1.10 — Testing the Hecksher-Ohlin Model

ECON 324 • International Trade • Spring 2023

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/tradeS23

tradeS23.classes.ryansafner.com

Predictions of the Hecksher-Ohlin Model

Hecksher-Ohlin Theorem

1) Hecksher-Ohlin (H-O) Theorem: a nation will export the good whose production requires the intensive use of the nation’s relatively abundant factor, and import the good whose production requires the intensive use of the nation’s relatively scarce factor

L: Eli Hecksher (1879-1952)

R: Bertil Ohlin (1899-1979)

Factor-Price Equalization Theorem

2) Factor Price Equalization (FPE) Theorem: under certain conditions, international trade tends to bring about equalization in relative and absolute returns to homogeneous factors across nations

3) Stolper-Samuelson Theorem: in the long run, an increase in the relative price of a good will increase the real earnings of the factor used intensively in that good’s production and decrease the earnings of the other factor

L: Eli Hecksher (1879-1952)

R: Bertil Ohlin (1899-1979)

Trade and Factor Prices

- Assume:

- U.S. is relatively capital abundant → produces & exports capital-intensive goods

- China is relatively labor abundant → produces & exports labor-intensive goods

Trade and Factor Prices

- U.S. opens up trade with China

- U.S. is a relatively high-wage country, China is a relatively low-wage country

- What would we expect to happen to wages in both countries? capital returns?

Trade and Factor Prices

- Factor price equalization theorem:

- U.S.: ↓ wages; ↑ capital returns

- China: ↑ wages; ↓ capital returns

Trade and Factor Prices

- Stolper-Samuelson Theorem:

- U.S.: ↓ real income to labor; ↑ real income to capital

- China: ↑ real income to labor; ↓ real income to capital

Trade and Factor Prices

- Essentially an arbitrage story

- why hire expensive labor in U.S.? Outsource to China!

- why invest capital in China? Earn higher returns in the U.S.!

- process continues until long run equilibrium: no more gain in shifting resources across countries

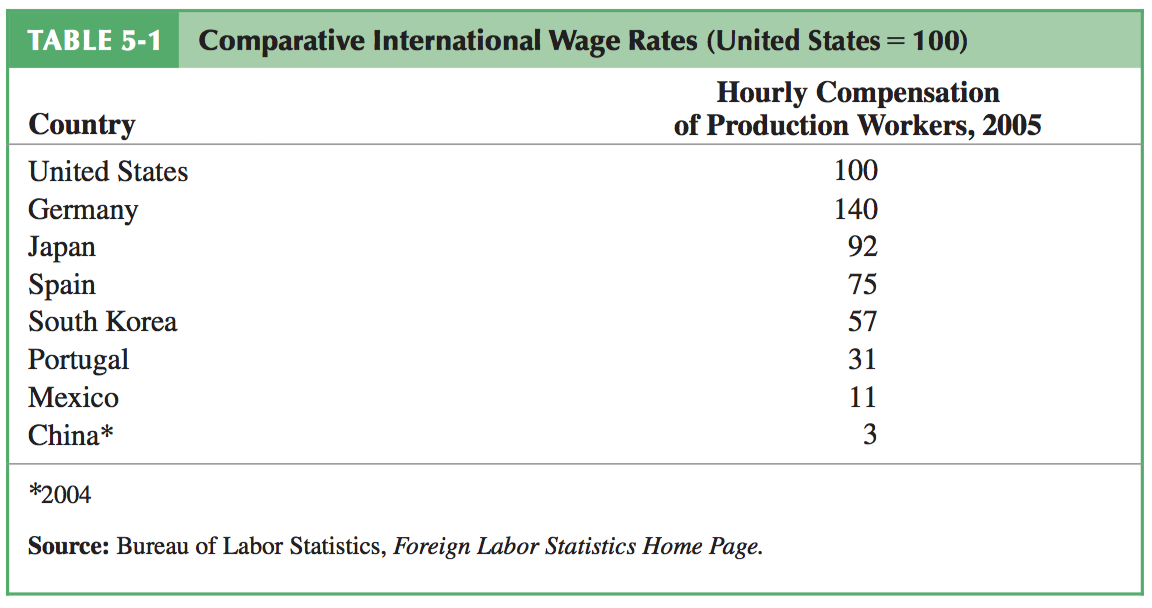

Limits to Factor Price Equalization

But clearly, wages in reality remain higher in U.S. than China!

FPE theorem has restrictive assumptions:

- identical technology (and institutions) across countries

- perfect competition

- free trade

- no transaction costs

Limits to Factor Price Equalization

- FPE theorem applies only to identical or homogenous factors of production

- e.g. not “Labor” or “Capital”, but python programmers, or football players, or beer barrels, or blast furnaces, etc.

