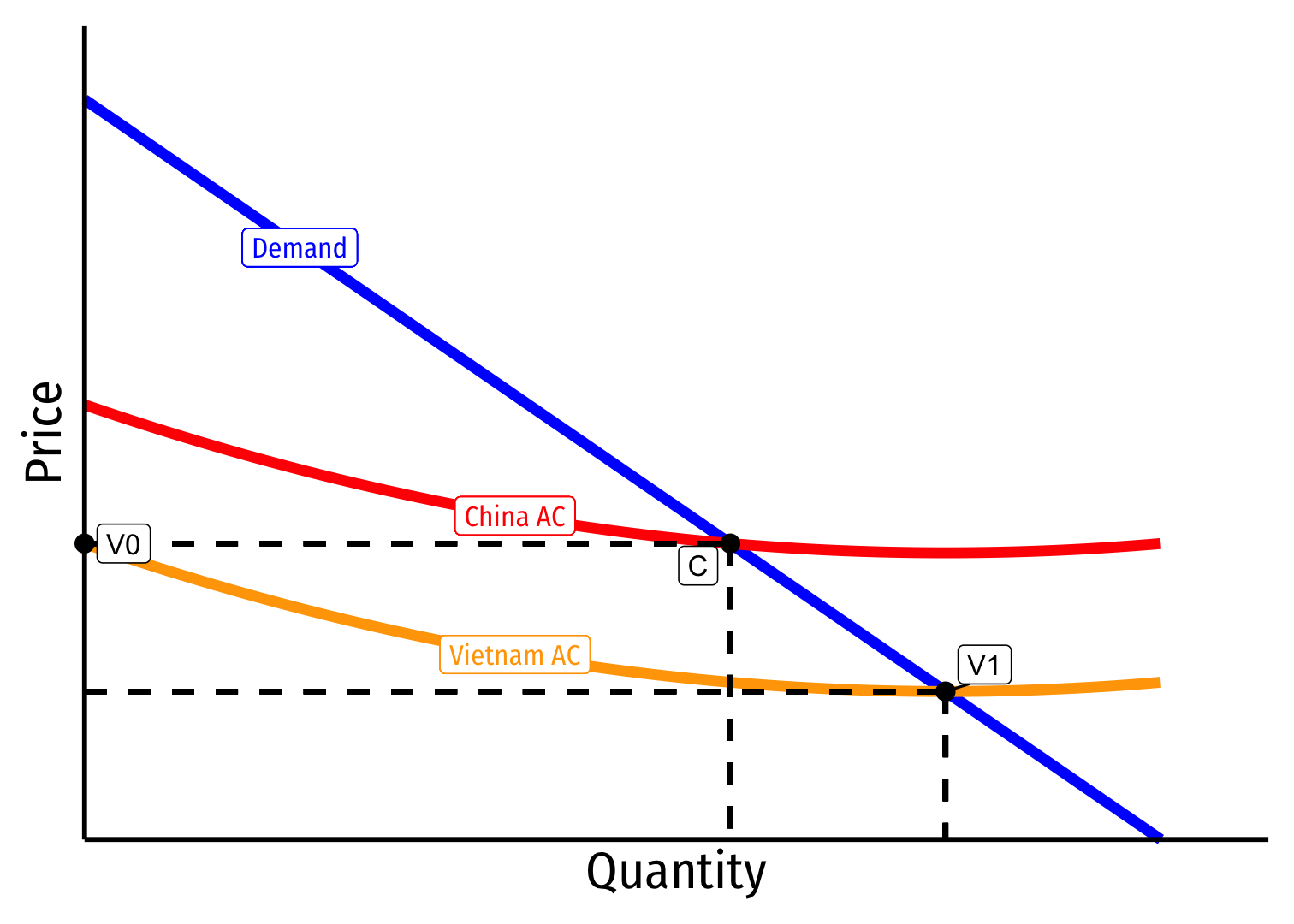

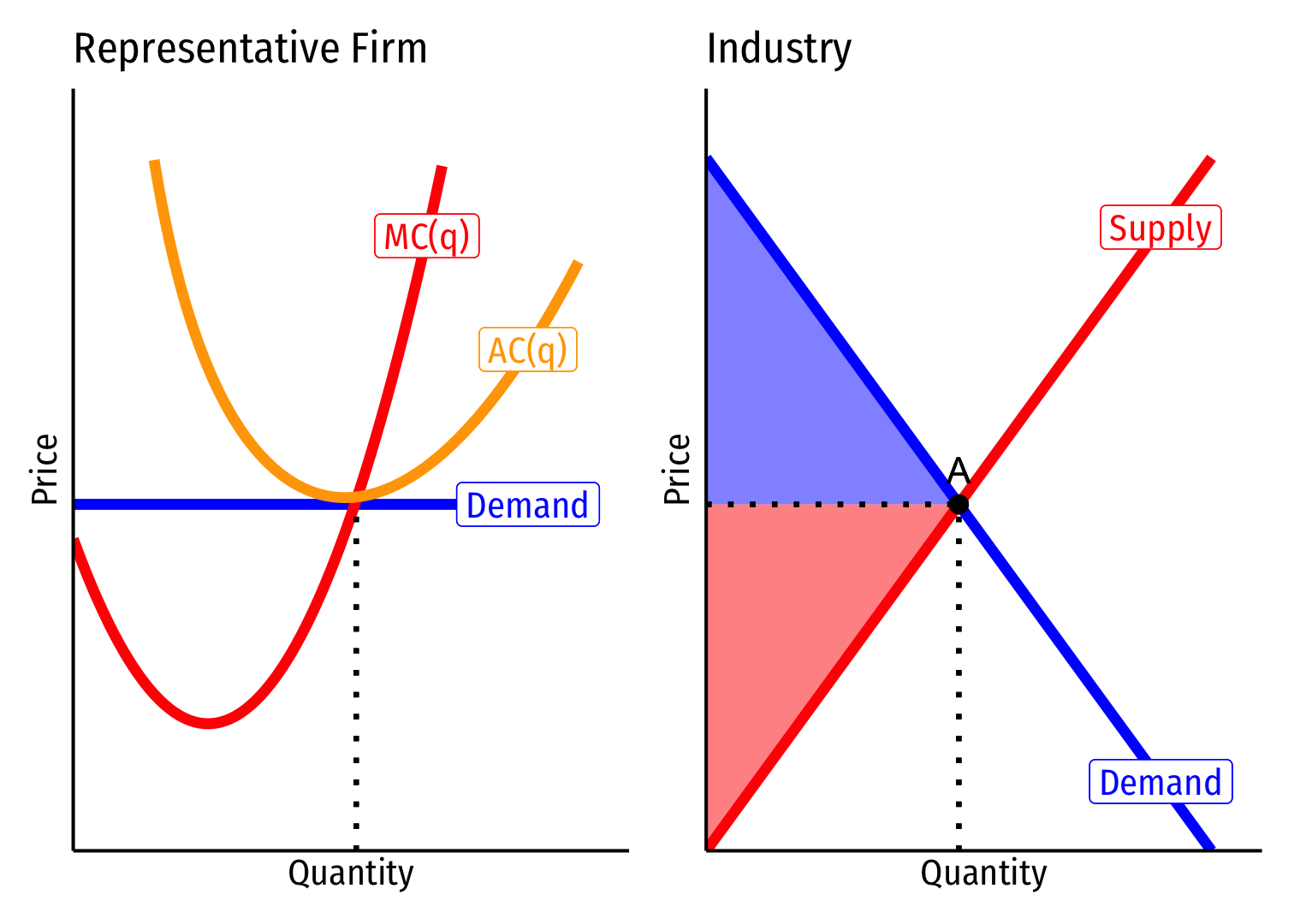

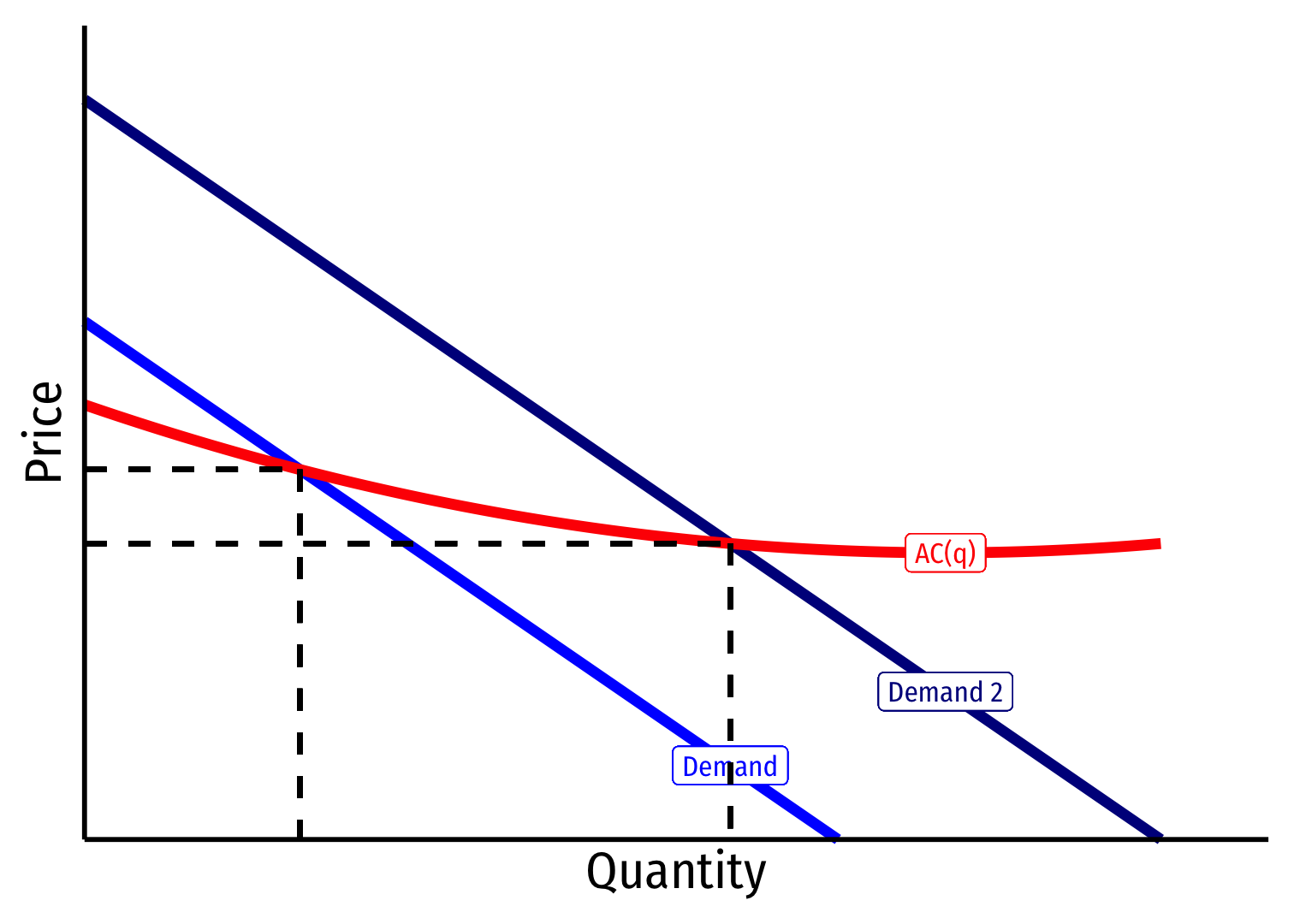

(Anti-)Competitive Implications of Economies of Scale

U.S.

China

- Before trade, China has lower AC and p than U.S.

(Anti-)Competitive Implications of Economies of Scale

Trade increases demand for China’s output

Lowers AC and p even further, further outcompeting U.S.

China

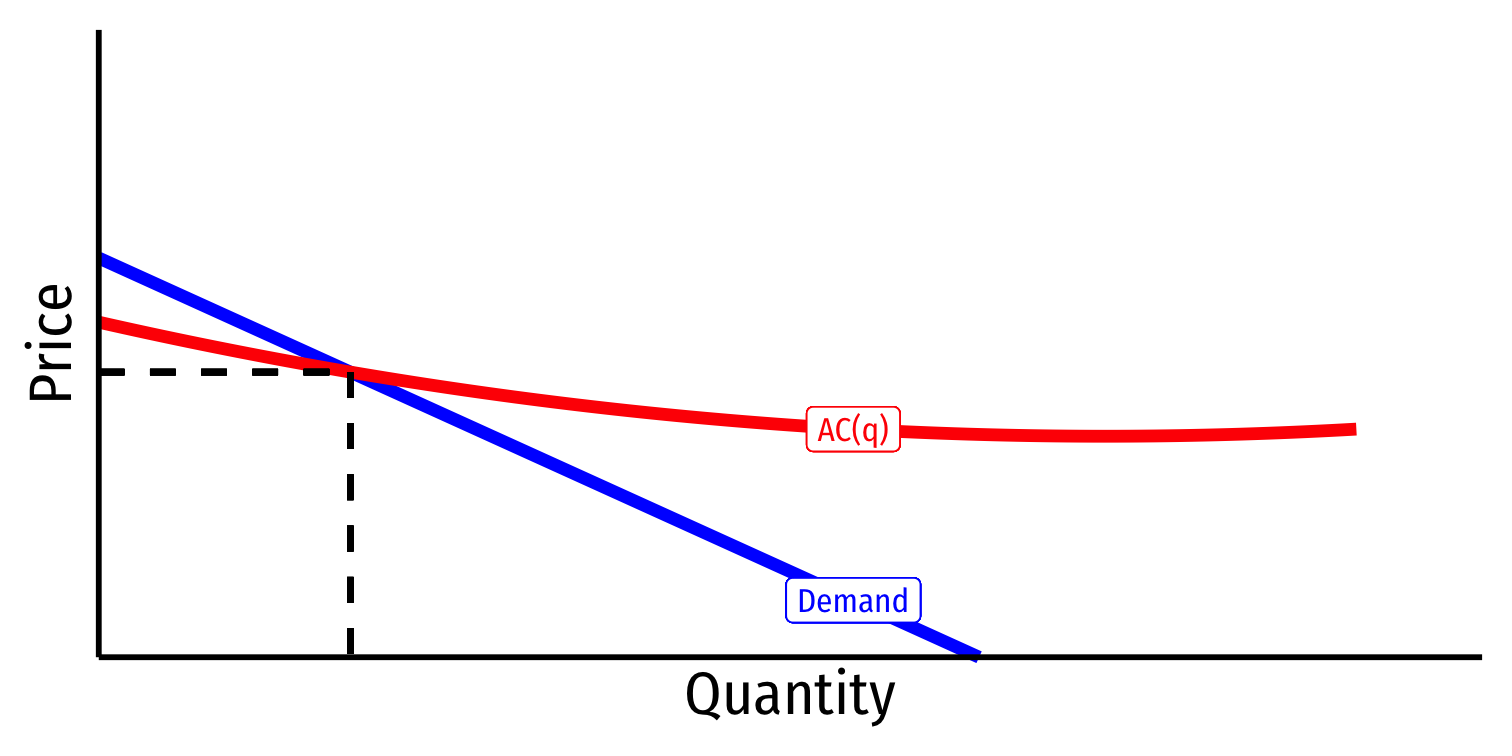

(Anti-)Competitive Implications of Economies of Scale

Suppose Vietnam actually has lower AC than China, once it gets up to scale (V1)

Chinese economies of scale have world market price at C

Current market price provides no profit to Vietnamese producers starting production at V0

World is inefficiently “locked in” to Chinese production, sub-optimal path dependence

China and Vietnam

(Anti-)Competitive Implications of Economies of Scale

Policy implication for Vietnam: shut out imports from China with tariffs, and subsidize this industry to get it up to scale

In the long run, Vietnam can become the least-cost producer, increasing welfare

China and Vietnam

Trade and Variety

Trade and Variety

Consumers are better off with more variety

Two interpretations of why:

- Love of variety: consumers value variety for its own sake (directly enters utility function)

- Ideal variety: consumers have an ideal variety in mind, and having more varieties available increases probability that each consumer matches with their ideal variety

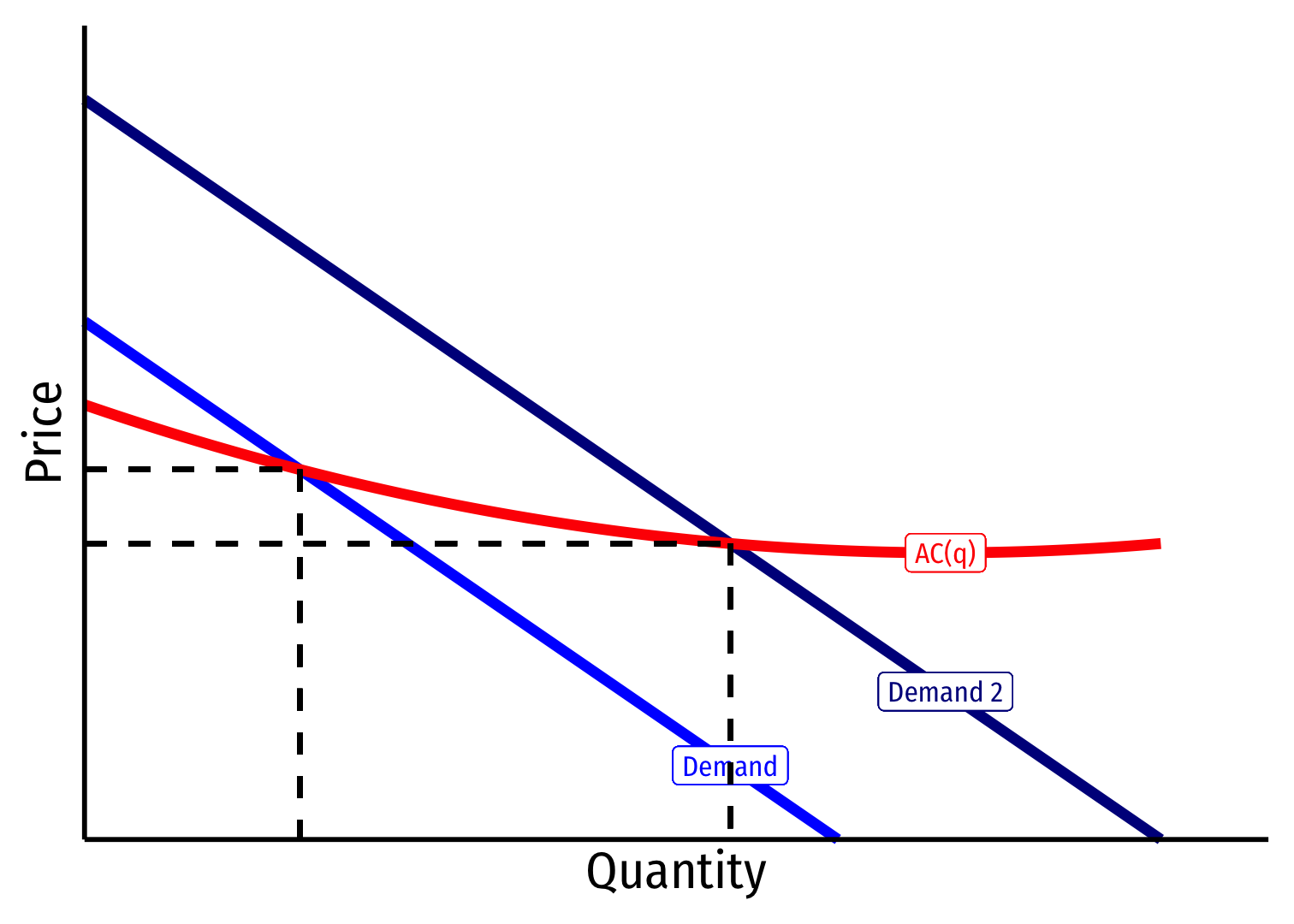

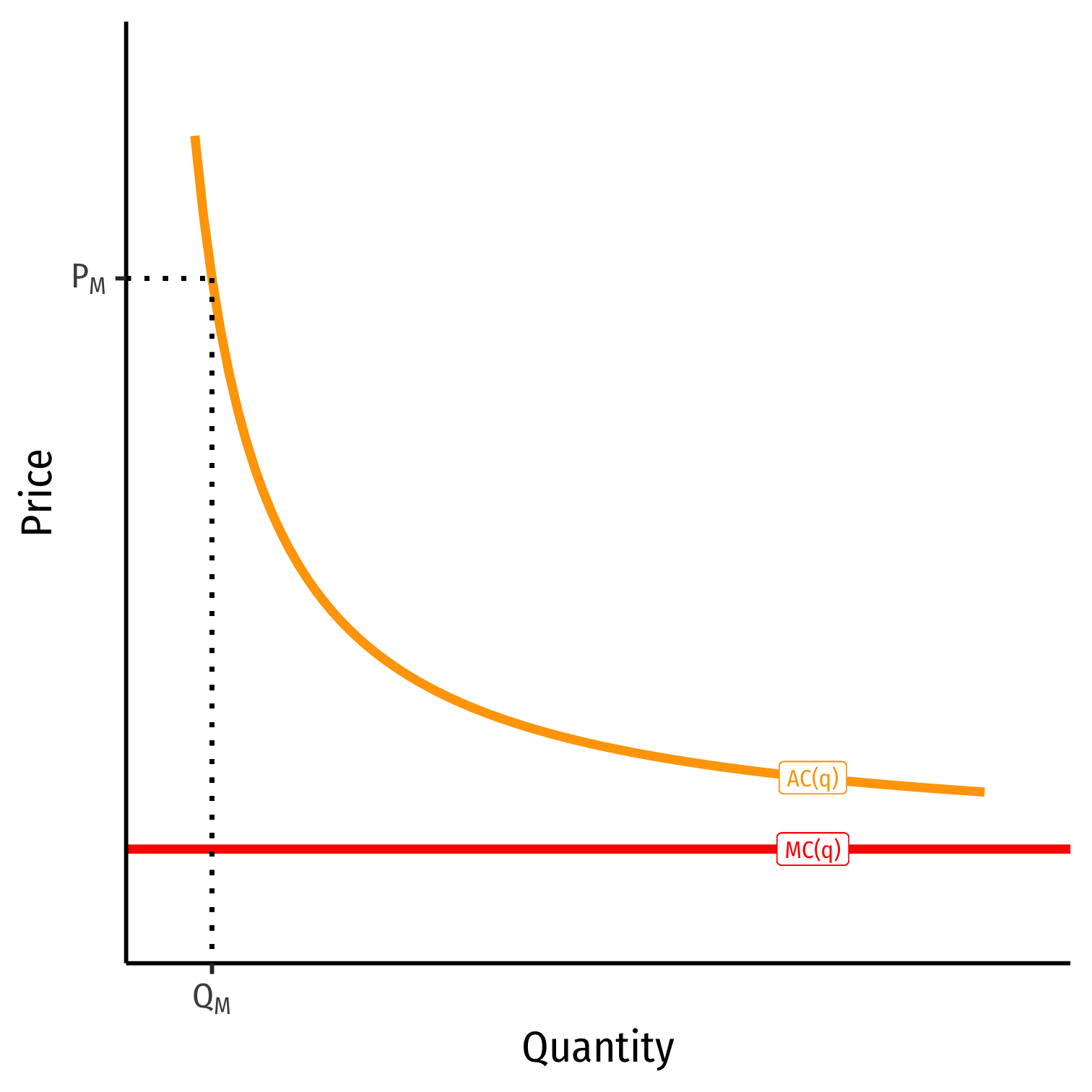

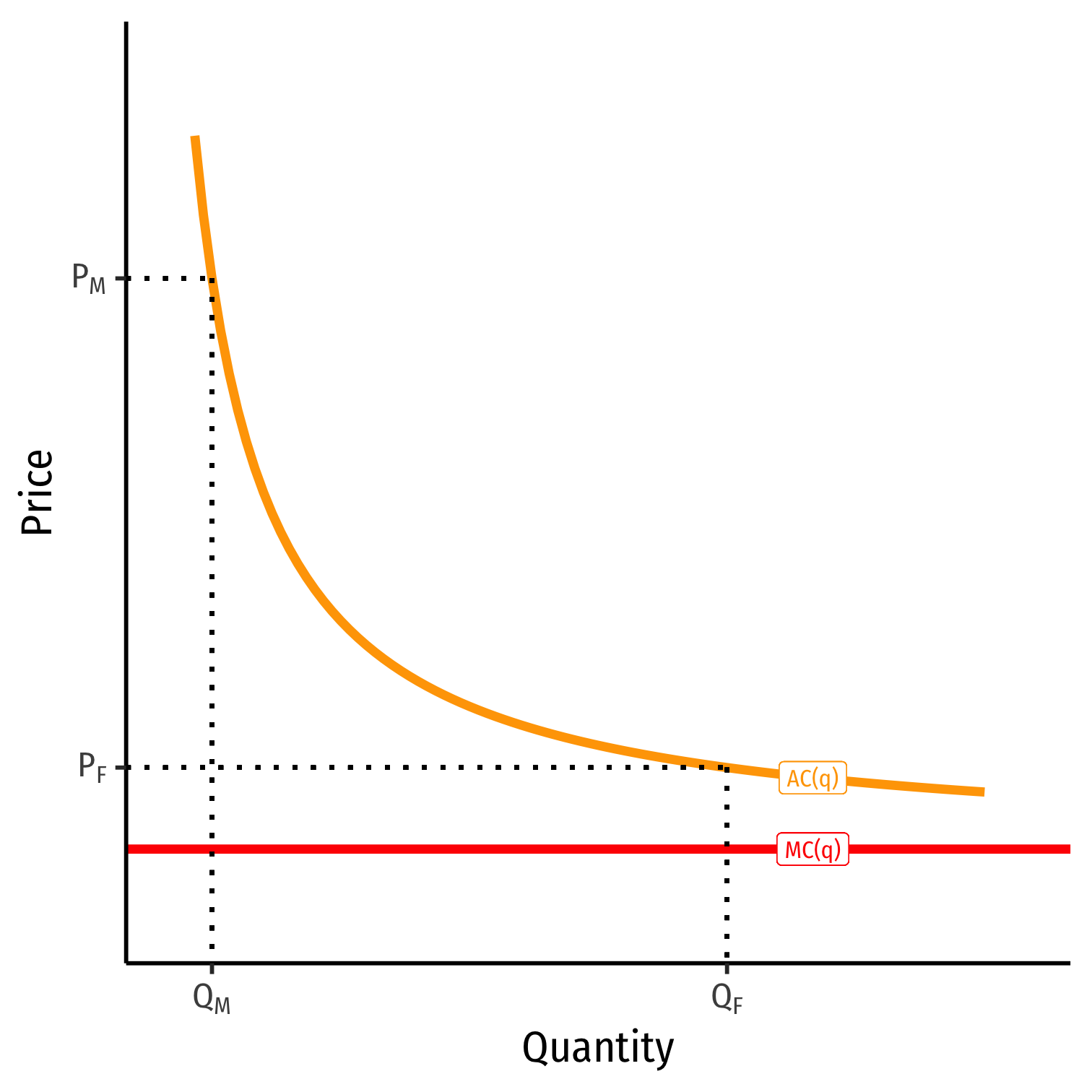

Trade & Variety: Tradeoff Between Variety & Cost

Why can’t consumers each always have their favorite variety?

Tradeoff between variety and (average) cost

Trade & Variety: Tradeoff Between Variety & Cost

Why can’t consumers each always have their favorite variety?

Tradeoff between variety and (average) cost

If every consumer had their favorite variety: many varieties, each firm produces very few units at a very high price (QM,PM)

Trade & Variety: Tradeoff Between Variety & Cost

Why can’t consumers each always have their favorite variety?