Limits to Stolper-Samuelson Theorem

What about the Stolper-Samuelson Theorem?

In most cases, it seems (final goods) prices have converged globally more than wages!

Considered an interesting analytical result, but doesn’t really hold in practice

Limits to FPE and SS Theorems

Krugman, Paul, Maurice Obstfeld, and Mark Melitz, 2011, International Economics: Theory & Policy, 9th ed., p.97

Limits to FPE and SS Theorems

Both FPE and SS theorems apply only when factors are mobile within each nation

In short run, factors (especially capital) are fixed or specific

Specific factors will not flow out of its specific sector, keeping returns unequal

The Leontief Paradox

H-O Theory's Prediction

Main prediction: countries should export the goods that require a relatively intensive use of the country's relatively abundant factor (and import goods that require a relatively intensive use of the country's scarce factor)

e.g. relatively capital-abundant U.S. should export capital-intensive goods and import relatively labor-intensive goods

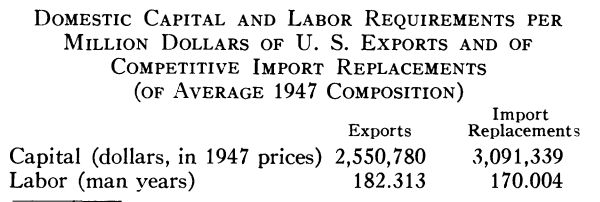

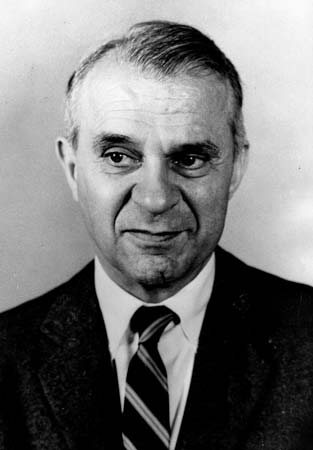

Leontief Paradox

Wassily Leontief

1905-1999

Economics Nobel 1973

Leontief (1953, p.343)

Leontief Paradox

Wassily Leontief

1905-1999

Economics Nobel 1973

“These figures show that an average million dollars' worth of our exports embodies considerably less capital and somewhat more labor than would be required to replace from domestic production an equivalent amount of our competitive imports. America's participation in the international division of labor is based on its specialization on labor intensive, rather than capital intensive, lines of production. In other words, this country resorts to foreign trade in order to economize its capital and dispose of its surplus labor, rather than vice versa. The widely held opinion that as compared with the rest of the world-the United States' economy is characterized by a relative surplus of capital and a relative shortage of labor proves to be wrong. As a matter of fact, the opposite is true” (p.343)

Leontief, Wassily (1953). “Domestic Production and Foreign Trade; The American Capital Position Re-Examined,” Proceedings of the American Philosophical Society 97(4): 332-349

Leontief Paradox

Wassily Leontief

1905-1999

Economics Nobel 1973

Leontief (1953) found in 1947, U.S. (then clearly a capital-abundant nation) exported more labor-intensive goods and imported capital-intensive goods

Calculated L-output and K-output ratios for U.S. sectors to find how much K & L were 'embodied' in exports

A direct contradiction of H-O theory! In fact, the exact opposite!

Leontief, Wassily (1953). “Domestic Production and Foreign Trade; The American Capital Position Re-Examined,” Proceedings of the American Philosophical Society 97(4): 332-349

Leontief Paradox

Wassily Leontief

1905-1999

Economics Nobel 1973

Krugman, Paul, Maurice Obstfeld, and Mark Melitz, 2011, International Economics: Theory & Policy, 9th ed., p.99

Responses to the Leontief Paradox

Responses to the Leontief Paradox

- 70 years of responses to Leontief (1953):

1) H-O Theorem is overly simple, restrictive assumptions

- 2-factor, 2-good, 2-country world

- identical technologies

- perfect mobility of factors

Responses to the Leontief Paradox

- 70 years of responses to Leontief (1953):

2) Other minor quibbles:

- Leontief only measures land and labor, what about land? U.S. is also relatively land abundant

- Leontief looked right after WWII (returning from major disruption)

- U.S. was not engaged in full free trade at the time

Responses to the Leontief Paradox

- 70 years of responses to Leontief (1953):

3) What counts as “L” vs “K”?

- High-skilled vs. low-skilled labor?

- U.S. Labor highly-skilled from human-capital embodied in “L”, not “K”

- This could make U.S. a labor-abundant country (H-O predicts we export labor-intensive goods)!