Tradeoff between variety and (average) cost

If every consumer had their favorite variety: many varieties, each firm produces very few units at a very high price (QM,PM)

If there are only a few varieties, few firms produce many units at very low price (QF,PF)

International Trade and Variety

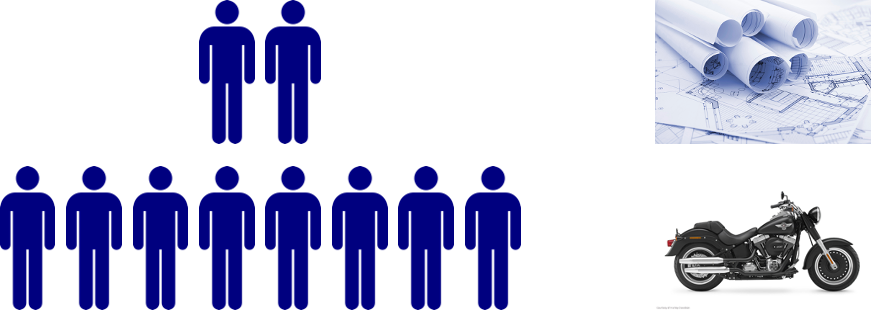

Example

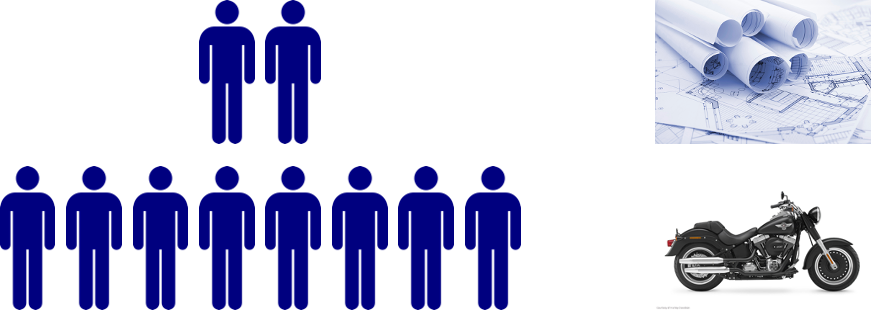

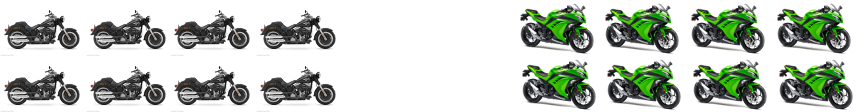

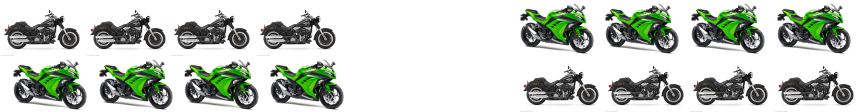

Suppose it takes 2 workers to design a motorcyle

Once designed, it takes 1 worker to produce a motorcycle

There are 2 countries, each with 10 workers

Without trade, in each country:

8 units of 1 variety

International Trade and Variety

Example

Suppose it takes 2 workers to design a motorcyle

Once designed, it takes 1 worker to produce a motorcycle

There are 2 countries, each with 10 workers

Alternatively:

3 units each of 2 varieties

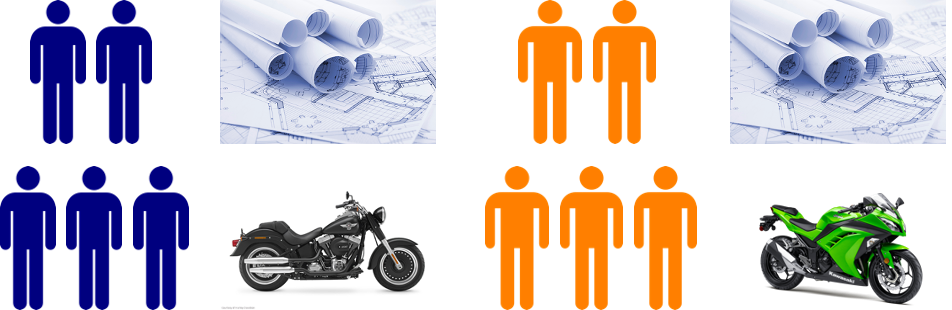

International Trade and Variety

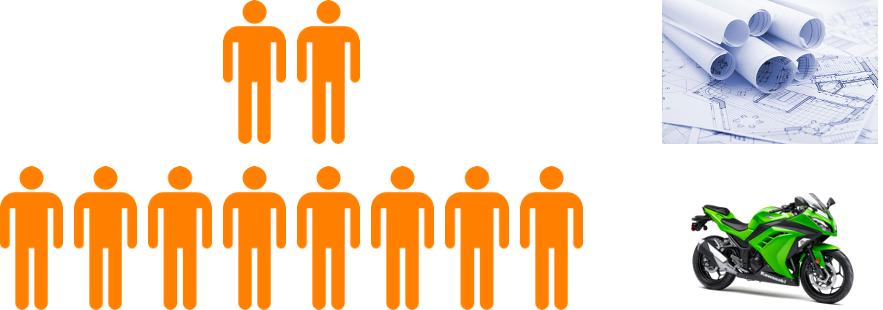

Example

Suppose it takes 2 workers to design a motorcyle

Once designed, it takes 1 worker to produce a motorcycle

There are 2 countries, each with 10 workers

With trade:

Each country specializes in one variety

International Trade and Variety

Example

Suppose it takes 2 workers to design a motorcyle

Once designed, it takes 1 worker to produce a motorcycle

There are 2 countries, each with 10 workers

With trade:

Each country specializes in one variety

International Trade and Variety

Example

Suppose it takes 2 workers to design a motorcyle

Once designed, it takes 1 worker to produce a motorcycle

There are 2 countries, each with 10 workers

- Suppose they trade 4 Harleys for 4 Kawasakis

With trade:

Each country ends up with 4 units of 2 varieties

International Trade and Variety

Globalization reduces geographic variation (more places look the same, have same amenities)

But increases varieties available to individuals in each area

A McDonalds in China, and a Chinese restaurant in the U.S.

Monopolistic Competition

The Role of the Firm in Trade

Classical trade theory (Ricardo, Hecksher-Ohlin, etc) has no role for the firm!

- might as well be people directly selling wheat or computers, etc.

Once we jettison the unrealistic assumption of perfect competition (p=MC), we can say a lot more about firms and trade

We move to a theory of imperfect competition: where firms have market power (but not full market power, as in a monopoly)

Imperfect Competition

Imperfect Competition

Imperfect Competition

Imperfect Competition

Monopolistic Competition

Monopolistic Competition

Monopolistic competition: each firm has some market power, but, the industry has free entry and exit (no barriers to entry)

- Each firm faces its own downward-sloping demand

- Firms are price-searchers

Model as a hybrid of monopoly and perfect competition models

Monopolistic Competition: Product Differentiation

Product differentiation: firms’ products are imperfect substitutes

Consumers recognize non-price differences between sellers’ goods

- Brand name & reputation

- Customer service

- Product features, shape, color, etc.

- Marketing

- Location, convenience

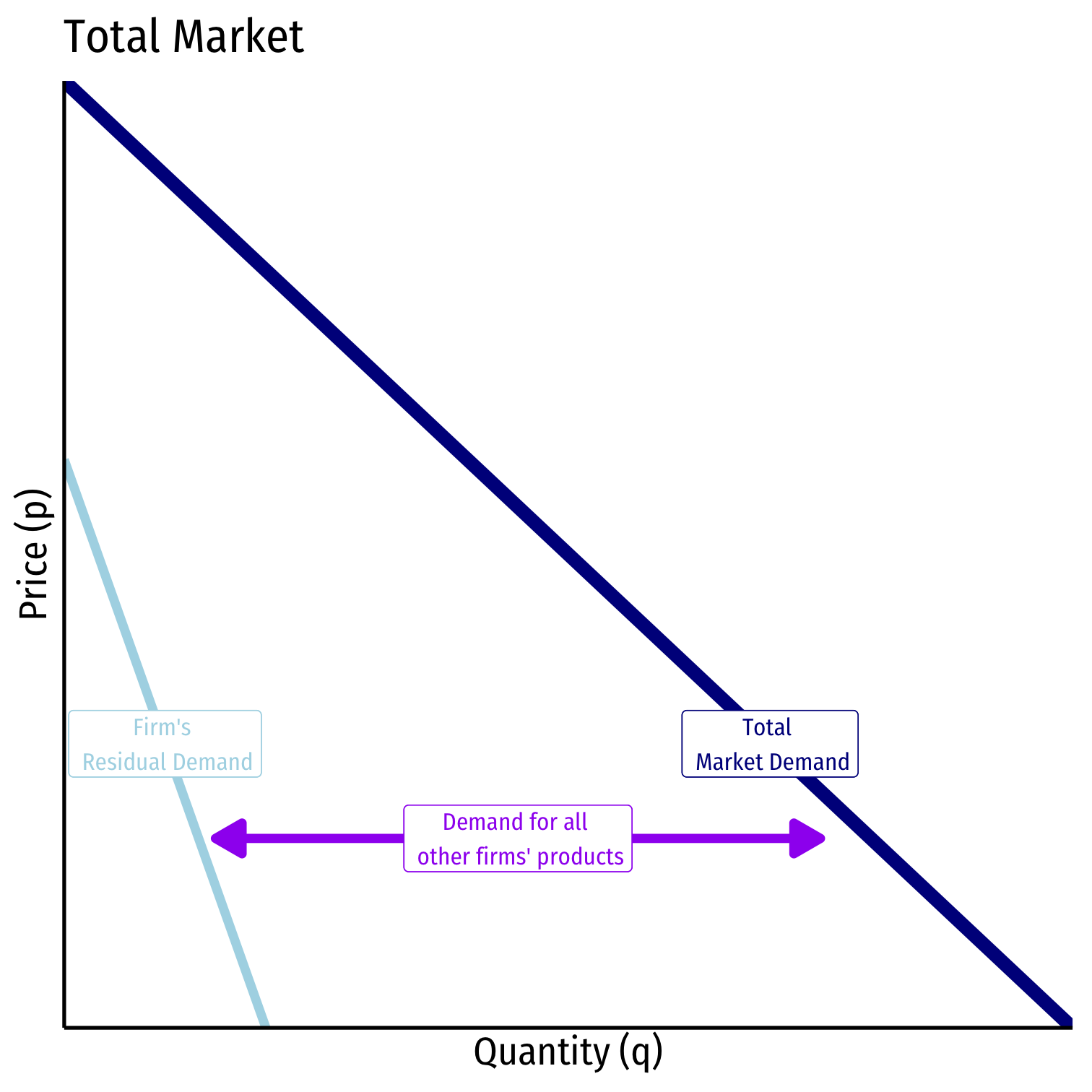

Monopolistic Competition: Residual Demand

Each firm faces own downward-sloping “residual” demand for each firm’s products

- Firm faces market demand (for broad product) leftover from all other firms’ sales

Example: demand for Lenovo laptops ≈ demand for laptops minus laptops supplied by Acer, Asus, Apple, Dell, etc.

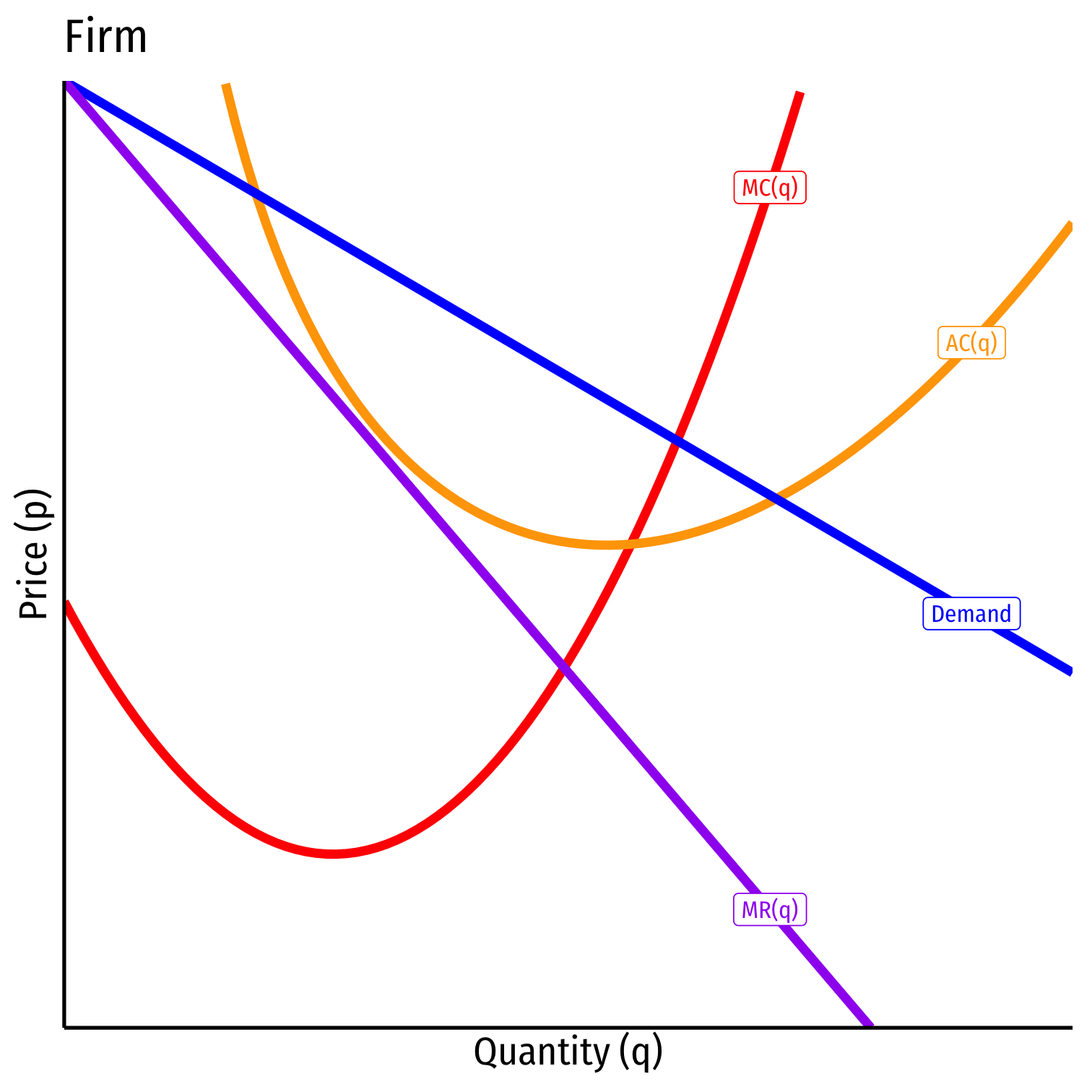

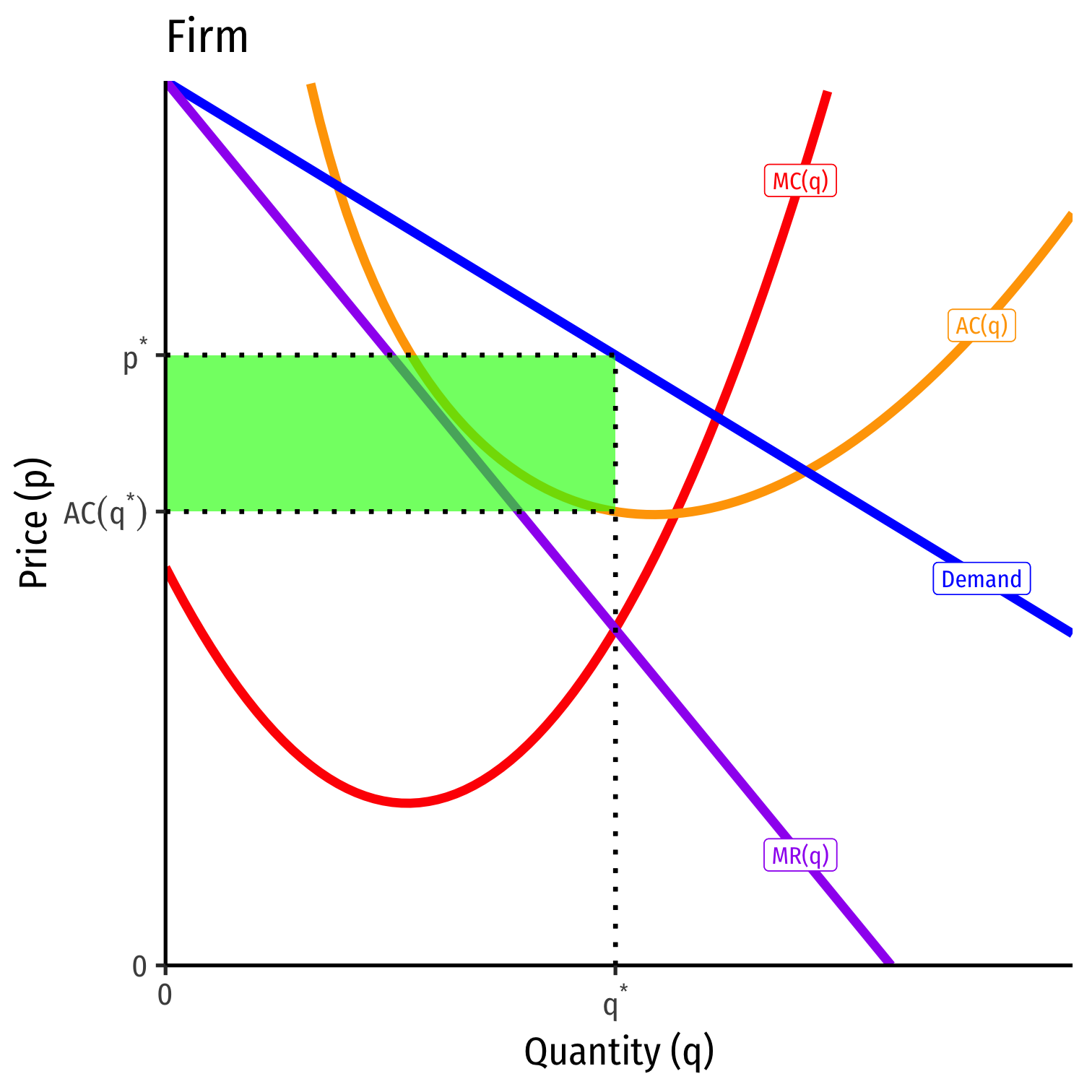

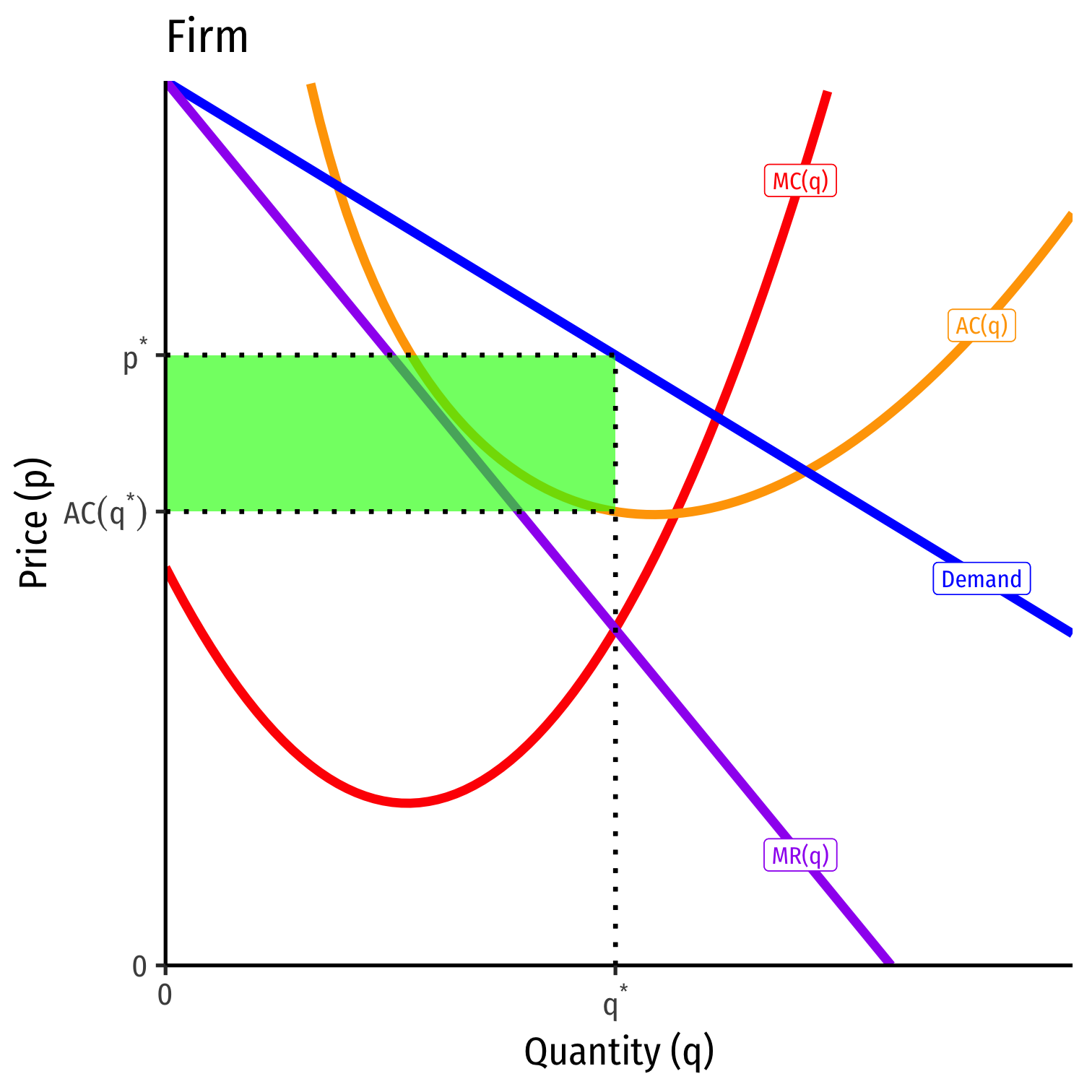

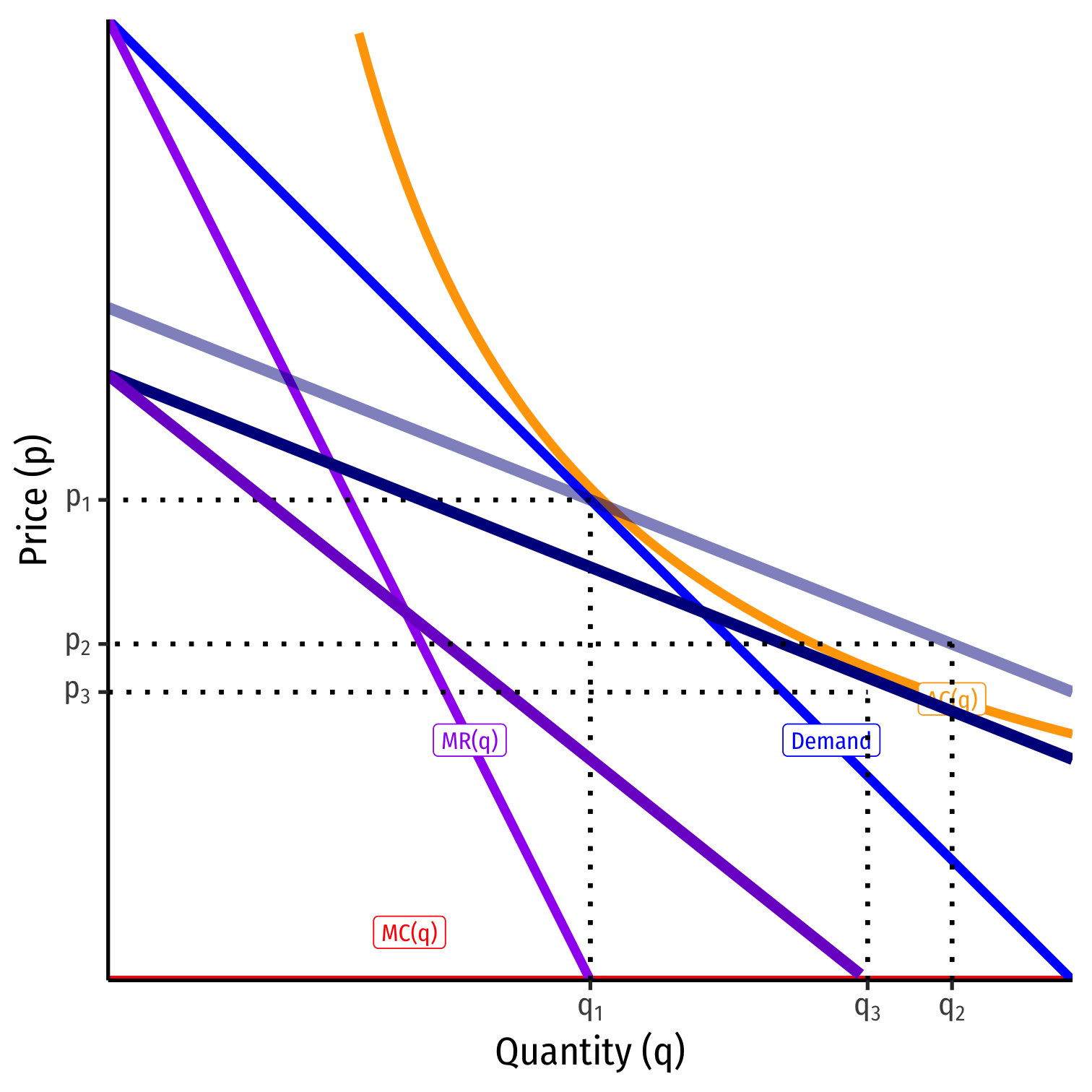

Monopolistic Competition Model: Short Run

- Short Run: model firm as a price-searching monopolist:

Monopolistic Competition Model: Short Run

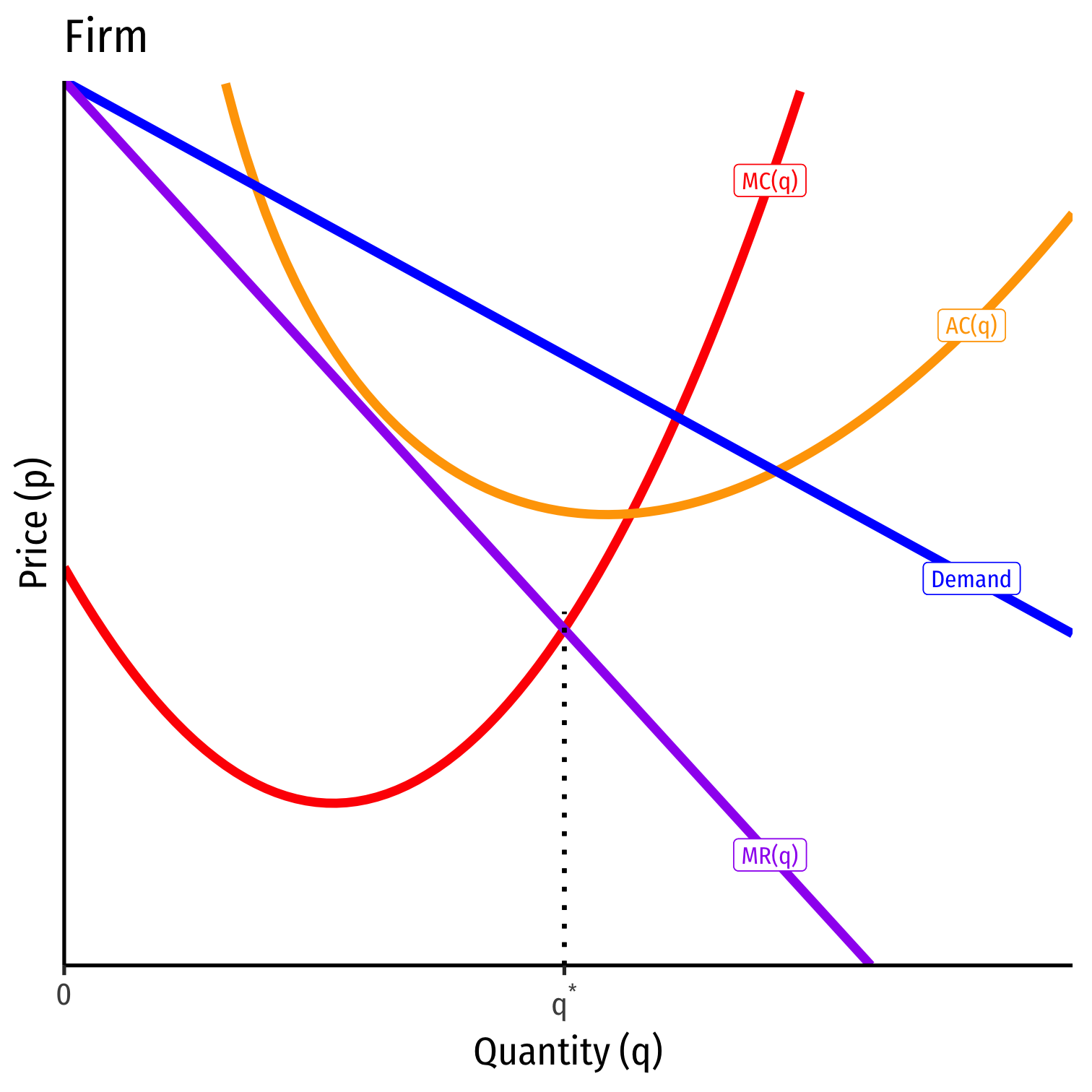

Short Run: model firm as a price-searching monopolist:

q∗: where MR(q)=MC(q)