Leontief's Suggested Explanation

Wassily Leontief

1905-1999

Economics Nobel 1973

“What is the explanation of this somewhat unexpected result? The conventional view of the position which the United States occupies today in the world economy is...that the United States possesses more productive capital per worker than any other country. It can hardly be disputed.’ (p.343)

“Let us, however, reject the simple but tenuous postulate of comparative technological parity and make the plausible alternative assumption that in any combination with a given quantity of capital, one man year of American labor is equivalent to, say, three man years of foreign labor...Spread trice as thinly as the unadjusted figures suggest the American capital supply per [foreign] ‘equivalent worker’ turns out to be comparatively smaller, rather than larger, than that of many other countries.'' (p.344)

Leontief, Wassily (1953). “Domestic Production and Foreign Trade; The American Capital Position Re-Examined,” Proceedings of the American Philosophical Society 97(4): 332-349

Responses to the Leontief Paradox

Wassily Leontief

1905-1999

Economics Nobel 1973

- 70 years of responses to Leontief (1953):

4) Revisions, extensions, replacements to H-O theory:

- economies of scale (endogenous comparative advantage regardless of factor endowments)

- imperfect competition

- transaction (transportation) costs

- differing technologies internationally

Testing the H-O Theory

Measuring Factor Endowments

Measuring factor endowments in countries

Assumed definitions:

- A country is abundant in a factor if its share in that factor exceeds its share in world GDP

- A country is scarce in a factor if its share in that factor is less than its share in world GDP

- Allows us to use multiple factors and multiple countries

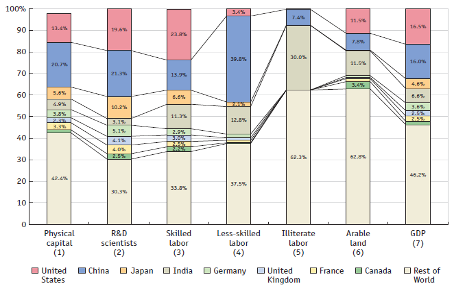

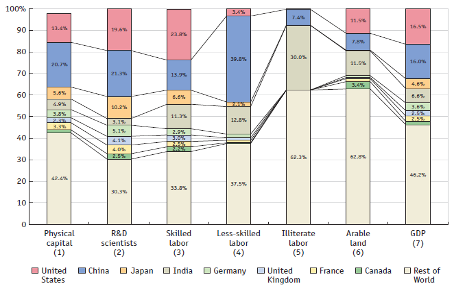

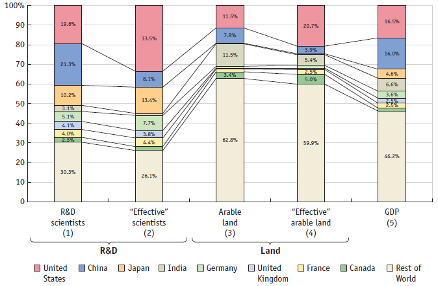

Country Factor Endowments (2013)

Feenstra and Taylor (2017, p.103)

Measuring Factor Endowments

Taking physical capital as example:

U.S. has 13.4% of world's physical capital; 16.5% of world GDP

- U.S. is physical capital scarce (!)

China has 20.7% of world's physical capital; 16.0% of world GDP

- China is physical capital abundant (!)

Country Factor Endowments (2013)

Feenstra and Taylor (2017, p.103)

Measuring Factor Endowments

But absolute numbers of physical factors are often not relevant

Some countries may have few physical factors, but they may be very productive!

So we care about effective factor endowment:

effective factor endowment = actual endowment × factor productivity

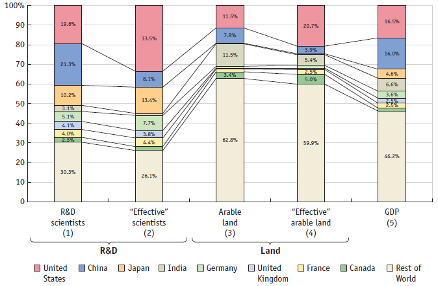

Country Effective Factor Endowments (2013)

Feenstra and Taylor (2017, p.106)

Measuring Factor Endowments

- Examples:

- U.S. is scarce in absolute R&D but abundant in effective R&D

- U.S. is scarce in absolute land, but abundant in effective land

- China is abundant in both in absolute terms, but scarce in both in effective terms

Country Effective Factor Endowments (2013)

Feenstra and Taylor (2017, p.106)

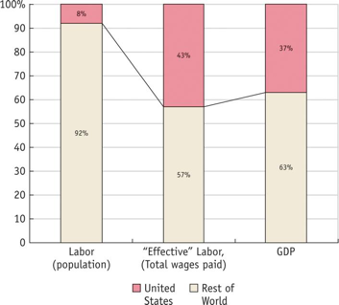

Was The U.S. Labor Abundant?