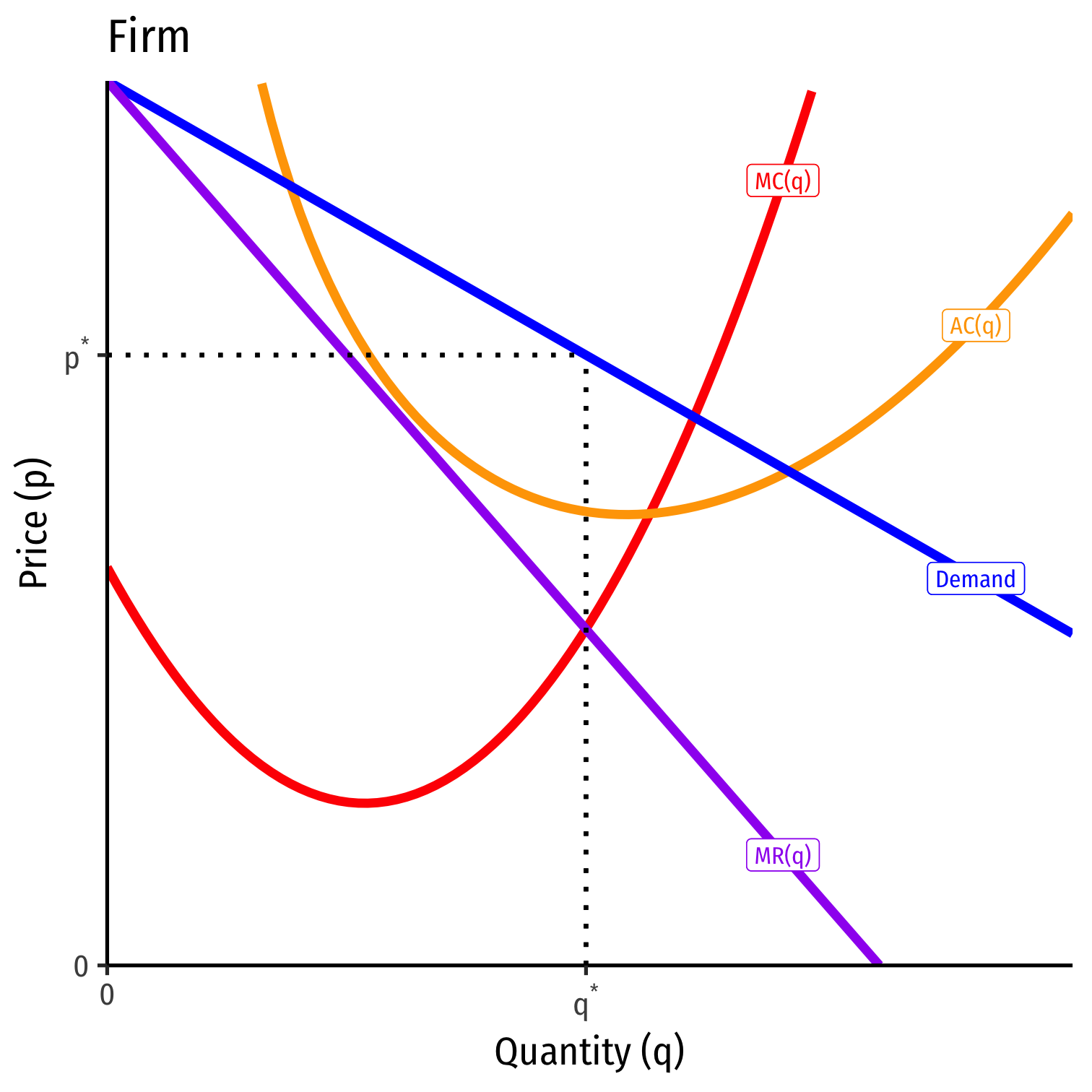

Monopolistic Competition Model: Short Run

Short Run: model firm as a price-searching monopolist:

q∗: where MR(q)=MC(q)

- p∗: at market demand for q∗

Monopolistic Competition Model: Short Run

Short Run: model firm as a price-searching monopolist:

q∗: where MR(q)=MC(q)

- p∗: at market demand for q∗

- Earns π=[p∗−AC(q∗)]q∗

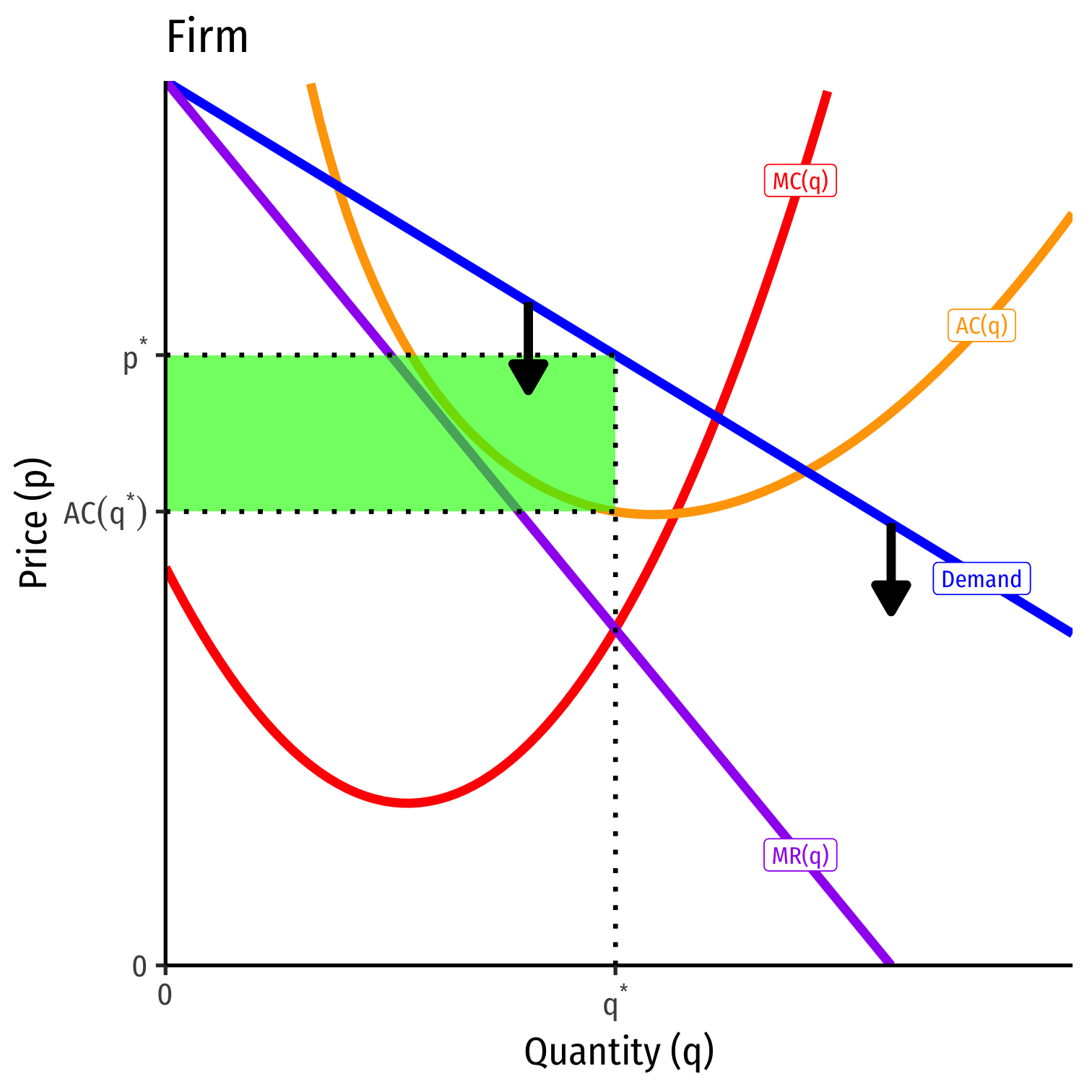

Monopolistic Competition Model: Long Run

Long Run: market becomes competitive (no barriers to entry!)

π>0 attracts entry into industry

Monopolistic Competition Model: Long Run

Long Run: market becomes competitive (no barriers to entry!)

π>0 attracts entry into industry

Residual demand for each firm’s product:

- decreases (more output by other firms)

- become more elastic (more substitutes from new competitors)

- until...

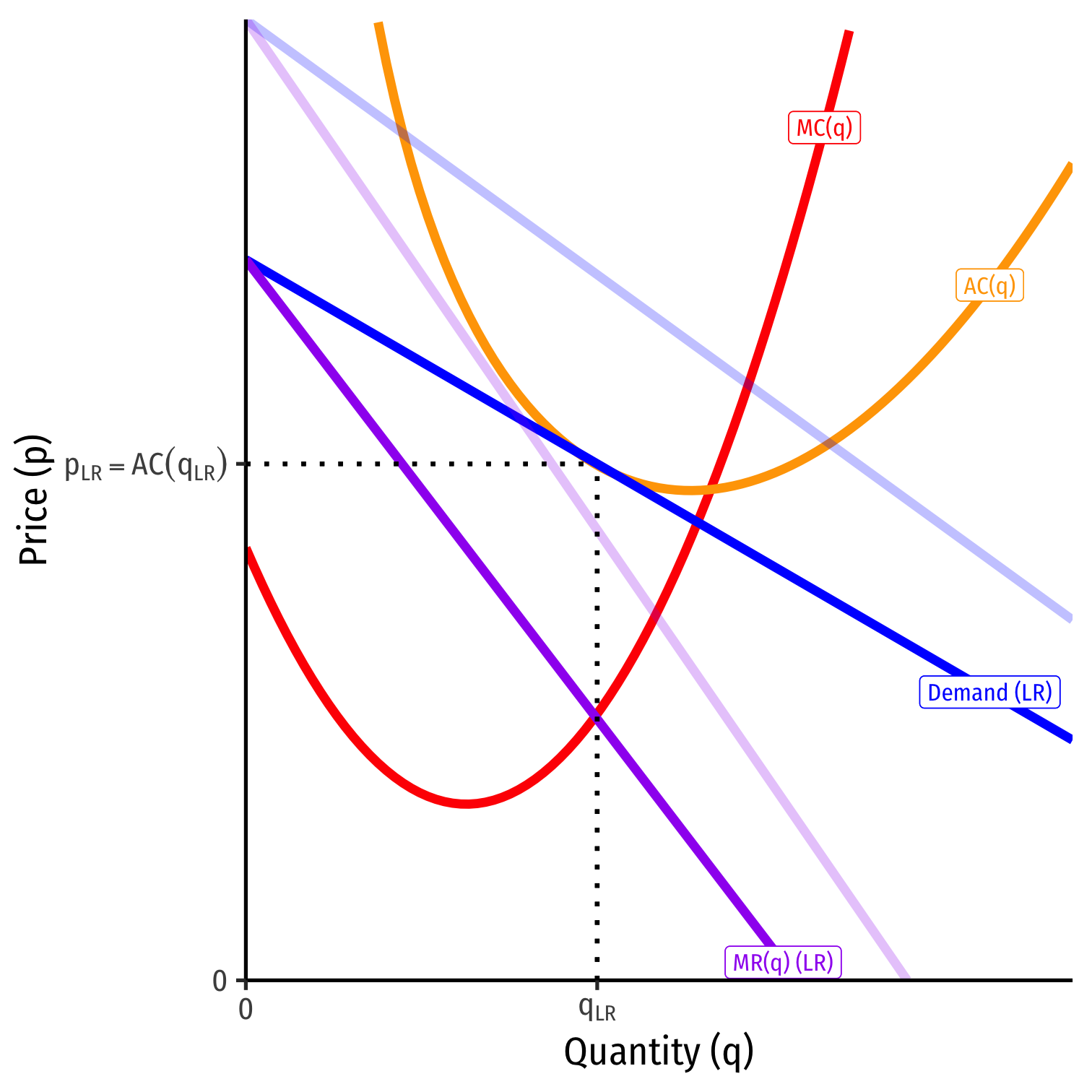

Monopolistic Competition Model: Long Run

† Note it is not at the minimum of AC(q)!

Long Run: market becomes competitive (no barriers to entry!)

π>0 attracts entry into industry

Residual demand for each firm’s product:

- decreases (more output by other firms)

- become more elastic (more substitutes from new competitors)

Long run equilibrium: firms earn π=0 where p=AC(q)