U.S. Labor in 1947

While the U.S. in 1947 may have been labor scarce in absolute terms, it was labor abundant in effective terms, consistent with Leontief's finding.

Was The U.S. Labor Abundant?

Labor Productivity and Wages (Relative to the U.S.) in 1990

Labor productivity and wages are highly correlated, further suggesting Leontief's findings and H-O Theory are not necessarily inconsistent when considering effective labor.

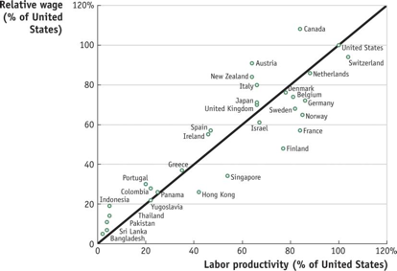

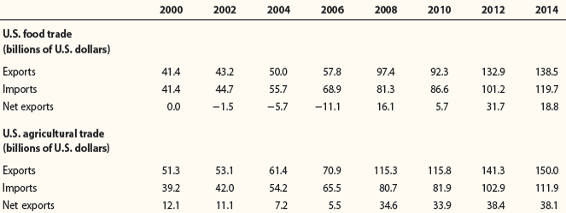

Measuring Factor Content in Trade

While U.S. food imports occasionally exceed food exports, agricultural exports have always exceeded agricultural imports, consistent with finding that U.S. is land abundant.

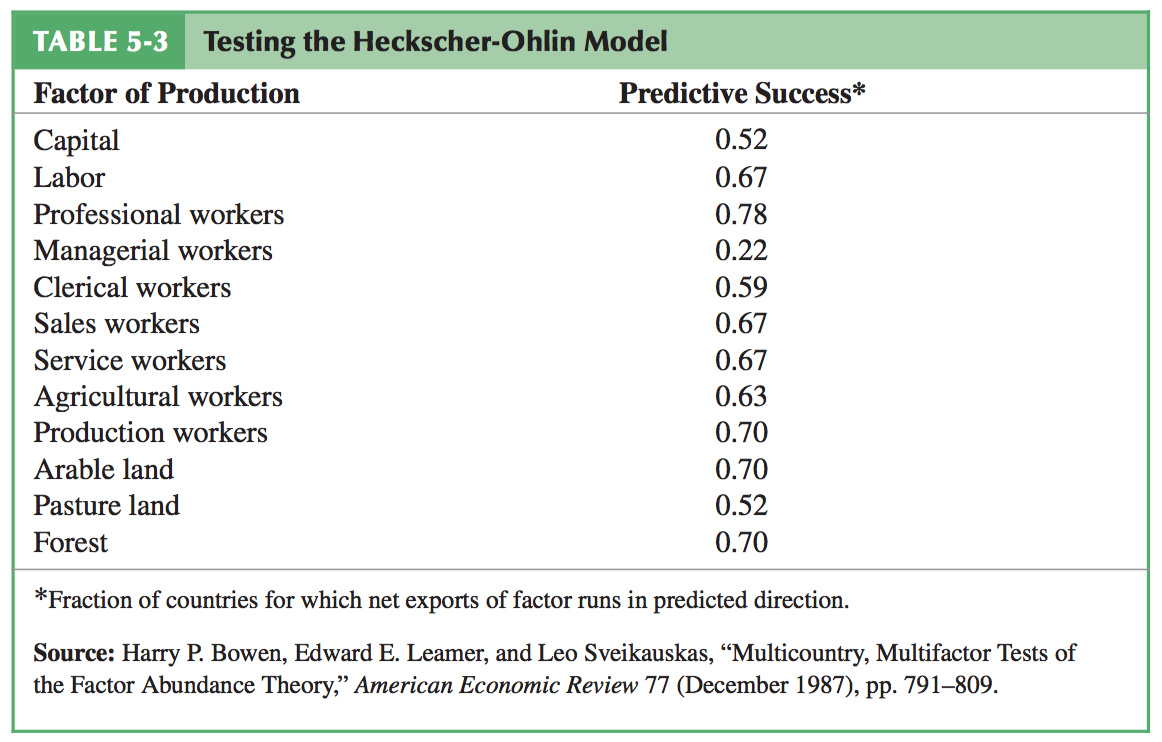

Other Tests of H-O Theory: Bowen et. al (1987)

Strong version of H-O Theory is a poor predictor of exports/imports

Weaker versions do much better - is a country relatively more abundant in a factor than the world average?

- Sign test: does a country export goods that are more-intensive in the factor that they have relatively more than the world average?

- About 60% of the time: yes

Bowen, Harry P., Edward E. Leamer, and Leo Sveikauskas (1987), “Multicountry, Multifactor Tests of Factor Abundance Theory,” American Economic Review 77(5): 791-809

Other Tests of H-O Theory: Bowen et. al (1987)

Krugman and Obstfeld (2011, p.100)

Bowen, Harry P., Edward E. Leamer, and Leo Sveikauskas (1987), “Multicountry, Multifactor Tests of Factor Abundance Theory,” American Economic Review 77(5): 791-809

Krugman, Paul, Maurice Obstfeld, and Mark Melitz, 2011, International Economics: Theory & Policy, 9th ed.

Other Tests of H-O Theory: Bowen et. al (1987)

Rank test: rank countries based on relative abundance of factors (e.g. rank countries based on Labor, on Capital, etc)

- Does that country also rank similarly in terms of exports of those factor-intensive goods

Doesn't predict very well!

- e.g. a country ranking high in labor abundance might be exporting more capital intensive goods than expected!

Bowen, Harry P., Edward E. Leamer, and Leo Sveikauskas (1987), “Multicountry, Multifactor Tests of Factor Abundance Theory,” American Economic Review 77(5): 791-809

Other Tests of H-O Theory: Bowen et. al (1987)

“The Hecksher-Ohlin model does poorly, but we do not have anything that does better. It is easy to find hypotheses that do as well or better in a statistical sense, but these alternatives yield economically unsatisfying parameter estimates”

Bowen, Harry P., Edward E. Leamer, and Leo Sveikauskas (1987), “Multicountry, Multifactor Tests of Factor Abundance Theory,” American Economic Review 77(5): 791-809