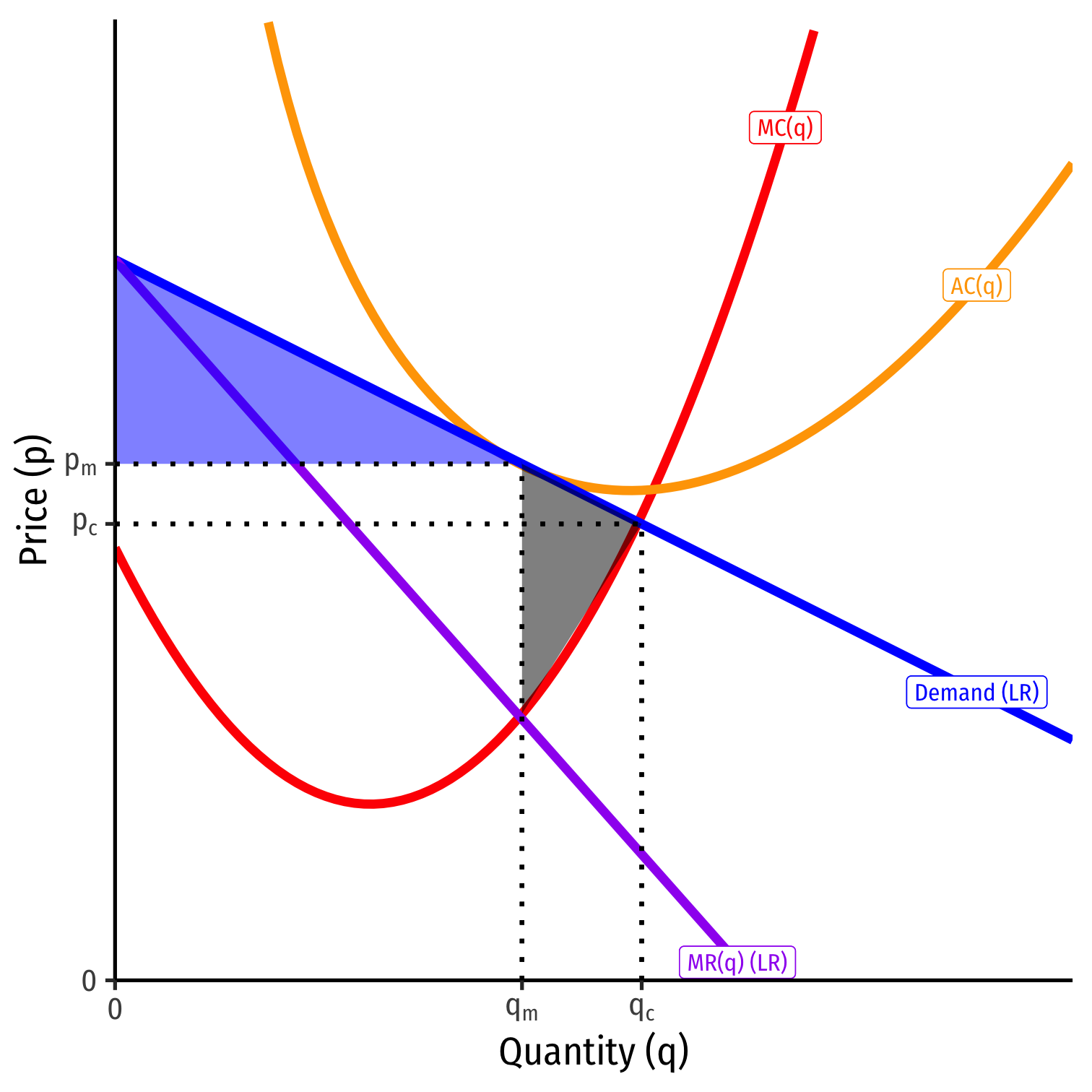

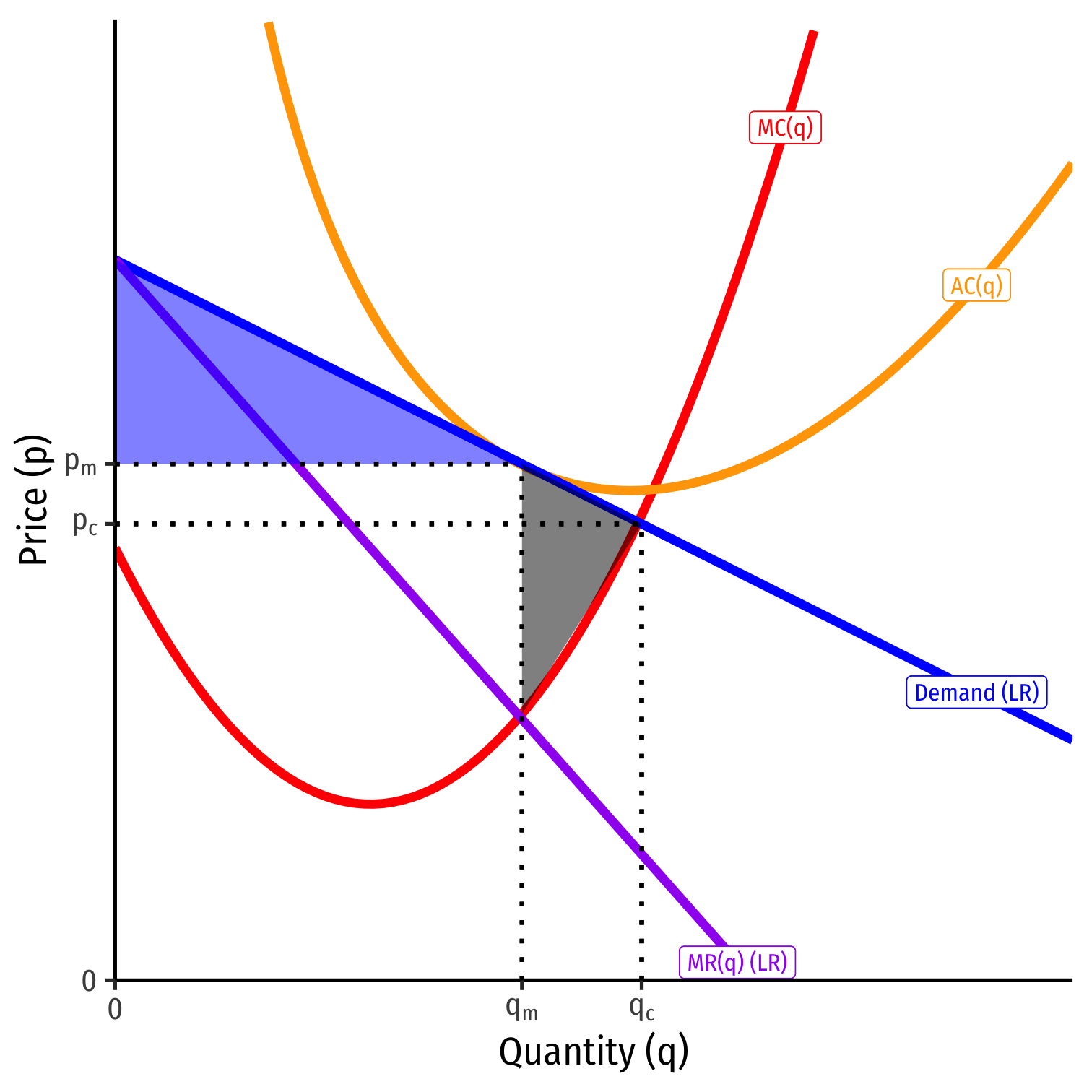

Monopolistic Competition vs. Perfect Competition

Perfect competition (qc,pc)

qc where P=MC(q)

pc=AC(q)min, productively efficient

- Production at lowest average cost

pc=MC(q), allocatively efficient

- Production until MB = MC

- Maximum consumer surplus (and producer surplus)

- No DWL

Monopolistic Competition vs. Perfect Competition

Monopolistic competition (qm,pm)

qc>qm, where MR(q)=MC(q)

pm=AC(q)

- but not ACmin, so some productive inefficiency

pm>MC(q), allocative inefficiency

- Less Consumer Surplus

- Some Deadweight loss

Monopolistic Competition vs. Perfect Competition

Like a monopoly, produces less q at a higher p than competition, some DWL

But like perfect competition, still no π in the long run!

Outcome is between perfect competition & monopoly in terms of efficiency & social welfare