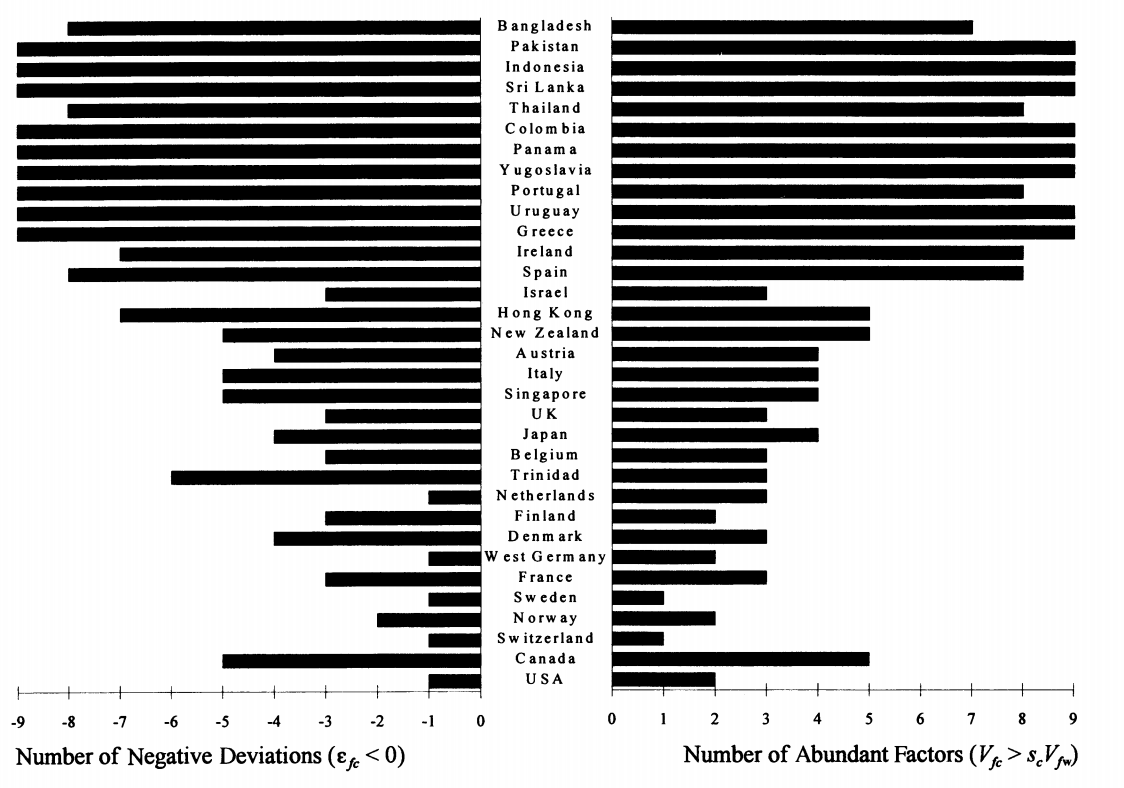

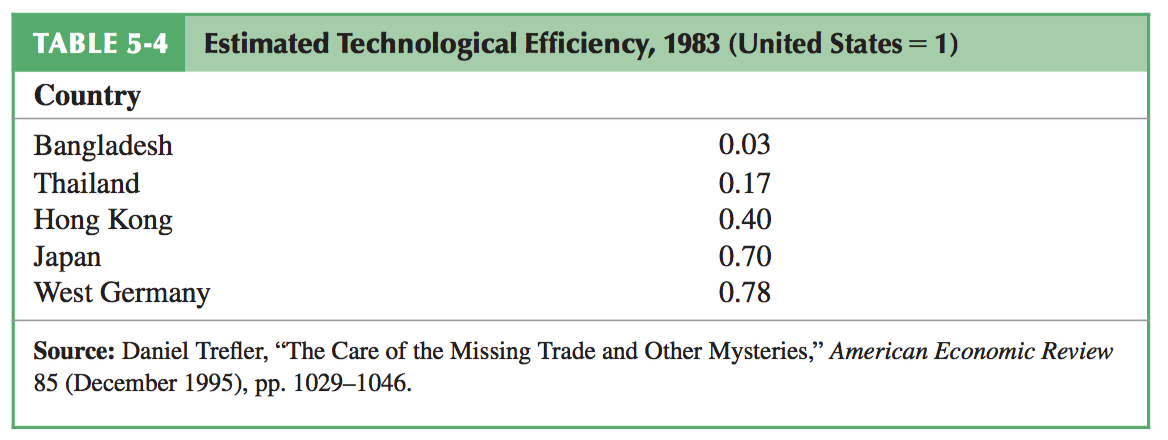

Other Tests of H-O Theory: Trefler (1995)

Given there are big differences in factor endowments across countries, we should expect to see much more trade than we observe!

Trade we do see on net doesn't really send much embodied capital to labor-intensive countries and vice versa!

- e.g. barely any trade in “net factor content”!

Trefler, Daniel (1995), “The Case of the Missing Trade and Other Mysteries,” American Economic Review 85(5): 1029-1046

Other Tests of H-O Theory: Trefler (1995)

Trefler, Daniel (1995), “The Case of the Missing Trade and Other Mysteries,” American Economic Review 85(5): 1029-1046

Other Tests of H-O Theory: Trefler (1995)

Trefler, Daniel (1995), “The Case of the Missing Trade and Other Mysteries,” American Economic Review 85(5): 1029-1046

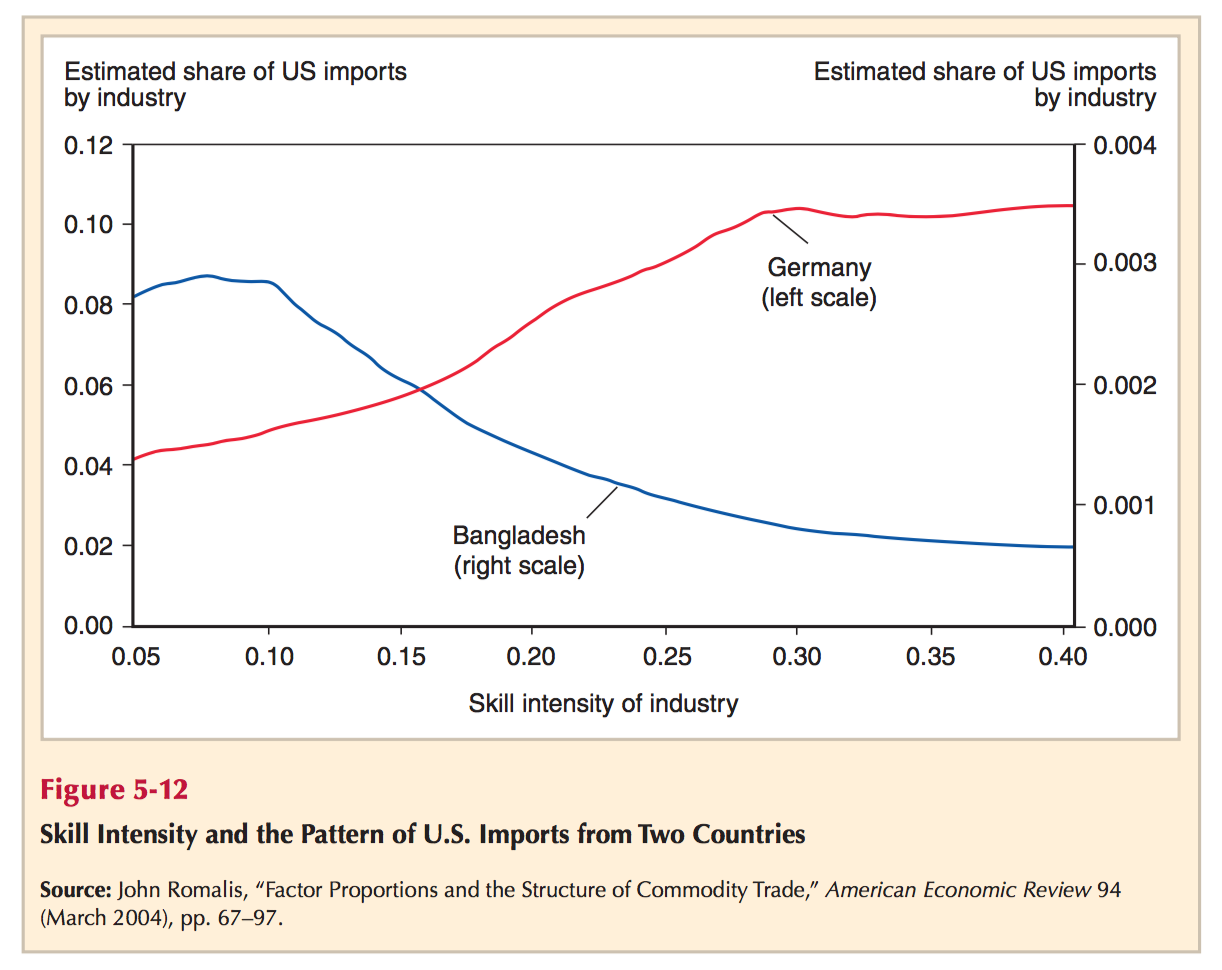

Institutions or Transaction Costs?

Perhaps these deviations from H-O Theory are really asking the question:

“Why are transaction costs so high to prevent mutually beneficial trades?”