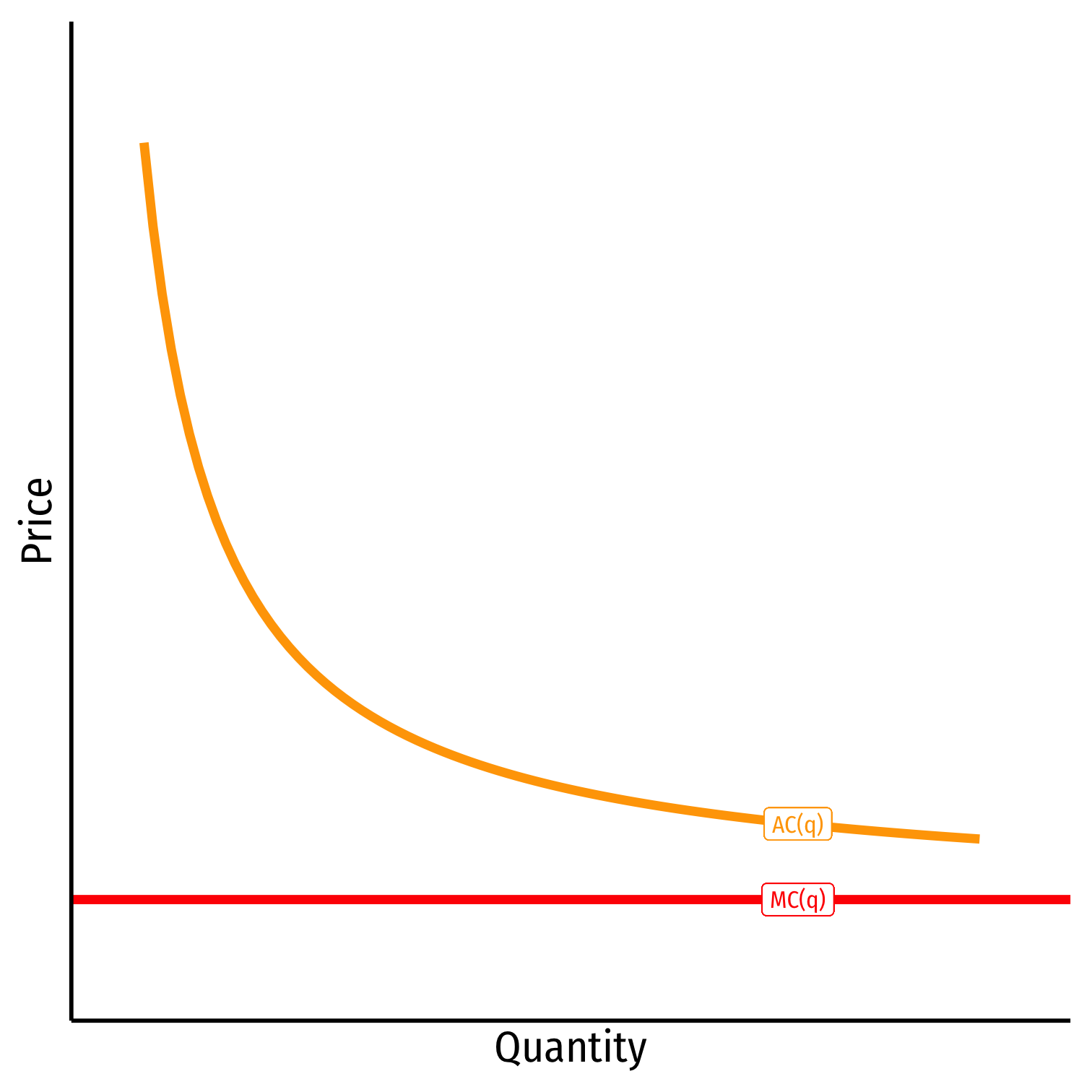

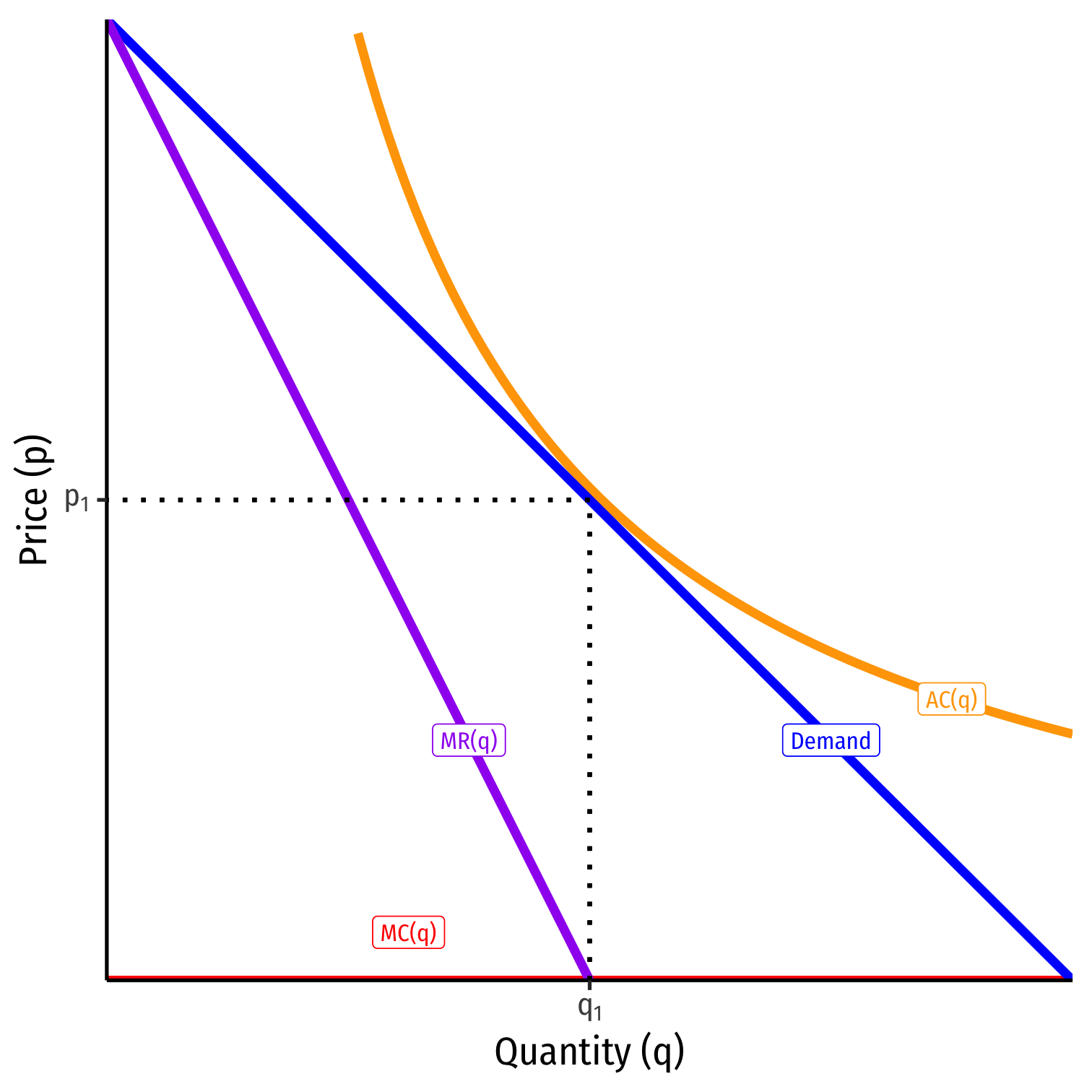

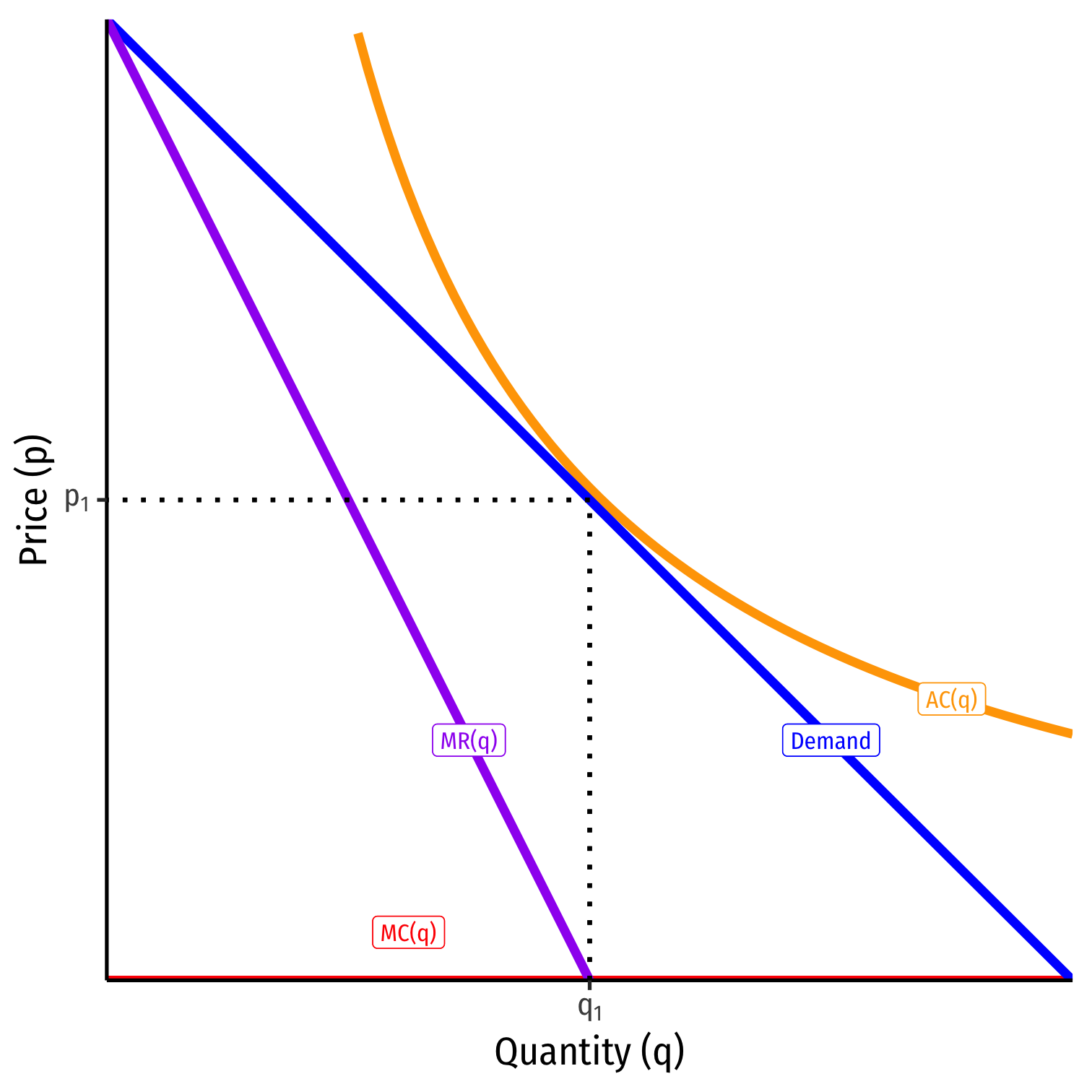

Monopolistic Competition in Autarky

Keep it simply, assume MC(q)=0

In autarky, long-run equilibrium for firm is p=AC, π=0 at q1,p1

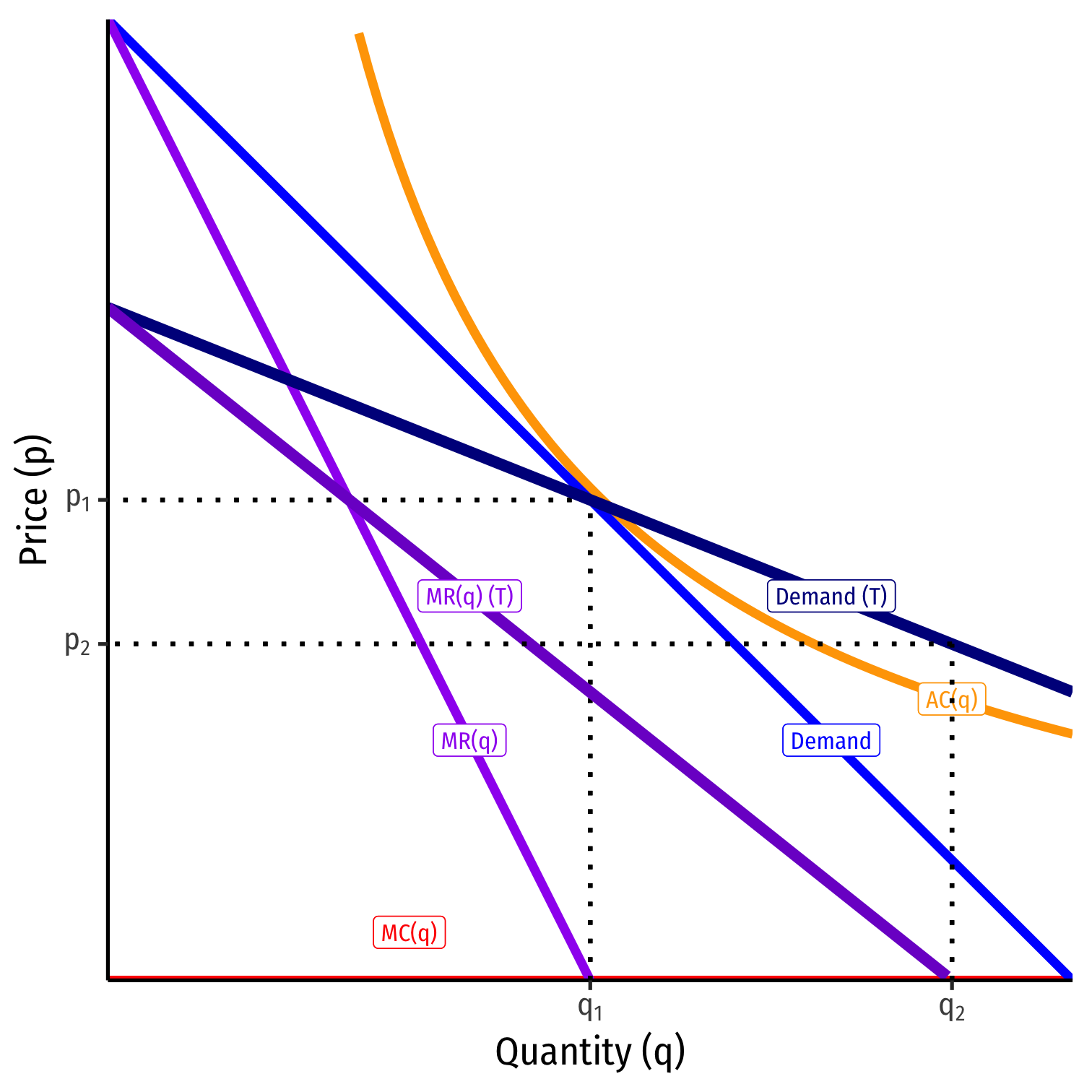

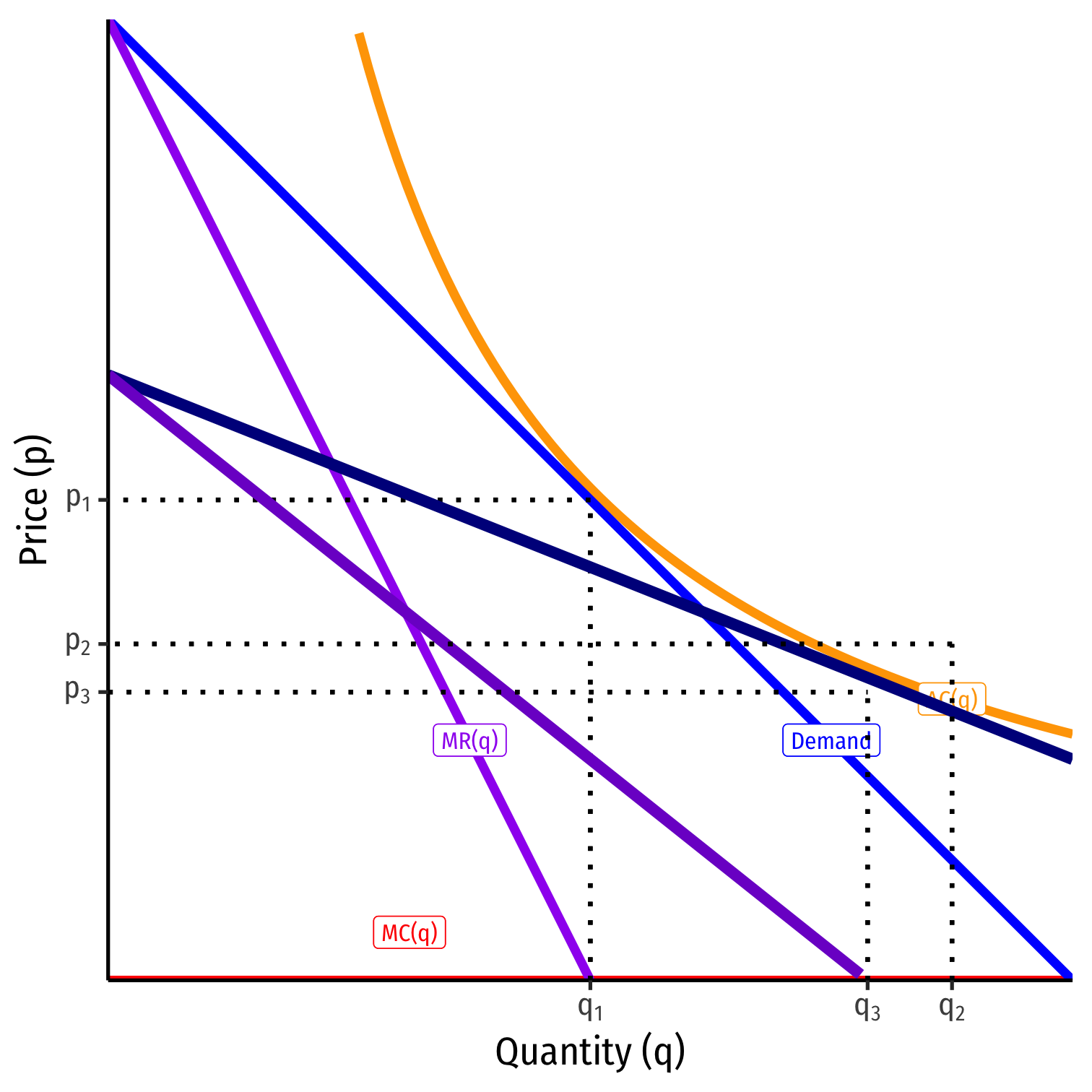

Monopolistic Competition with Trade: Short-Run

- Firm opens up to international trade, has two effects on demand for firm:

- greater demand for firm’s products

- more competition from other countries’ firms

- overall, demand becomes more elastic

Monopolistic Competition with Trade: Short-Run

Firm opens up to international trade, has two effects on demand for firm:

- greater demand for firm’s products

- more competition from other countries’ firms

- overall, demand becomes more elastic

Allows firm to lower price, produce more at q2,p2 and earn some profit

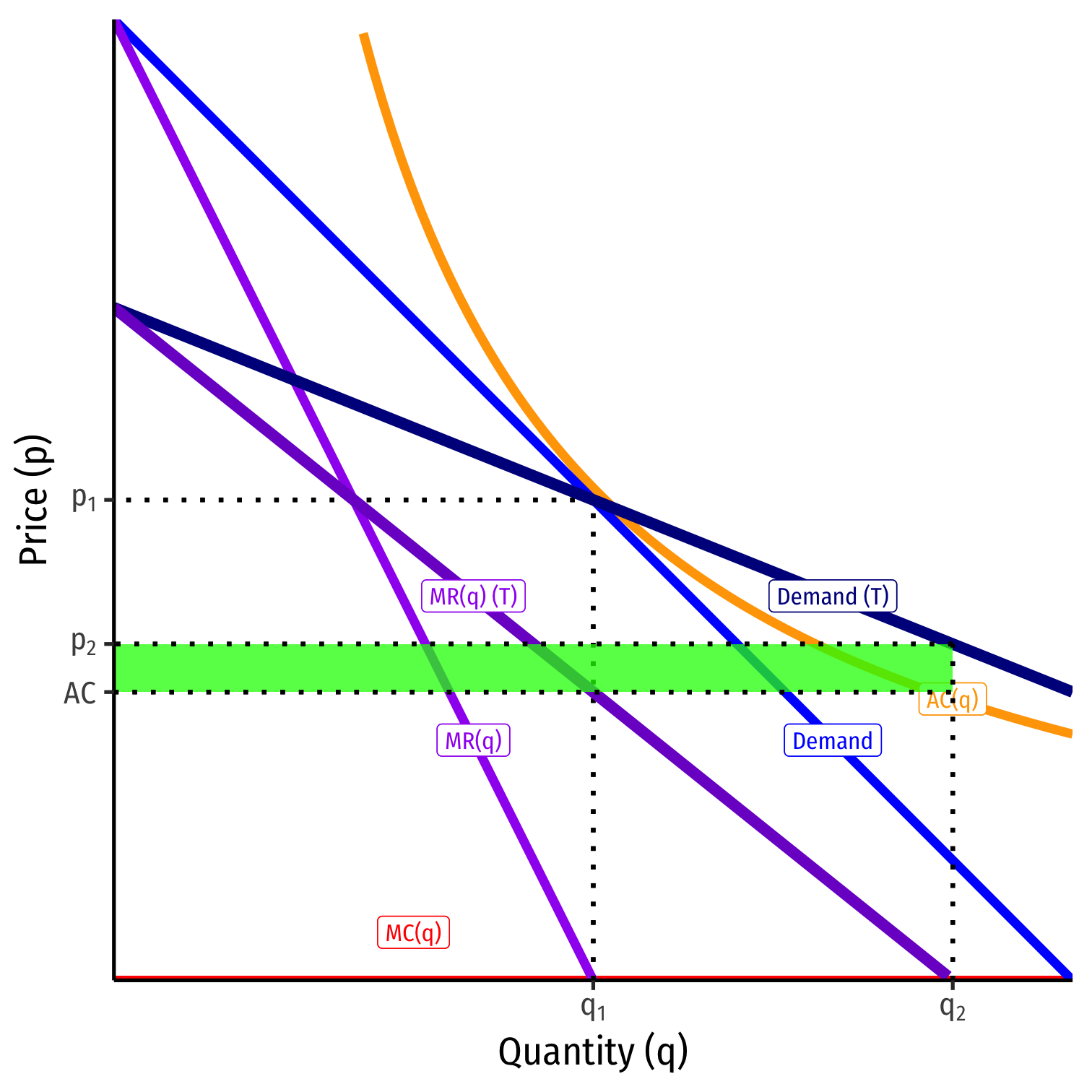

Monopolistic Competition with Trade: Short-Run

Firm opens up to international trade, has two effects on demand for firm:

- greater demand for firm’s products

- more competition from other countries’ firms

- overall, demand becomes more elastic

Allows firm to lower price, produce more at q2,p2 and earn some profit

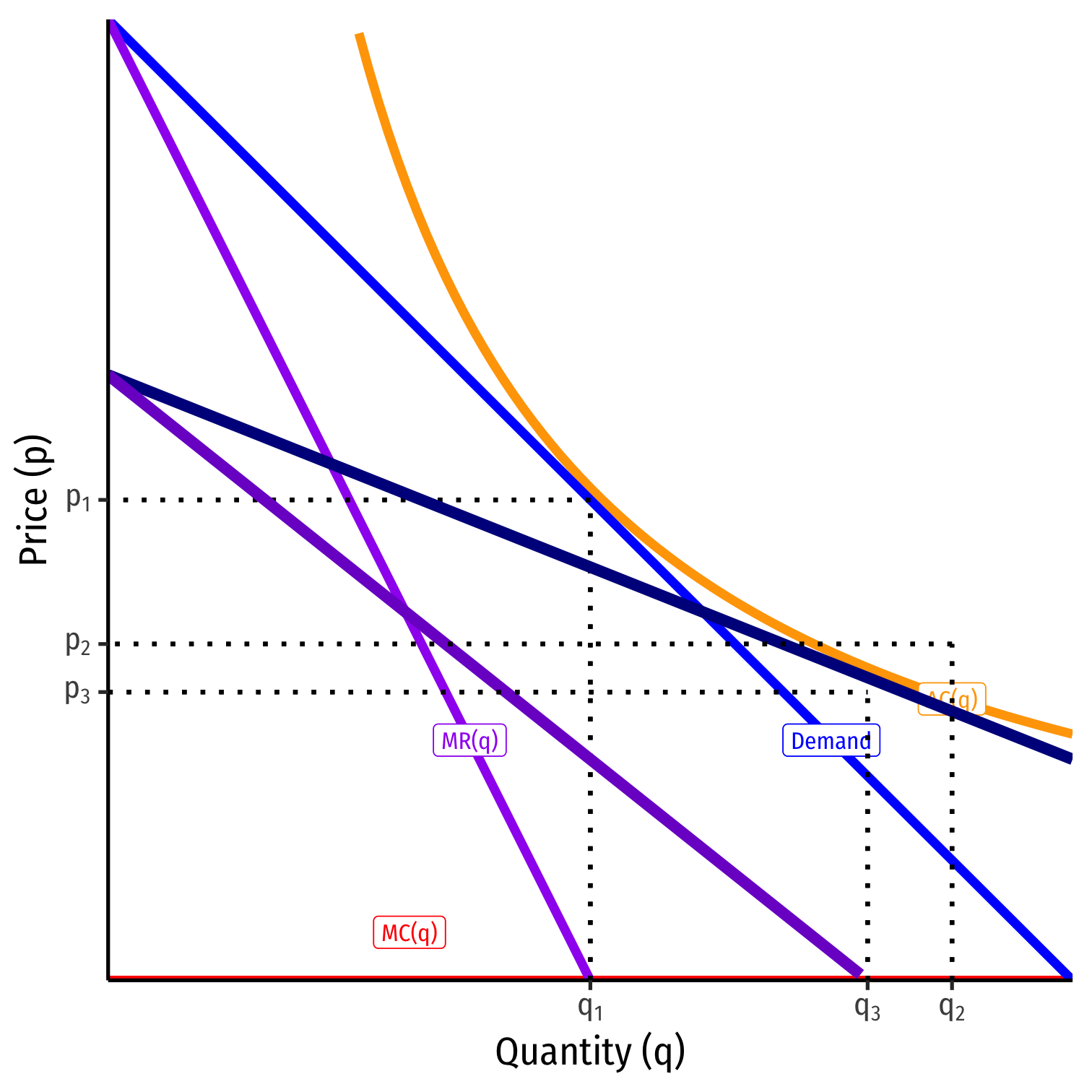

Monopolistic Competition with Trade: Long-Run

In reality, the size of the world market (Home+Foreign) has not changed

Thus, not all firms can expand and survive in global market

As all firms try to expand and compete, this lowers demand for each individual firm

Monopolistic Competition with Trade: Long-Run

In reality, the size of the world market (Home+Foreign) has not changed

Thus, not all firms can expand and survive in global market

As all firms try to expand and compete, this lowers demand for each individual firm

This continues until new equilibrium, where p=AC, π=0 again, at q3,p3

Monopolistic Competition with Trade: Long-Run

In reality, the size of the world market (Home+Foreign) has not changed

Thus, not all firms can expand and survive in global market

As all firms try to expand and compete, this lowers demand for each individual firm

This continues until new equilibrium, where p=AC, π=0 again, at q3,p3

Monopolistic Competition with Trade: Long-Run

In autarky (before trade), suppose there were 2n firms (n in each country)

When trade opens, each firm tries to gain larger share (but not all can)

Some firms exit; firms that remain will produce more than before (q1→q3)

With trade, and after the shakeout, there are n⋆ firms, n<n⋆<2n

Price & AC fall, and product variety in each country rises from n→n∗

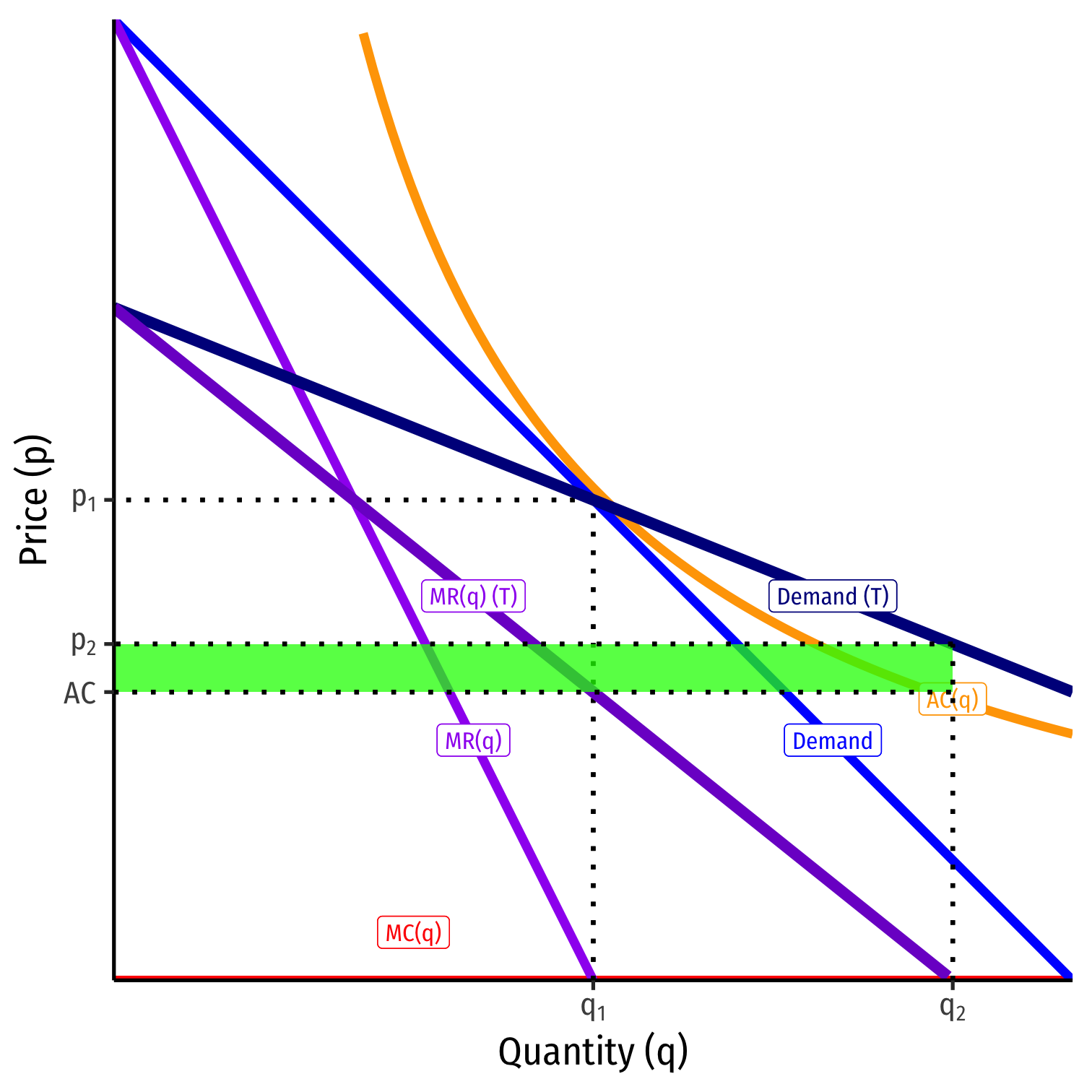

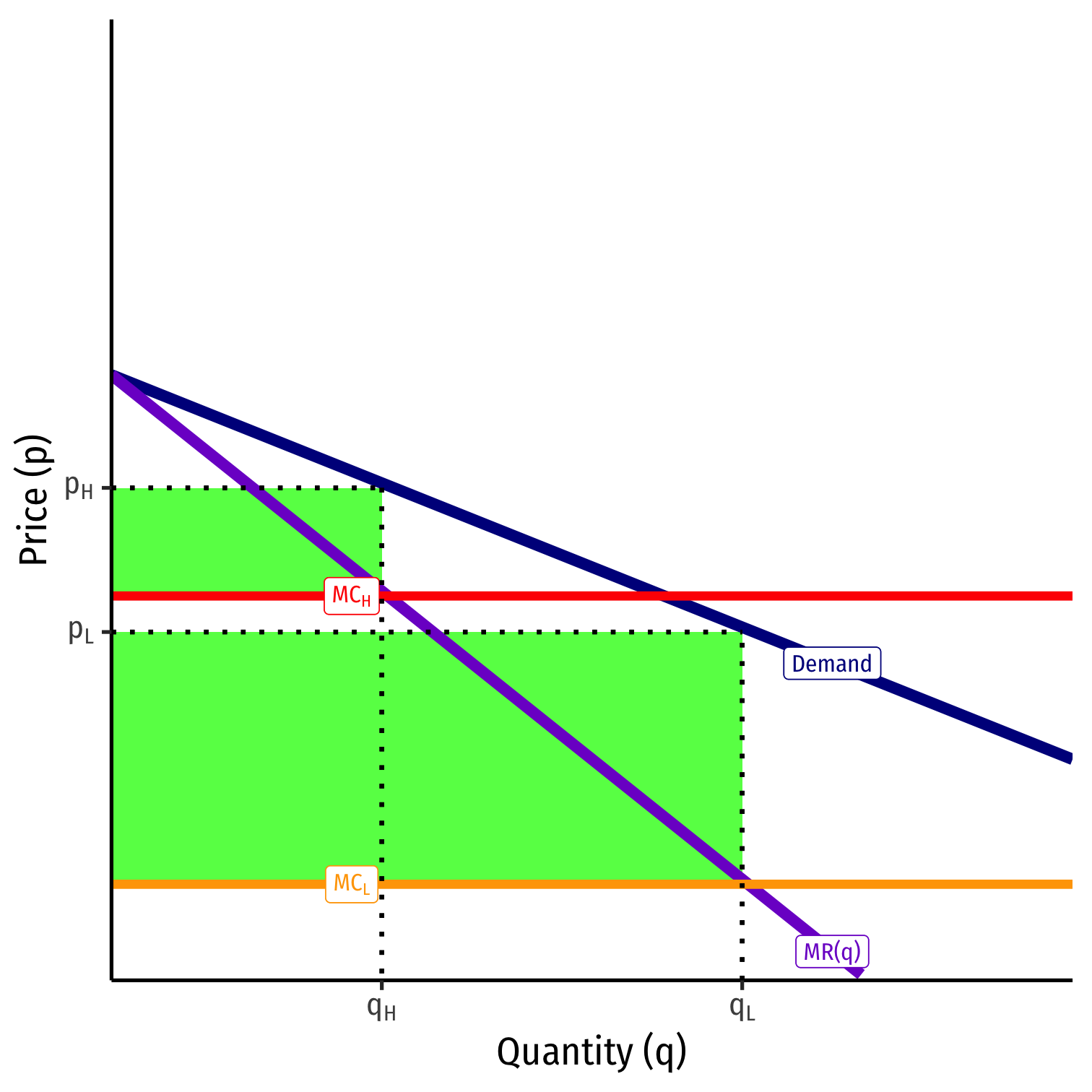

Monopolistic Competition with Trade: Long-Run

Which firms will survive and which will exit the market?

Compare two firms, one with high costs, MCH and one with low costs MCL

- Low cost firm earns more profits than high cost firm

Opening up trade increases competition, lowering profits

Low cost firms better equipped to survive falling profits

- High cost firms leave the market; allowing low cost firms to expand output!

Monopolistic Competition with Trade: Productivity

With fewer firms, the remaining (low cost) firms can further increase their output

Exploit economies of scale, moving down their average cost curves

Implies lower costs, lower prices, and greater productivity for the incumbent firms remaining

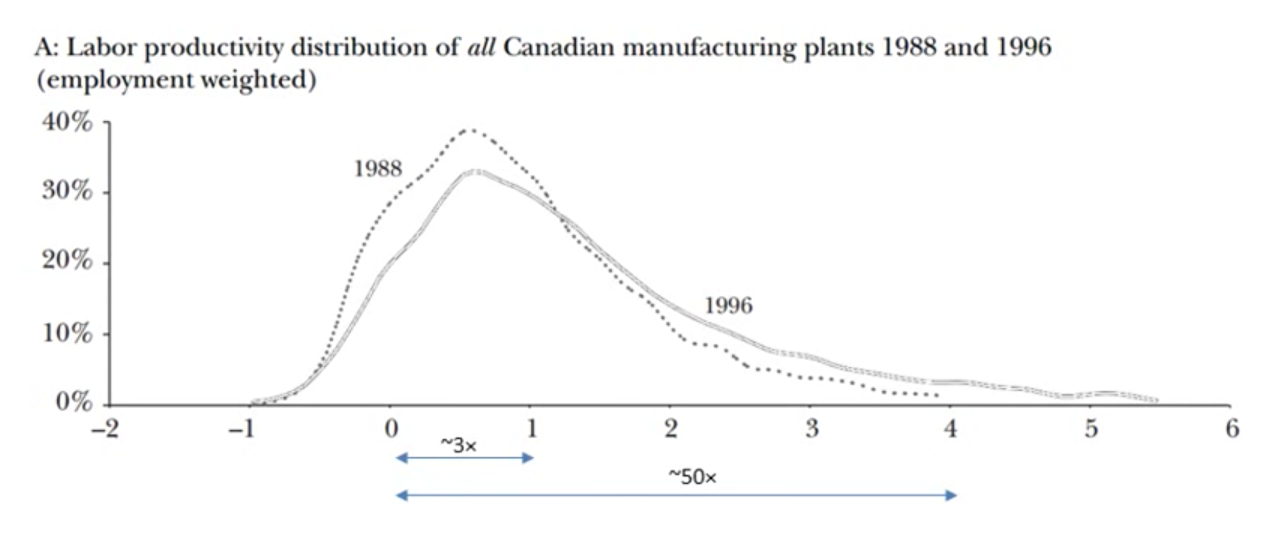

Trade Agreements and Firm Productivity

After Canadian free trade agreement with U.S., Canadian productivity increased rapidly by 8.4%, a huge increase over a short time period. Note this is a logarithmic scale!

What is at Stake in Competing Trade Theories?

H-O theory vs. increasing returns

Ex ante vs. ex post comparative advantage

Emphasize different causes of trade

Imply very different policies

- free trade vs. industrial policy?

Cultural/aesthetic views of the world? Difference vs. sameness?