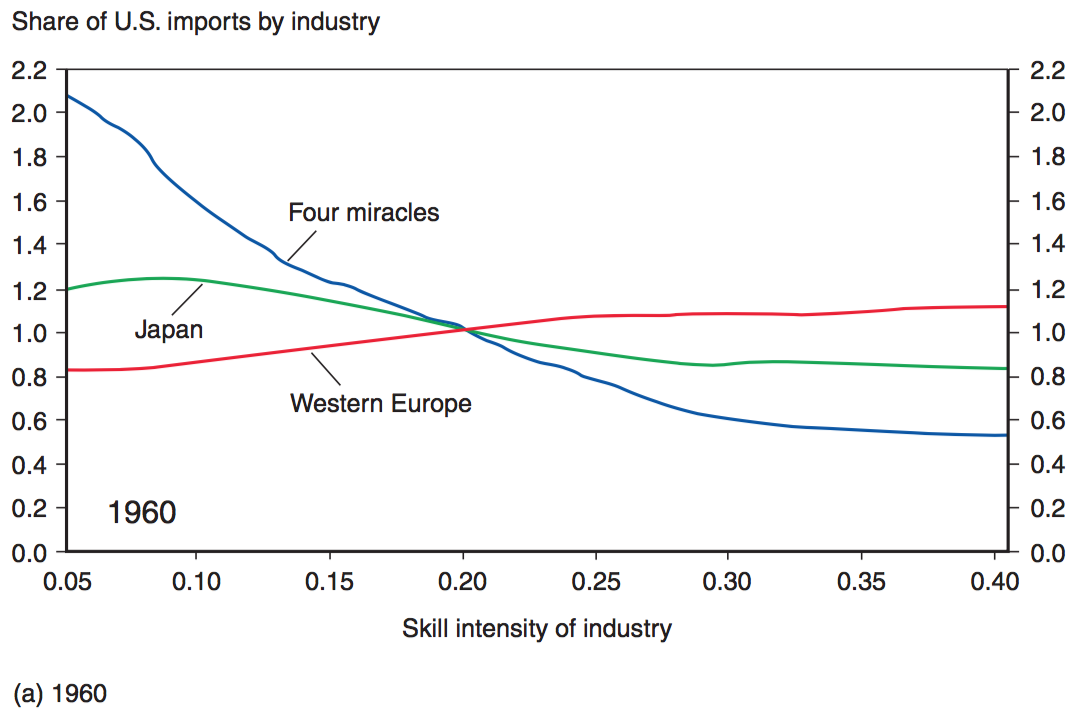

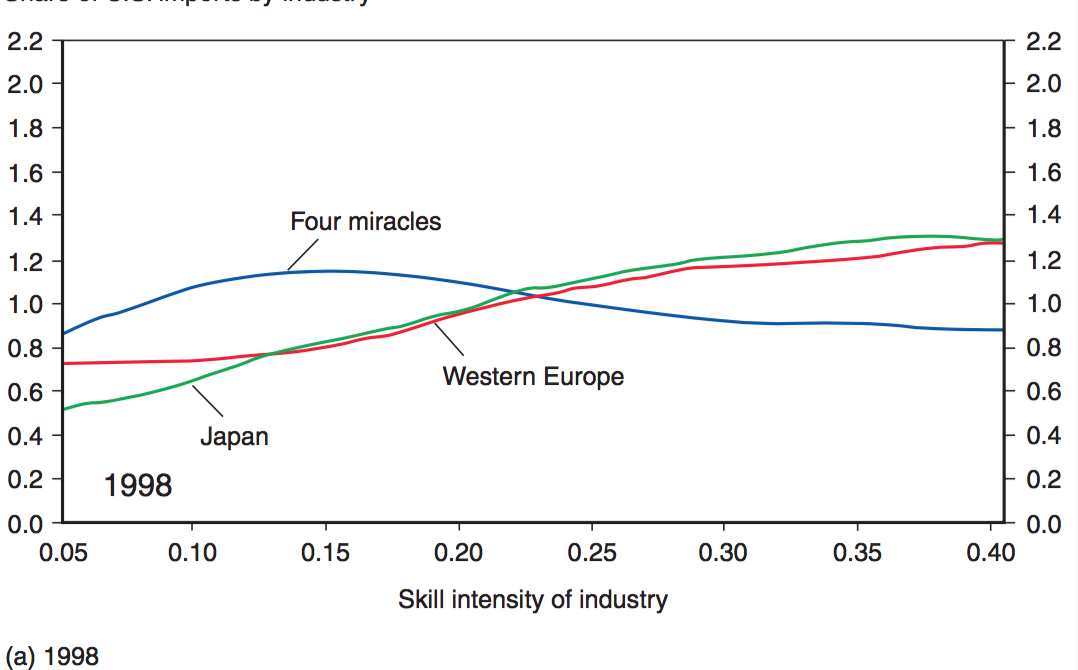

However, comparing exports of labor-abundant nations in the Third world with the exports of capital-abundant nations do fit the theory quite well

Also, changing comparative advantage over time is also reflected well

Better Results of H-O Theory

Krugman and Obstfeld (2011, p. 101)

Krugman, Paul, Maurice Obstfeld, and Mark Melitz, 2011, International Economics: Theory & Policy, 9th ed.

Better Results of H-O Theory

Krugman and Obstfeld (2011, p. 103)

Krugman, Paul, Maurice Obstfeld, and Mark Melitz, 2011, International Economics: Theory & Policy, 9th ed.

Better Results of H-O Theory

Krugman and Obstfeld (2011, p. 103)

Krugman, Paul, Maurice Obstfeld, and Mark Melitz, 2011, International Economics: Theory & Policy, 9th ed.

H-O Theory and Attitudes Towards Free Trade

H-O Theory and Attitudes Towards Free Trade

- In the specific factors model (1.8), we saw:

- labor can gain or lose from free trade

- specific factor in exporting industry gains

- specific factor in importing industry loses

H-O Theory and Attitudes Towards Free Trade

- If labor earns some of the income from the specific factor, then the industry workers work in may affect their attitudes towards free trade

- e.g. some farmers may own their land

- e.g. some manufacturing workers may earn bonuses from high output, or share in capital profits, etc.

H-O Theory and Attitudes Towards Free Trade

In the H-O model, what industry one works in should not affect one's position on free trade

- in long run, labor & capital are mobile, move across industries to best opportunities

Stolper-Samuelson theorem predicts an increase in relative price in exports (and decrease in relative price of imports) from trade benefits factor used intensively in exports and harms factor used intensively in import-competing industry, regardless of which industry the factors actually work in

H-O Theory and Attitudes Towards Free Trade

In U.S., export industries often use high-skilled labor and research & development

An increase in exports will benefit skilled labor in the long-run, regardless of what industry they are working in

Prediction: in long run, the skill level of workers should determine their attitudes about free trade!

H-O Theory and Attitudes Towards Free Trade

1992 survey by National Election Studies asking people about their attitudes on trade

Industry of employment was only somehwat important in explaining different attitudes

- Workers in export-oriented industries somewhat more likely to favor free trade than workers in import-competing industries

H-O Theory and Attitudes Towards Free Trade

Skill-level was much more important!

- High-skilled workers were much more likely to support free trade than low-skilled workers

Consistent with predictions of H-O and SS theorems!